Twelve reconciliations are available for the creation of the monthly VAT returns. These reconciliations combine the imported files and detect possible inconsistencies.

Reconciliations in detail

The reconciliations are mainly based on the standard SAP reports:

| Preliminary VAT return | from RFUMSV00 |

| Additional data on preliminary VAT return | from RFUMSV10 |

| Balance sheet / profit and loss account | from RFBILA00 |

| Reconciliation | Function | Requirement |

|---|---|---|

Reconciliation 1: Plausibility of VAT amounts in VAT report V00 | This reconciliation checks the imported reporting data from RFUMSV00 for plausibility. Thereby the tax base is compared with the tax using the defined tax rate. In case of discrepancies, this reconciliation provides the possibility to store a limit for auto adjustments. Deviations up to this limit are automatically adjusted by the system during import and entered corrected in the declaration. Which side is adjusted in the process can be configured under [Settings → Countries → Edit → General information → Automatic correction]. | Import of reported values from RFUMSV00 or Excel file |

Reconciliation 2: Comparison of G/L account with VAT Return | The reconciliation 2 compares the VAT amount calculated in the VAT-Return has been really posted in the balance sheet as VAT payable. | RFBILA imported/ Value manually stored VAT payable account configured |

Reconciliation 3: Differences between VAT reports V00 and V10 | The reconciliation 3 compares the tax base of the reports RFUMSV00 and RFUMSV10 per tax code. | Import of RFUMSV00 and RFUMSV10 |

Reconciliation 4: Completeness check of revenue accounts | The reconciliation 4 filters the balance of the revenue accounts in the [Master data] main area of the RFBILA and compares them to the sums of tax bases, assigned to these accounts in the imported additional list to the monthly VAT return RFUMSV10. The aim of this reconciliation is to find out whether the bookings on the revenue accounts in the period are taken without the tax code. Reconciliation 4 is a typical reconciliation for SAP and other ERP systems that allow using more than one tax code on one account. | Import of RFUMSV10 and RFBILA Reconciliation 3 should be without errors Reconciliation accounts maintained |

Reconciliation 5: Completeness check of expense accounts | The reconciliation 5 basically works in the same way as the reconciliation 4, with the only difference that the system compares the balance of the expense accounts from RFUMSV10 and RFBILA. | See Reconciliation 4 |

Reconciliation 6: Completeness check of balance sheet accounts | The reconciliation 6 basically works in the same way as the reconciliation 4, with the only difference that the system compares the amounts on the balance sheet accounts from RFUMSV10 and RFBILA. | See Reconciliation 4 |

Reconciliation 7: Plausibility check input Tax code | The reconciliation 7 filters all input tax codes from the imported RFUMSV10. The mapping - which type of tax code has a tax code - is taken from the tax code in the [Master data] main area. After that the system checks, which accounts are booked with this tax code and compares the list of accounts with the reconciliation accounts in VAT@GTC. | See Reconciliation 4 |

Reconciliation 8: Plausibility check output Tax code | The reconciliation 8 basically functions in the same way as the reconciliation 7 with the only difference that the system filters output tax codes and the corresponding expense accounts and compares them to the accounts in the VAT@GTC. | See Reconciliation 4 |

Reconciliation 9: Reconciliation with ESL | The reconciliation 9 identifies whether the reported values in the ESL match to the values in the monthly VAT return. | ESL filed with VAT@GTC |

Reconciliation 10: Deviation from the mean of the last 12 months | Reconciliation 10 can be configured per field and calculates the mean value of the last 12 months and is used across years. If the current value deviates from the mean value of the 12 previous months by more than a value or percentage defined in the configuration of the reconciliation, this reconciliation reports an error. | Only useful if the fiscal year is consistent. |

Reconciliation 12: Plausibility check for reverse charge | The reconciliation 12 controls whether the tax value that applies to the reverse charge turnover matches the value in the input tax field that is applicable to the reverse charge turnover. | Declaration info is imported |

Reconciliation 13: Plausibility check intra-comunity acquisitions / Inputtax | The reconciliation 13 controls whether the tax value that is applied to the intra-community acquisitions matches the value of the input tax that is applicable to the intra-community acquisitions. | Declaration info is imported |

