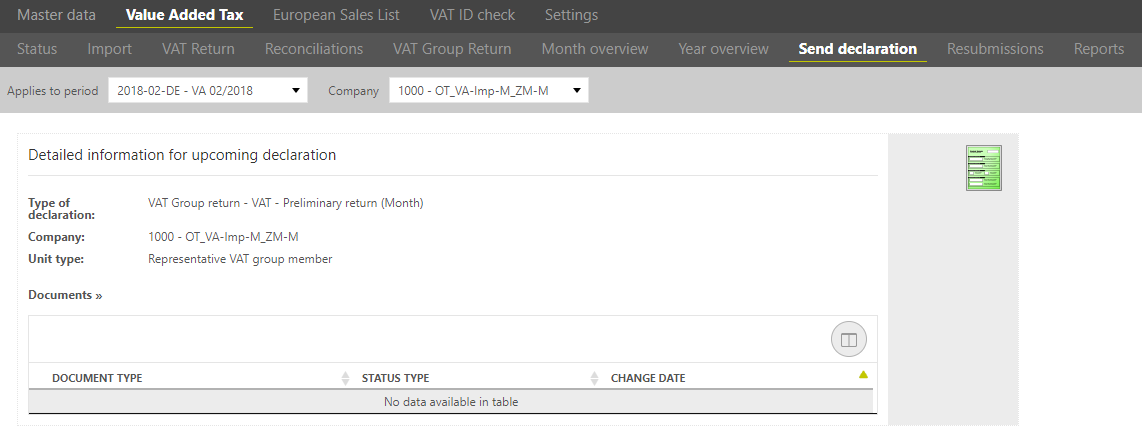

After the VAT return is created and all reconciliations are processed successfully, the VAT return can be send to the tax office using the [Send VAT return] dialogue. This dialogue is available only for the standalone companies and representative VAT group members.

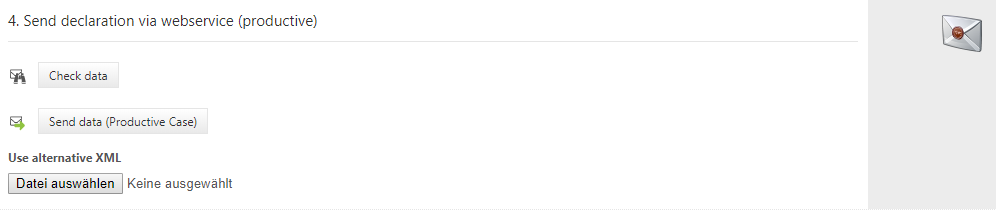

The VAT@GTC has an ELSTER interface function to the so-called Transfer-Client (TC). The authenticity of the sender can be ensured by signing the VAT return with the corresponding user or company certificate45 certificate (saved in the [Master data] main area).

...

As in the test case [check data ] is also possible here.

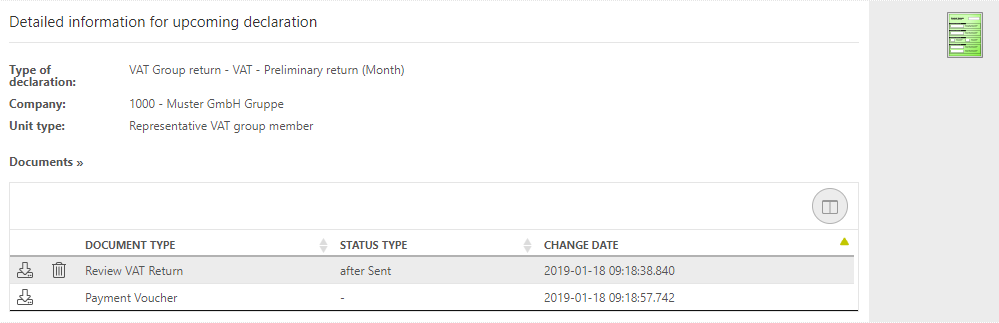

In the productive case the XML data is sent by authentication through the ELSTER certificate. The log files transported from the tax office are submitted from the TC to the VAT@GTC and saved in the database. By conducting the productive case, the milestone of this period for the company is converted. After that the declaration cannot be opened again so that corrections are only possible in a corrected VAT return.

The filing protocol which is generated after every dispatch under [documents], is only a copy for your own documentation. Also is the authentication advice visible on the first side of the report.

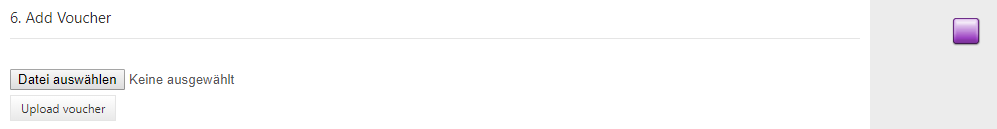

Upload voucher

If the VAT return has been sent successfully, a payment document can be saved in the VAT@GTC. This function requires the corresponding settings in the Master Data.