...

Check | Values from the RFUMSV00 | Calculation in VAT@GTC | Difference | Limit for automatic adjustments | Automatic adjustments of the | Result |

|---|---|---|---|---|---|---|

Tax base | 189 € | 1.000 € x 19 % = | 1€ | 5€ | tax | The deviation is below the limit for automatic adjustments. At the time of import, the tax is corrected by 1€ and added to the declaration. In the columns [Calculated Tax base / Tax] this automatic adjustment is already taken into account. The column [Initital difference Tax base / Tax] still shows a difference. In the column Reconciliation Result an exclamation mark and no tick is deposited. Editing is not necessary as this was done automatically. |

| Assessment base | 1.000 € | 185 € / 0,19 = 994,73€ | 5,27€ | 5€ | tax base | The deviation is above the limit for automatic adjustments and therefore has an error. Therefore, no automatic adjustment is made, requiring manual intervention. The reconciliation status is represented by an X. Editing of the reconciliation position is initiated via the checkbox in the [Edit] column. |

...

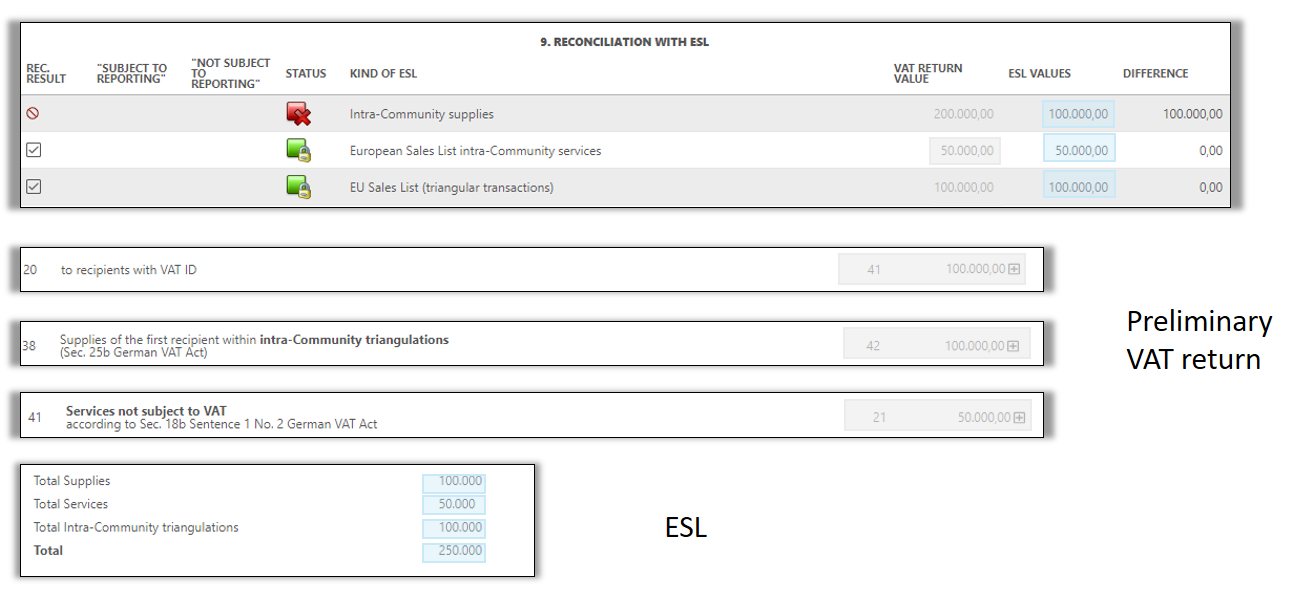

| Type of transaction | ||

|---|---|---|

| Intra-Comunity Supplies | Field 41 + Field 77 | All Entries with type of transaction "0" - Supplies- summed up |

| Intra-Comunity Services | Field 21 | All Entries with type of transaction "1" - Services - summed up |

| Intra-Comunity triangulations | Field 42 | All Entries with type of transaction "2" - triangulations - summed up |

...

In the master data, you can set whether the reconciliation is to be carried out when the advance return for VAT is created or when the recapitulative statement is created, or in both declarations.

...

| title | Good to know |

|---|

...

.

Reconciliation difference

...

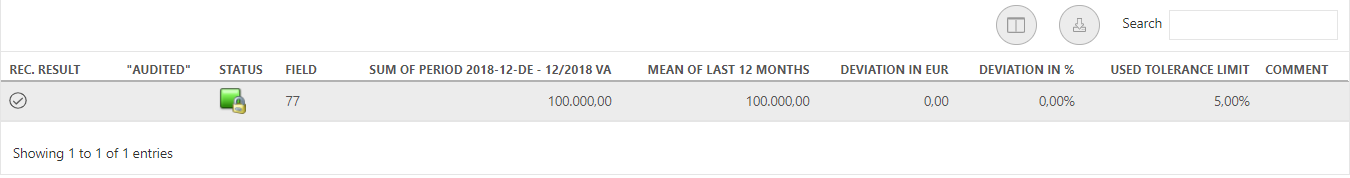

The configuration is possible in the [Master data] area under [Reconciliations]. To check the requested field, a tolerance limit hast to be specified. Either an absolute or a percentage tolerance limit can be specified. If both variants of the tolerance limit are configured for a reconciliation position, the percentage tolerance limit applies.

For a more detailed analysis, the 12-month comparison with mean deviation report should be used.

...

If certain tolerance limits are not exceeded in these two reconciliations, the user has the choice to ignore the difference or take this resubmission into the next period, where it can be checked again.

Reconciliation 14 Zero balance validation of G/L accounts

Reconciliation 14 checks whether there is a zero balance on deposited G/L accounts.

The zero balances are set in the area Master data → Reconciliations → Manage reconciliation accounts (edit).

Each account must be individually marked as to whether it belongs to the group zero balance G/L account and is to be taken into account in reconciliation 14.

When performing the reconciliation, it can be stored that the facts have been checked and that there is no error.