In the VAT@GTC the users can create annual VAT returns and send them to the tax office. It is always a great challenge for a company to manually collect all values of all companies in the VAT group and represent them in one annual VAT return of the entire VAT group.

The VAT@GTC provides the following options:

- Automatic transfer of values from the preliminary VAT returns incl. changes in the VAT group during the year

- Manual filling of the form (full scope including the annexes to the annual VAT return appendix UN and appendix UR)

- Comparison of these values with the annual values from the SAP system

- Direct filing of the VAT return to the tax office

The process-based workflow and the issues to be observed are explained in detail in the following chapters of the annual VAT return.

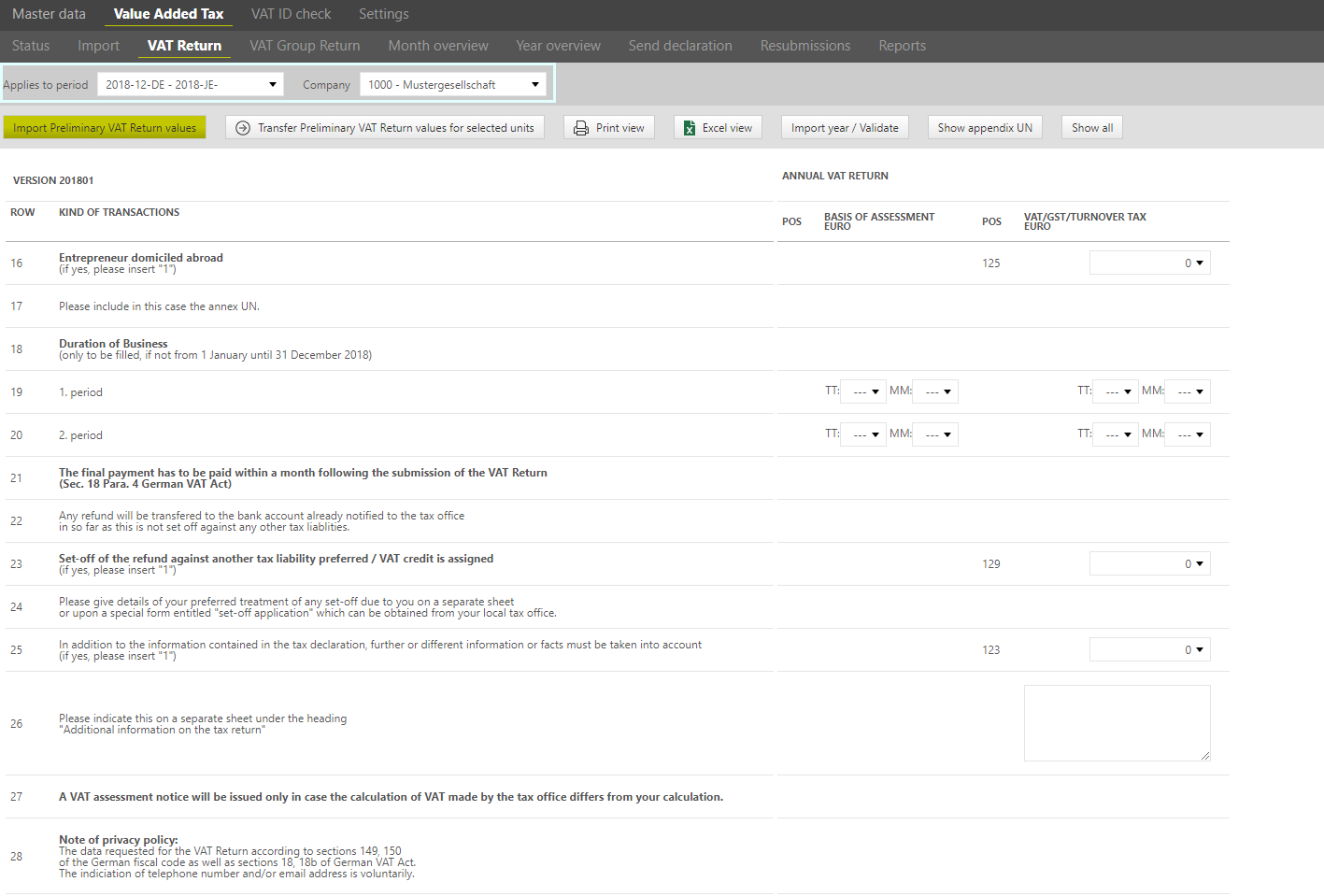

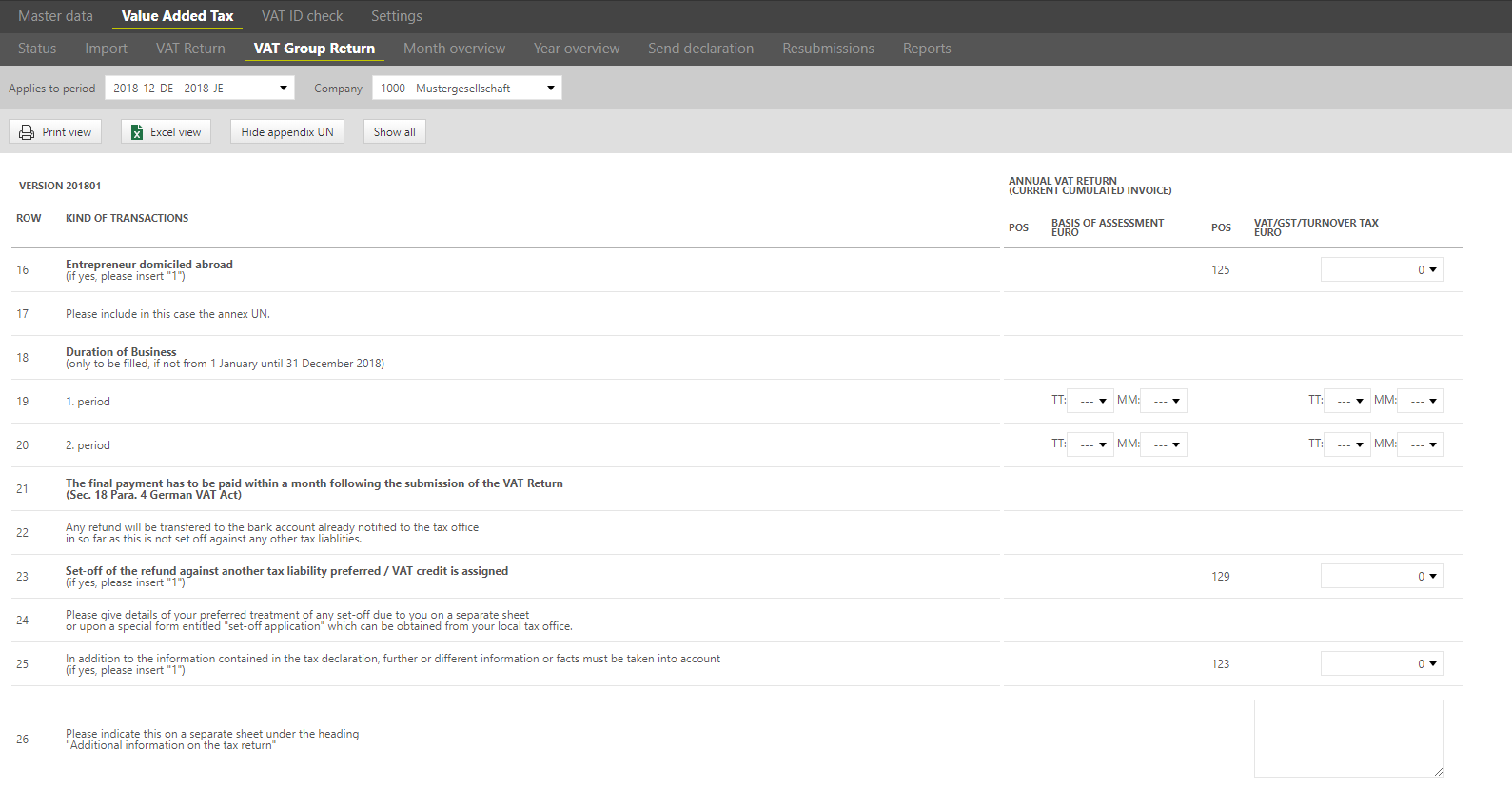

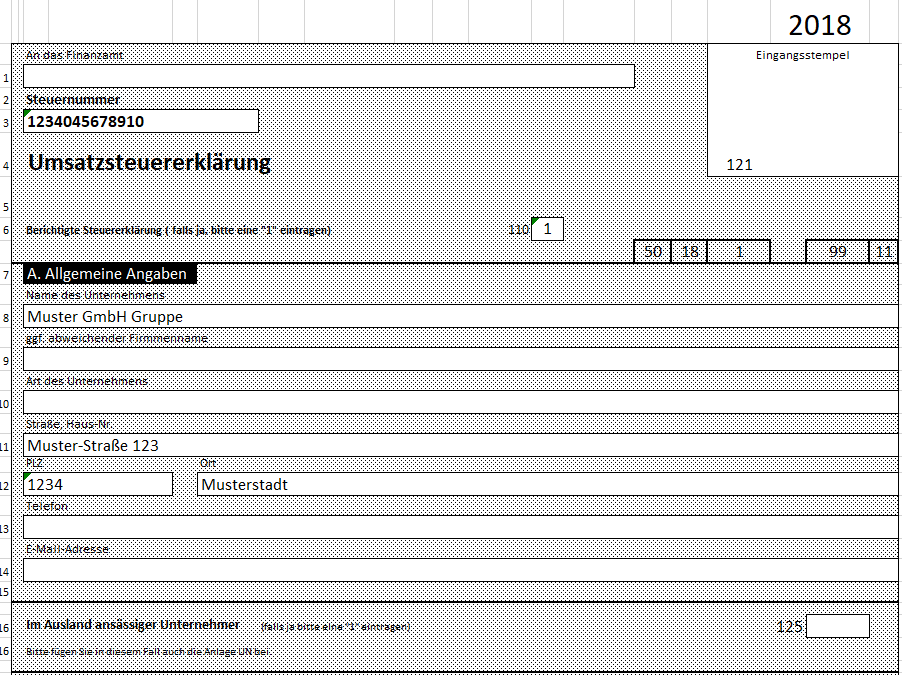

VAT return

Depending on the selected period type, the German form for the annual VAT return including appendix UR is visible in the sub-dialogue [VAT return].

VAT return filing

