...

If the VAT return has been sent successfully, a payment document can be saved in the VAT@GTC. This function requires the corresponding settings in the Master Data.

Transmission Protocol

Example: Header of a Test Transfer Log

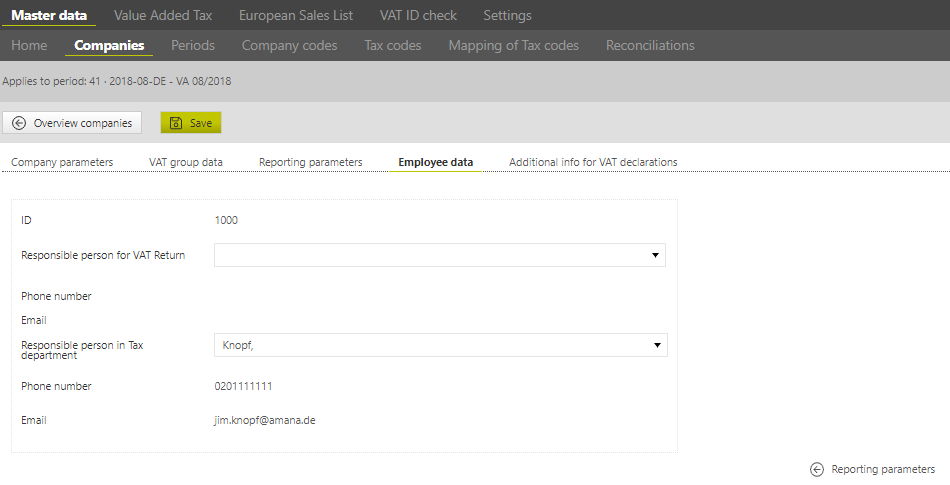

The transmitting company will always be issued as the transmitter and, if indicated, the data of the person in charge of the tax department.

This must be specified under [Master data] - [Companies] - [Employee data].