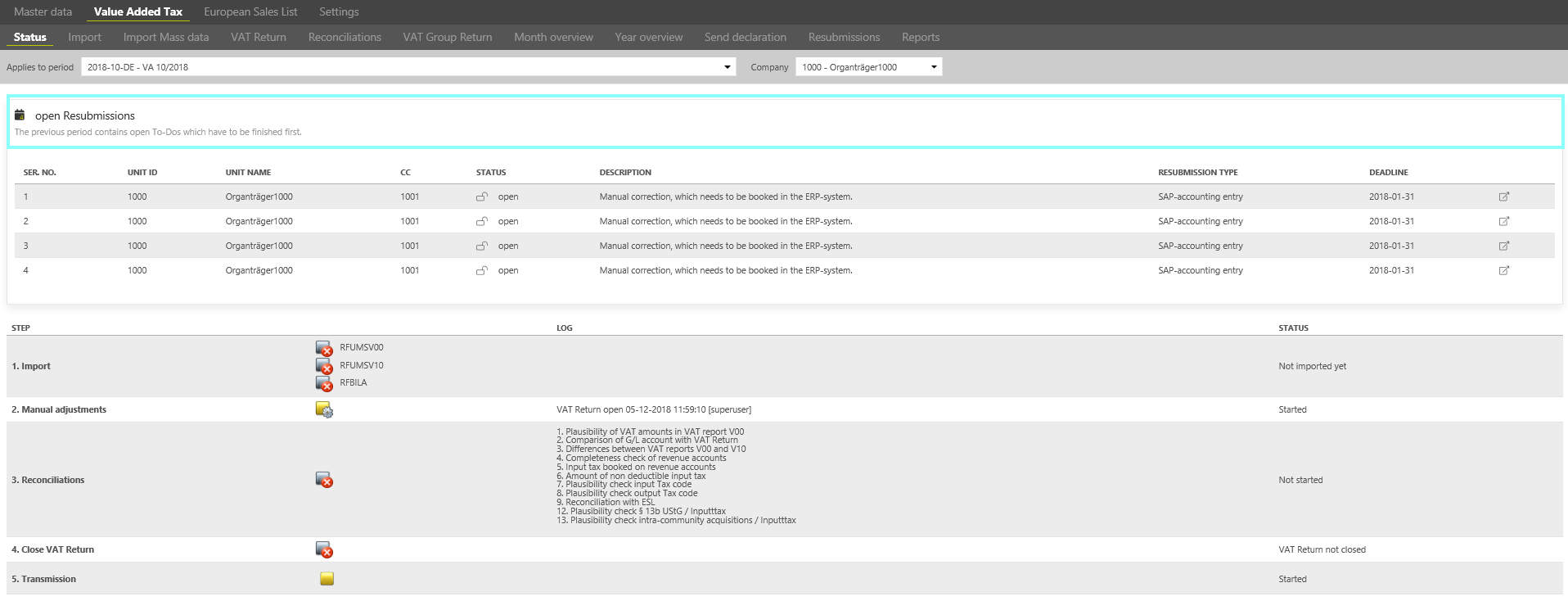

The subdialog [Status] functions as the start screen for the main dialogue [VAT] and provides information about the current status of the preliminary VAT return in VAT@GTC.

Good to know!

It is recommended to select the period and Company directly on this homepage.

Depending on the selected period type (monthly/ quarterly VAT return, annual VAT return or special prepayment), the additional dialogues next to the Status dialogue may vary. Read in the sections [preliminary VAT return], [Yearly VAT return] and [Special prepayment] to find out more about these three types of periods.

Resubmission status

If there are any to-dos left open from the previous period, a notification appears [] in the [Status] dialogue. The [Deadline] column contains the deadlines for the open to-dos. They have to be finished in the [Resubmission] dialogue before proceeding with the creation of the VAT return in the current period.

Good to know!

Resubmission processing is compulsory, otherwise other dialogues of the [VAT] area are not available.

If these to-dos are left unprocessed, the dialogues [Company subdivisions] and [VAT return] are blocked.

Process Status for the selected period

Company Code with Import.

Import | |

Overview of the RFUMSV00, RFUMSV10, RFBILA reports, imported from the SAP. | Imported.

|

Manual adjustments | |

Adjustments of the VAT return data, i.a. if an error messages is shown when you run Reconciliation. | No manual adjustments have been made yet (since the VAT return has not been created yet). The necessary adjustments have been started but have not been completed yet. Manual adjustments have been made and the VAT return has been closed. |

Reconciliations | |

Overview of the reconciliations selected in the [Master data] main area. If no reconciliations have been selected, this section is not shown at all. If manual adjustments have been made, the reconciliations must be carried out again. | Reconciliations have not been started yet. Reconciliations have been carried out but contain Errors. Reconciliation contains an error message; however, the error has been corrected. Corrections based on autolimit in reconciliation 1 are taken into account. Reconciliations without error Messages. |

Finalise | |

Provides information whether the VAT return has been closed or is still being processed. | The VAT return has not been closed yet, i.e. it is open. The VAT return has been closed. For the members of the VAT group this status means that the reporting data are now available to the representative VAT group member. |

Review | |

| The Status of the review appears only after the first review has been carried out. |

Transfer | |

Status overview whether the VAT return has been sent to the tax office. This section is shown only for the standalone companies and the representative VAT group members. | The VAT return has not been sent yet. The VAT return has been sent. |

Status Representative VAT group member | Status VAT group member | Status Standalone |

Manual input

The status of the reporting process with manual input differs from the reporting process with import. Import and reconciliations are not available for the manual input.