As explained in the chapter [Master Data], there is a separate period for the annual VAT return. When creating this period, the VAT@GTC takes into account all existing VAT-relevant data in the system, such as preliminary VAT return values and the VAT group structures, including any changes made during the year. The following two options are available for the creation of the annual VAT return:

Transfer of manual preliminary VAT return values with annual VAT return mapping

If the reporting values of the companies have been entered manually during the year, a separate mapping in the [Mapping of taxcodes] tab for the annual VAT return has to be created. With this mapping, the totals of the preliminary VAT returns are mapped to the corresponding boxes of the annual VAT return. Not all boxes of the preliminary VAT return can be transferred 1 to 1 in the annual VAT return. The following overview shows all positions which can be transferred directly and 1 to 1 from the preliminary VAT return into the annual VAT return.

Preliminary VAT return field | Annual VAT return field | Preliminary VAT return field | Annual VAT return field | Preliminary VAT return field | Annual VAT return field |

|---|---|---|---|---|---|

21 | 721 | 60 | 209 | 91 | 791 |

| 35 | 155 | 61 | 761 | 93 | 793 |

| 36 | 156 | 62 | 762 | 93a | 793a |

| 41 | 741 | 67 | 467 | 94 | 794 |

| 42 | 742 | 73 | 873 | 95 | 798 |

| 44 | 744 | 74 | 874 | 96 | 796 |

| 45 | 205 | 77 | 777 | 98 | 799 |

