...

To create a monthly VAT return you will need the standard SAP report RFUMSV00. The reports RFUMSV10 and RFBILA00 are necessary for the reconciliations. They can be generated from the SAP, when you select the file path. Detailed instructions for the preparation will be given at the beginning of the Project.

| RFUMSV00 | The report contains tax base and tax amount (difference in output VAT or input VAT and/ or deductible VAT or VAT not to be paid) which are classified according to tax codes. They must be imported to the [Taxcode] dialogue in the [Master data] main area beforehand. |

| RFUMSV10 | Tax bases of every tax code in the RFUMSV10 report are assigned to the corresponding accounts in the general ledger. |

| RFBILA00 | This report contains the financial balance sheet as well as the profit and loss account SAP-Reports. |

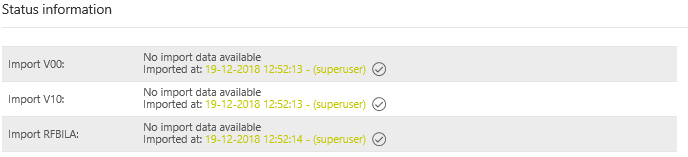

Status Information

The [Status Information] is used to display the imported reports V00, V10 and RFBILA. The respective report shows whether an import has been carried out, when and by which user.

The imported reports can also be displayed in the overview table below. The report can be selected via [Import Selection], it appears in the overview table. It is possible to see the most recent Import.

Import of reports

The reports can be imported manually, via a network drive (and fallback) or via the web service. The import method used in the VAT@GTC is defined at the beginning of the Project.

Manual import

If the data are imported manually, select a report using the dropdown and the upload a locally saved document using the [Browse] button.

...

If the VAT@GTC recognises the available reports, they appear in the overview. Use the [New import data are available] to import the available reports into the VAT@GTC.

Fallback Import

If the network drive is temporarily not available, the [Fallback Import] option can be used. Select the report type, find it on your computer and Import.

...

No plausibility errors in the report Position.

Import process

The following section is not relevant for the companies with manual VAT return creation. If an import is carried out, the VAT@GTC processes the files during import and adapts them to the rules in the master data. The following sections explain what exactly happens when importing the respective Reports.

...

If all the items match, a green check mark [] is displayed in the overview table for each line.

If the import has been carried out successfully, the signs are adjusted as follows:

...