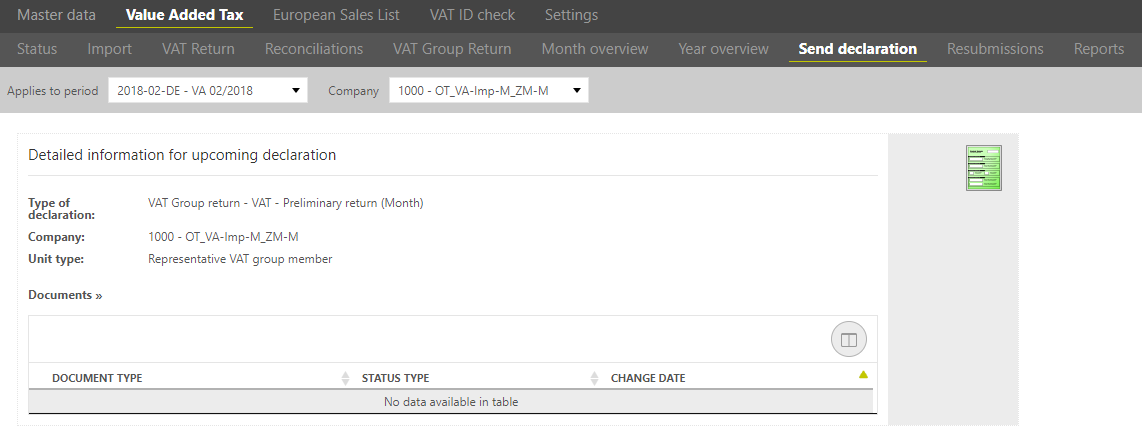

After the VAT return is created and all reconciliations are processed successfully, the VAT return can be send to the tax office using the [Send VAT return] dialogue. This dialogue is available only for the standalone companies and representative VAT group members.

The VAT@GTC has an ELSTER interface function to the so-called Transfer-Client (TC). The authenticity of the sender can be ensured by signing the VAT return with the corresponding user or company certificate45 (saved in the [Master data] main area).

...

1. Export der declaration:

With help of this function the report can be printed or exported to Excel. Moreover, it is possible to download the file as XML file. If the transfer of data is not possible, the XML file can be used for failure analysis. Manual transmission is also possible, when webservice should not be used and TC is locally installed.

2. Send declaration via webservice(test):

Via [check data ] the credibility of the data as well as the transfer to the tax authorities is checked presupposed that the conaction is valid. The VAT@GTC in association with the TC sets up a XML file based on the VAT return values, which audits completeness and technical credibility with the help of ERiC. Recorded failures in the log file have to be analysed. One reason for that could be missing Master data maintenance. As a consequence, missing information with ragrd to the company’s Master data have to be completetd in order to be able to send the declaration to the tax office.

Before data is actually sent productive to the tax offe, it is recommended to send it via test case in advance. Additionally to the validation via [check data ] the submittion of test case causes that the above mentioned XML file is actually sent to the tax authorities, but with the notation that it is solely a test case.

...