...

| Table of Contents |

|---|

...

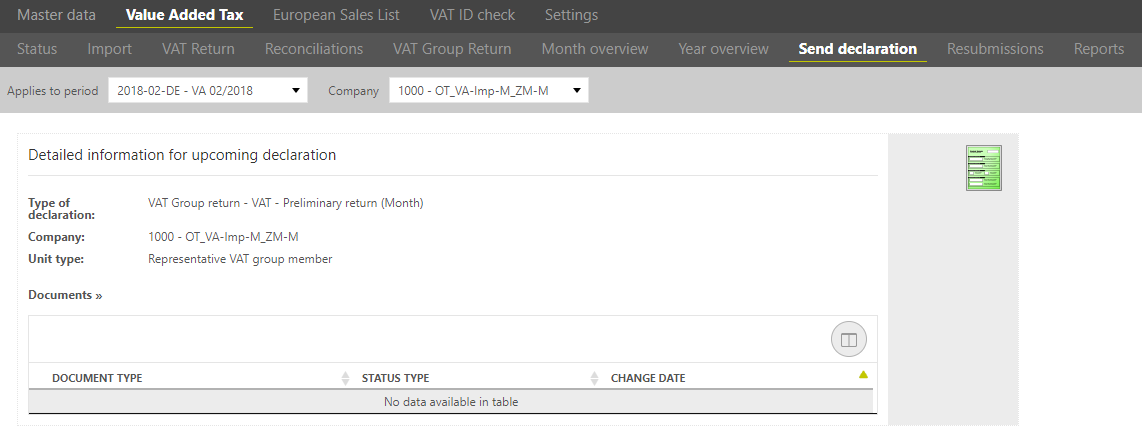

After the VAT return is created and all reconciliations are processed successfully, the VAT return can be send to the tax office using the [Send VAT return] dialogue. This dialogue is available only for the standalone companies and representative VAT group members.

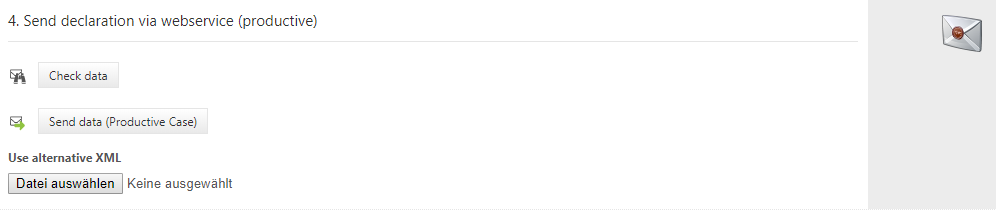

The VAT@GTC has an ELSTER interface function to the so-called Transfer-Client (TC). The authenticity of the sender can be ensured by signing the VAT return with the corresponding user or company certificate (saved in the [Master data] main area).

...

The filing protocol which is generated after every dispatch under [documents], is only a copy for your own documentation. Also is the authentication advice visible on the first side of the report.

4.

Upload voucher

If the VAT return has been sent successfully, a payment document can be saved in the VAT@GTC. This function requires the corresponding settings in the Master Data.

...