...

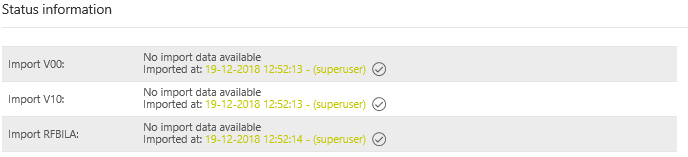

The [Status Information] is used to display the imported reports V00, V10 and RFBILA. The respective report shows whether an import has been carried out, when and by which user.

The imported reports can also be displayed in the overview table below. The report can be selected via [Import Selection], it appears in the overview table. It is possible to see the most recent Import.

...

The reports can be imported manually, via a network drive (and fallback) or via the web service. The import method used in the VAT@GTC is defined at the beginning of the Project.

Manual import

If the data are imported manually, select a report using the dropdown and the upload a locally saved document using the [Browse] button.

...

If the VAT@GTC recognises the available reports, they appear in the overview. Use the [New import data are available] to import the available reports into the VAT@GTC.

Fallback Import

If the network drive is temporarily not available, the [Fallback Import] option can be used. Select the report type, find it on the local computer and click [Import].

...

The original report and the overview table in the VAT@GTC can be seen in the following figure [Import process RFUMSV00]. The columns from [Company code] to the column [Non-deductible] are displayed in the overview table as in the report.

When importing the RFUMSV00 the following items are first checked for correctness:

...

If all the items match, a green check mark [] is mark is displayed in the overview table for each line.

If the import has been carried out successfully, the signs are adjusted as follows:

...

If all the items match, a green check mark [] is displayed in the overview table for each line.

...

If all the items match, a green check mark [] is displayed in the overview table for each line.

...