| 46 | 846 | 84 | 877 | ||

| 47 | 847 | 85 | 878 | ||

| 49 | 749 | 89 | 781 | ||

| 59 | 759 | 89a | 781a |

Good to know!

Other positions should be discussed with AMANA.

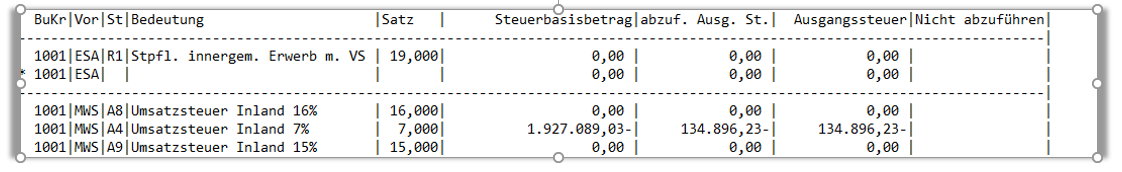

Transfer of preliminary VAT return values with mapping of tax codes

If the annual VAT return is created using the mapping of tax codes, it has to be defined, which tax code should be assigned to which field of the annual VAT return form. It needs to be ensured that all tax codes are mapped, since only then it is possible to completely transfer the imported data into the annual VAT return.

Good to know!

Regardless of whether the annual VAT return data is imported or entered manually, further information fields of the annual VAT return have to be filled in always manually. These can be found in the following rows of the annual VAT return:

- rows 20, 21 (period of the entrepreneurial status)

- rows 25 (set-off of the refund against another taxability preferred)

- rows 33, 34 (information about the small company status)

- rows 133 ff. (adjustment of the deduction of input tax, §15a German VAT Act (UStG))

- rows 106 (assignment of tax exemption)

In addition, there are information fields in the appendix UN, which can be opened separately.

