To access the [Company subdivisions] dialogue, select the company that represents a parent unit for the required company subdivision in the drop-down. The company subdivision is a special type for certain companies which have already been defined in the master data. If the company is represented in two different SAP systems, usually a single VAT return cannot be generated. Company subdivisions are constructed for these very cases. Company subdivisions make it possible to consolidate the data automatically by the VAT@GTC on a monthly basis. The necessary steps are described below.

1. Import or manual entry of reporting data

If the respective company subdivisions have been imported, the values are shown in the VAT return form. If no import has been performed for a company, manual entry is possible. The settings for the copying of values to the VAT@GTC are made in the same way as for the regular VAT group members and the representative VAT group members.

2. Finalise the VAT return

After the import or manual entry of the respective company subdivision the VAT return can be finalised. The VAT return is created in the same way as for the regular VAT group members and the representative VAT group members.

3. Get VAT return data

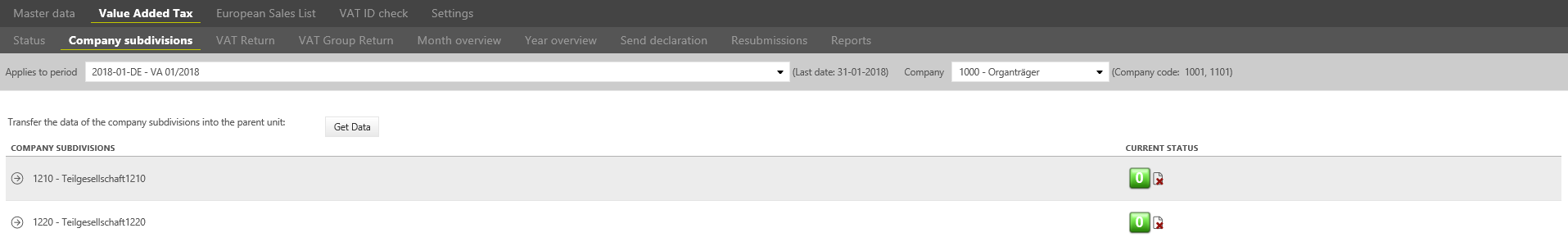

The [Company subdivisions] dialogue appears when you select a company consisting of subdivisions in the dropdown. This dialogue shows which company subdivisions this company contains and whether they have their VAT returns finalised.

The required company subdivision can be opened by clicking on the [arrow]. The status shows whether the VAT return is still in progress [] or already closed []. Only after all company subdivisions have closed their VAT returns, the data can be copied to the parent unit. If the data has been copied successfully, it can be viewed when the last data transfer took place.

After the data transfer, all values of the company subdivisions are added up and appear in the VAT return of the representative VAT group member or consolidated VAT group member.

Good to know!

The combination of a manual reporting subdivision company and a parent company that reports purely manually does not lead to valid results.