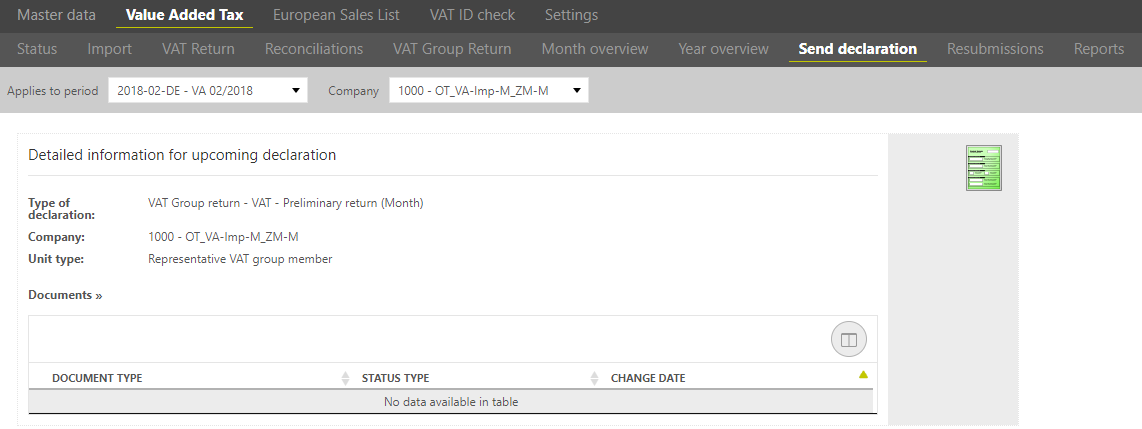

After the VAT return is created and all reconciliations are processed successfully, the VAT return can be send to the tax office using the [Send VAT return] dialogue. This dialogue is available only for the standalone companies and representative VAT group members.

The VAT@GTC has an ELSTER interface function to the so-called Transfer-Client (TC). The authenticity of the sender can be ensured by signing the VAT return with the corresponding user or company certificate (saved in the [Master data] main area).

Good to know!

The sending of the VAT return can be carried out automatically via the web service or manually via the TC. The type of sending was determined during the implementation project, its description can be found in the following sections.

Automatic filing via Webservice

The following functions are only visible when the VAT return is finalised.

1. Export der declaration:

With help of this function the report can be printed or exported to Excel. Moreover, it is possible to download the file as XML file. If the transfer of data is not possible, the XML file can be used for failure analysis. Manual transmission is also possible, when webservice should not be used and TC is locally installed.

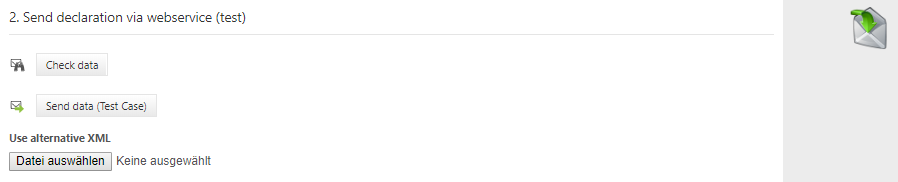

2. Send declaration via webservice(test):

Via [check data] the credibility of the data as well as the transfer to the tax authorities is checked presupposed that the conaction is valid. The VAT@GTC in association with the TC sets up a XML file based on the VAT return values, which audits completeness and technical credibility with the help of ERiC. Recorded failures in the log file have to be analysed. One reason for that could be missing Master data maintenance. As a consequence, missing information with ragrd to the company’s Master data have to be completetd in order to be able to send the declaration to the tax office.

Before data is actually sent productive to the tax offe, it is recommended to send it via test case in advance. Additionally to the validation via [check data] the submittion of test case causes that the above mentioned XML file is actually sent to the tax authorities, but with the notation that it is solely a test case.

- When data is successfully sent to the tax office, you get a log file back and the test case data is discarded.

- Not getting a log file back indicates connections issues. The problem could be a wrong configuration on your connection server or a failing connection to the server of the tax office. We recommend to try it again at a later time. If this problem occurs again, the IT service should be contacted.

- If the log file contains error maessages, the failures are to be fixed.

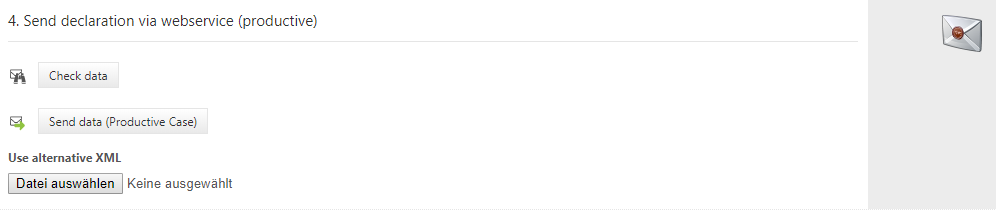

3. Send declaration via webservice (Productive):

As in the test case [check data] is also possible here.

In the productive case the XML data is sent by authentication through the ELSTER certificate. The log files transported from the tax office are submitted from the TC to the VAT@GTC and saved in the database. By conducting the productive case, the milestone of this period for the company is converted. After that the declaration cannot be opened again so that corrections are only possible in a corrected VAT return.

The filing protocol which is generated after every dispatch under [documents], is only a copy for your own documentation. Also is the authentication advice visible on the first side of the report.

4. Upload voucher

If the VAT return has been sent successfully, a payment document can be saved in the VAT@GTC. This function requires the corresponding settings in the Master Data.