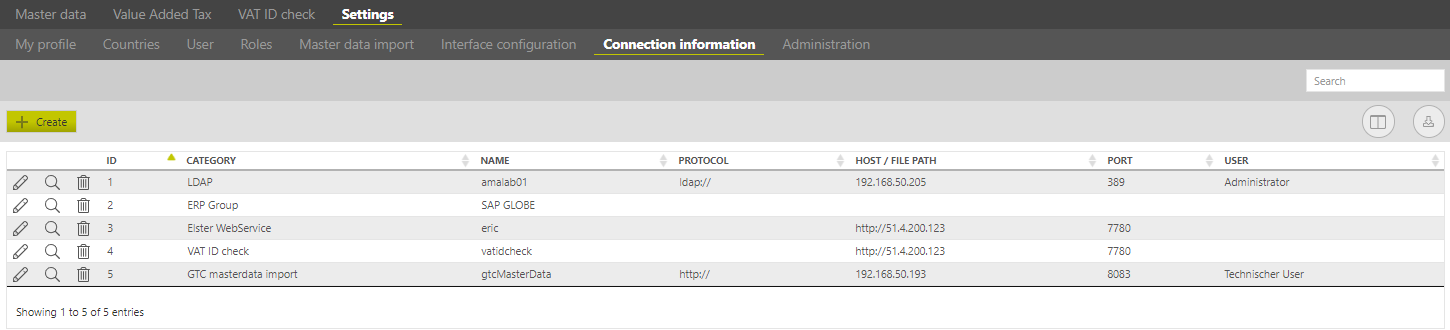

The connection parameters can be divided into the following two categories:

Standard interface | |

Category | Description |

Elster WebService | Configuration of the interface to the transfer client (TC) for Elster filing. The configuration includes at least service name [ericXX], the server URL (host) and the port. |

VAT ID check | Configuration of the interface to the transfer client (TC) for the VAT Id check. The VAT Id is checked by the Federal Central Tax Office or VIES. The configuration includes at least service name [vatidcheck], the server URL (host) and the port. |

VAT ID check Proxy | A proxy server can be specified here to provide the connection of 'vatidcheck' web-service to the Internet. The configuration contains at least the server URL (host) and the port. Optionally, username, password and authentication method can be specified. |

GTC Master data Import | Connection to another AMANA product (e.g. tax portal) that shares its master data with other (client) applications. Required fields are service name [gtcMaster data], the server URL (host), port, username and password of the target system. When connected to the income tax system, the entry 'GTC' is expected as parameter 1. |

TransferClient Proxy | Configuration of a proxy server between the VAT@GTC and the Transfer Client. |

LDAP | Here you can enter the required LDAP parameter for a possible SingleSignOn authentication per LDAP. The configuration includes at least service name, the LDAP Server URL (host) and the port. Optionally, username, password and authentication method can be specified. |

| Internet Proxy | Configuration of a proxy server that is set up between a transfer client and the Internet. The configuration includes at least the server URL (host) and the port. Optional user name and password as well as the authentication procedure can be specified. |

| STMP-Server | Configuration of a STMP server to receive an e-mail when forgetting the user password. |

| HMRC HTTP Transfer | Configuration of the interface to the transfer client (TC) for sending to the HMRC (the British tax office). The configuration includes at least the service name [ericXX], the server URL (host) and the port. |

Custom interfaces | |

Category | Description |

ERP Group | Companies that are stored on similar SAP machines (e.g. same chart of accounts, tax code) can be gathered in one ERP group in the VAT@GTC. The names of the ERP groups can be created in the [Admin] dialogue. In the [Company] dialogue the company is assigned to the group. It is possible to simplify the tax code creation and maintenance by copying the new tax codes to all companies of the same ERP group. Furthermore, the reconciliation accounts can be created and maintained for ERP groups instead for every individual company. |

ERP server | You can define in which SAP machine the company is stored. The name of the ERP groups can be created in the [Admin] dialogue. In the [Company] dialogue the company is assigned to the ERP machine (server). This information can be used, for example, in an accounting record for the respective assignment. |