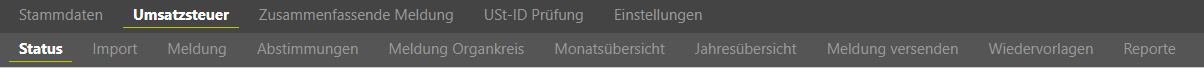

In the main dialogue [VAT], the sub-dialogues are arranged the way the VAT return is processed. It should be noted that not every dialogue is available for every company. Availability of dialogues depends on company type, authorisations and period type. The following figures show how the VAT menu can look like for different company types. Representative VAT group member:  Image Modified Image Modified

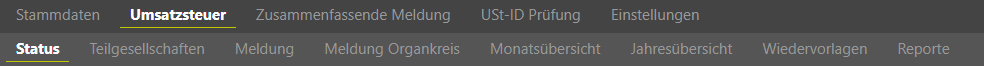

Consolidated VAT group member:  Image Modified Image Modified

Company subdivision:  Image Modified Image Modified

VAT group member:  Image Modified Image Modified

Standalone:  Image Modified Image Modified

The [Import] dialogue is not available for the companies that prepare their VAT returns manually. The [Send VAT return] dialogue is displayed only for standalones as well as representative VAT group members. The functions of each sub-dialogue are described in the following chapters.

|