In the main dialogue [VAT], the subdialogues are arranged the way the VAT return is processed. It should be noted that not every dialogue is available for every company. Availability of dialogues depends on company type, authorisations and period type. The following figures show how the VAT menu can look like for different company types.

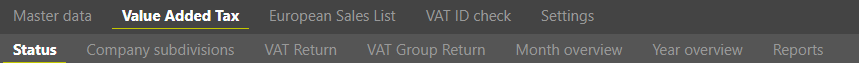

Representative VAT group member:

Consolidated VAT group member:

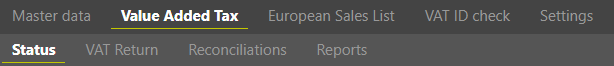

Company subdivision:

VAT group member:

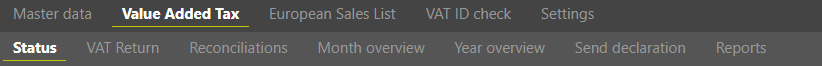

Standalone:

...

The [Import] dialogue is not available for the companies that prepare their VAT returns manually. The [Send VAT return] dialogue is displayed only for standalones as well as representative VAT group members. The functions of each subdialogue are described in the following chapters.