...

- Apply changes directly in the VAT return form by adjusting the respective tax code in the corresponding box.

- Run reconciliation again - after this, the status should change to [Successful].

Adjustment RFBILA

The adjustment of the relevant the G/L account VAT to pay or recover from the balance sheet is the standard procedure in the case of a reconciliation difference. The respective account is specified by the VAT@GTC. However, another account can also be selected.

...

Different adjustment options

Adjustment of V10

The RFUMSV10 must be adjusted to the RFUMSV00. This adjustment does not result in a change to the reporting form, since the RFUMSV10 is not used to create the monthly/ quarterly VAT return (preliminary VAT return) in the the VAT@GTC.

When adjusting the RFUMSV10, an account must be selected in the detail view next to the specified tax code. All accounts available in RFUMSV10 and posted in the balance sheet for tax purposes are available for selection. If the required account does not appear in the list or if no special account is to be created, select the default account [---].

Adjustment V00

The RFUMSV00 is not adjusted to the RFUMSV10, since the RFUMSV00 is the standard SAP report for the monthly/ quarterly VAT return (preliminary VAT return) and consequently the RFUMSV10 must be adjusted.

...

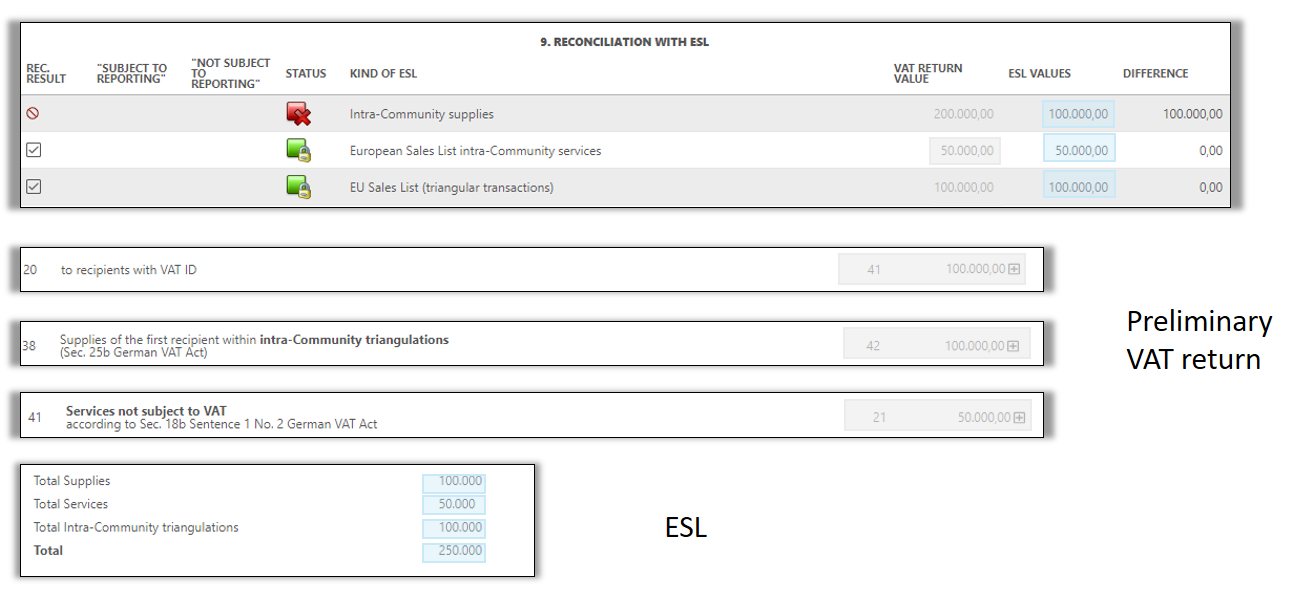

The aim of the reconciliation 9 is to identify whether the reported values in the ESL match to the values in the monthly VAT return. In order to perform this reconciliation in the VAT@GTC you need the amounts reported in the ESL.

The tax code defines what relevant values from the VAT return are used for the reconciliation. That is why it is necessary to identify in the [Tax Code] dialogue in the [Master data] main area whether they are relevant for the ESL. Using the form field assignment in the [Mapping of tax codes] dialogue the VAT@GTC differentiates between the intra-community supply [field 41], reverse charge supply [field 21] and intra-community triangular transactions [field 42]. In the reconciliation the tax bases of the tax codes mapped to these fields are added and compared with the entries in the import dialogue or added up import data.

Run reconciliation

The master data can be used to specify whether the reconciliation is to be carried out during the monthly VAT return or ESL. The deadline for VAT return submission is the basis for decision-making. In the case of a permanent extension of the filing deadline, the ESL (25th of the following month) shall be submitted before the monthly VAT return (10th of the next but one month). The reconciliation therefore makes sense during the submission of the monthly VAT return. If necessary, a corrected VAT return must be prepared.

...

Reconciliation difference This

This reconciliation always results in differences, since, in contrast to the monthly VAT return, the amounts in the ESL do not contain cents (the amounts are displayed in euros when importing the RFASLM). Thus, in large ESLs the differences cam amount to more than € 100. The user can set a tolerance limit in the master data (optionally with absolute amount or percentage). If the deviation is within this tolerance limit, the reconciliation is no longer faulty, but is displayed with a yellow exclamation mark.

...