Good to know

In the annual declaration there are input fields which are not supported by a field ID and which can only be determined by the corresponding line. Since the lines in the annual declaration can change each year, a fictitious field ID is stored in VAT@GTC. The assignment of the line in the declaration to the fictitious field ID can be found here: Link.

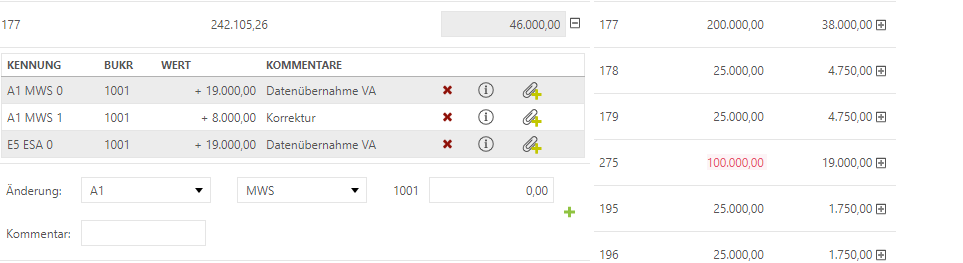

Manual adjustments

Irrespective of how the Preliminary VAT return values have been incorporated into the Annual Declaration, manual adjustments and additions can be made in the Annual Declaration for amounts that may still be missing. This works in the same way as in the Preliminary VAT returns.

Import year / Validate

You can use this function to compare the subsumed values from the preliminary VAT returns with the annual values from the underlying SAP system.

The following process should be noted:

Upload the annual RFUMSV00 from SAP into the Import area, (import process at this point with [Fallback import] only). It does not mandatorily need to contain all periods of the year.

Each tax code contains the annual values. In contrast to the SAP reports as the basis for the preliminary VAT returns, these amounts are not mapped. They are compared with the values from the mapped annual VAT return positions in the dialogue [Import year / Validate].

The comparison is broken down by the field of the annual declaration. For each field of the annual declaration, all tax codes that are mapped to it are taken into account.

| Origin of the values | Column name | Meaning |

|---|---|---|

Annual Declaration (Summed values of the pre-declarations mapped into the annual declaration and the manual adjustments taken in the annual return). | Field-ID/Tax codes | The Field-ID from the annual return or the tax codes mapped to this field. |

| Tax code form | Tax code form | |

| JE declaration | Annual declaration | |

| Source | The origin of the return values:

| |

| Import the RFUMSV00 for the whole year. | Tax code | Tax code from the RFUMSV00 |

| Tax code form | Tax code form from the RFUMSV00 | |

| V00 Import | Value from the RFUMSV00 | |

| Difference | The difference between the values from the V00 import and the annual return. | |

| Manual and automatic adjustments from the preliminary VAT returns. | Tax code | Tax code to which manual adjustments have been made. |

| Tax code form | Tax code form to which manual adjustments have been made. | |

| Sum of VA Adjustments | Total of manual adjustments made in the preliminary VAT returns. | |

| Difference | The difference between V00 import + VA adjustments and the JE declaration. |

If the values differ, please check them. Possible causes of differences:

- Additional entries in the SAP system was not yet booked

- Incorrect postings in the SAP system

- Correction bookings were not made in the SAP system

- Incorrect processing of resubmissions by the user

- Subsequent postings in SAP

Praxishinweis

Das Feld mit der ID je108 wird errechnet und nicht aus dem RFUMSV00 importiert. Daher wird es hier in der Regel zu einer Abweichung kommen, da der Wert in der Spalte V00 Import immer null ist. Diese Abweichung kann ignoriert werden.

Possible differences may result in the necessity to adjust the preliminary VAT return values in the VAT@GTC. This can be done in the upcoming month, in the preliminary VAT return for December or in the annual VAT return. If the preliminary VAT return is changed, the corrections are required. After adjusting the numbers, they can be compared again.

The “appendix UN” can be opened by clicking on the [Show appendix UN] button [in the upper part of the [VAT return] dialogue].

Monthly status, yearly status, send VAT return

This point is described in detail in the preliminary VAT return period chapter. The processing/functioning is analogous.

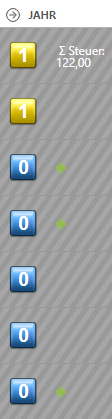

Yearly VAT return correction

To create a corrected VAT return use the [Plus sign]. A confirmation prompt pops up asking the user whether a correction VAT should really be created, since once created the action cannot be cancelled. If the correction is made in a company, the number of the milestone increases (for example, a blue zero becomes a yellow one). At the same time, the [VAT return] dialogue is used to automatically duplicate the VAT return column and display a correction column.

The values can be adjusted in the [Correction 1] column. Please add a meaningful description.

If a correction is made for a VAT group member, the milestone of the VAT group member and the milestone of the representative VAT group member increase. In addition, both milestones are set to [in process]. After the VAT return has been finalised, the representative VAT group member or parent unit must also be finalised again so that the VAT group return can be sent. The difference between the tax to be declared and the correction is always displayed in the annual VAT return.

Reports

The [Report] dialogue contains amongst others the following reports: [VAT returns of the current calendar year] and [Current VAT return in detail]. In addition, further reports are available. Please keep in mind to select the required company.

Annual VAT return

This report displays the print version of the annual VAT return form. It can be used as a basis for the written report to the tax office, which, however, should be done only in very exceptional cases.

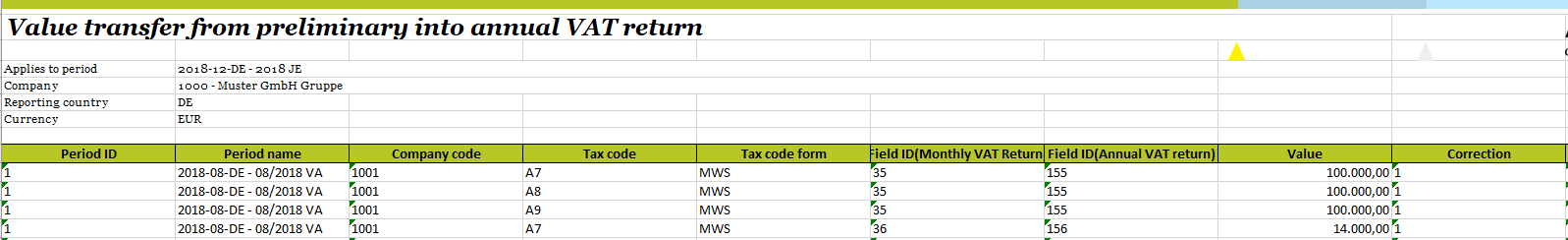

Value transfer from preliminary into annual VAT return

In this report, the user can see which values have been copied to the annual VAT return for each selected company code. These are displayed as a list grouped according to tax codes and origin (manual adjustment, imported value from the preliminary VAT return, etc.).

The values which have not been copied are displayed in a separate tab. The values may not be copied due to the following reasons:

- Mapping on field [0] in the preliminary VAT return

- Missing mappings in the annual VAT return period

Good to know!

In order for the values to be displayed, the preliminary VAT returns must be closed in the individual periods.

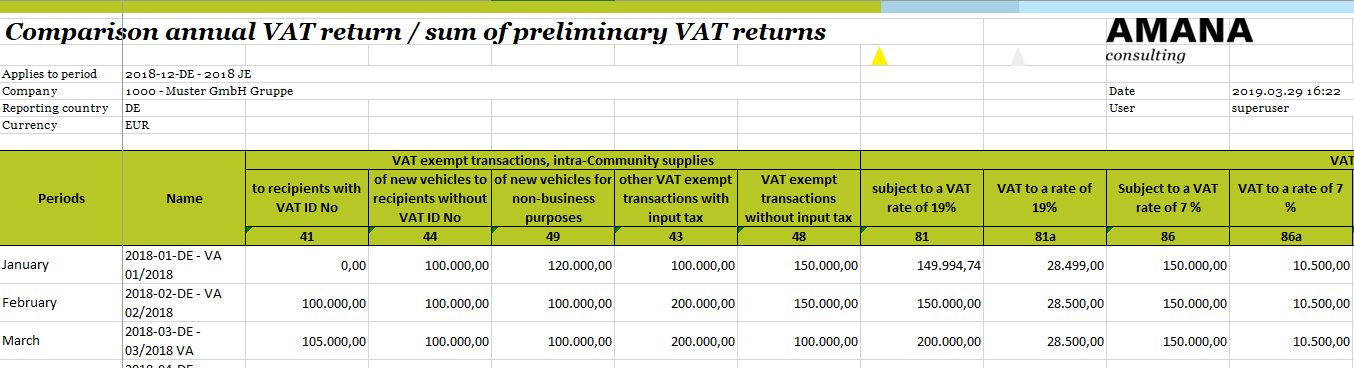

Comparison annual VAT return/sum of preliminary VAT returns

The total preliminary VAT return values from the calendar year are compared with the annual declaration. These are listed sorted by field position, totaled, and compared with the corresponding fields in the annual declaration.

The system displays the selected company and, if necessary, the values of the VAT group.