Configuration of the reconciliations

General configuration

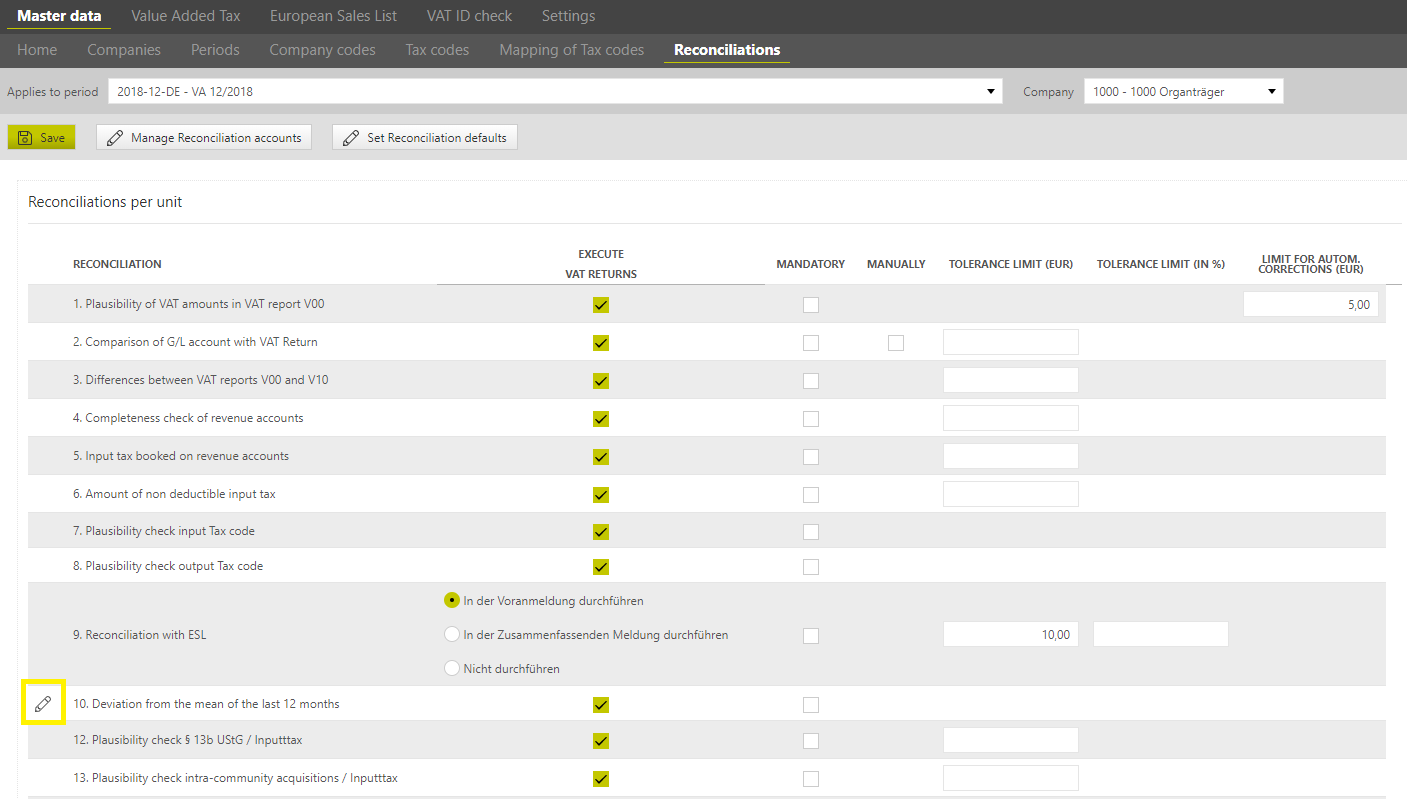

The reconciliations are configured in the tabular overview, since the setting options are basically the same.

Execute [the reconciliations] for VAT returns or annual returns | By activating this checkbox, the corresponding reconciliation can be executed for the creation of the preliminary VAT return (month or quarter). The reconciliation will not be executed for the preliminary VAT return in the selected period for the selected company. |

Execute ESL | Is relevant only for the reconciliation 9 [Reconciliation with ESL]. Further Details in the next section [Configuration of Reconciliation 9] When the checkbox is activated the reconciliation will be executed for the ESL. If the checkbox is left unmarked the reconciliation will not be executed for the ESL in the selected period for a certain company. |

Mandatory | If the reconciliation will be executed for the monthly or annual VAT return, define whether its execution is mandatory. For time reasons during the VAT return creation process, it can be reasonable to mark the reconciliations as not mandatory. If the checkbox is activated, this reconciliation has to be performed successfully before the VAT return can be finalised and sent. If the checkbox is left unmarked, it is possible either not to execute the reconciliation at all or ignore the eventual errors. In both cases, it is possible to finalize the VAT return. In any case, this will be saved to the “Resubmission”. |

Manually | This field relates only to the filed 2 [Comparison of G/L account with VAT return]. It is relevant when this reconciliation is to be performed for the monthly or annual VAT returns without importing the RFBILA. If the checkbox is activated, the VAT@GTC knows that the G/L account VAT to pay or recover data cannot be read from the balance sheet (e.g. since the RFBILA has not been imported or the tax accounts have been closed via the G/L account VAT to pay or recover). As a result, there is a field for the manual input of the G/L account VAT to pay or recover balance in the [Import] dialogue. Here the user can enter the value of the G/L account VAT to pay or recover. It is important to create the G/L account VAT to pay or recover in the VAT@GTC [Master data] main area before that. If the checkbox is left unmarked, the reconciliation 2 is performed, using the data from the RFBILA report. In this case, it is necessary to create the G/L account VAT to pay or recover in the [Manage reconciliation accounts] sub-dialogue. |

Tolerance limit (EUR) tax amount | This parameter is irrelevant for the reconciliations 7 and 8 [Plausibility check input tax code] and [Plausibility check output tax code], so that no entry is possible for these reconciliations. The user can define the tolerance limit [EUR] when the reconciliation can still be considered correct. The setting can be used to deal with the rounding differences. The tolerance limit applies to one row of the current reconciliation. If the reconciliation value is at or below the tolerance limit, the reconciliation is considered successful, but a warning appears. If the reconciliation value is over the defined tolerance limit, the reconciliation fails. No entry means that there is no tolerance limit. Even the tiniest deviation results in an error. |

Tolerance limit (in %) | The tolerance limit in % is used only for the reconciliation 9 [Reconciliation with ESL]. Due to different rounding procedures, higher variances often occur between the values in the VAT return and those in the european sales list. It can therefore be useful to specify a percentage tolerance limit. Variances within this tolerance are not displayed as reconciliation errors. A numbered tolerance limit can be entered aswell. However, only one of the two limits should be specified. |

Limit for autom. corrections (EUR) | The defined limit is used for reconciliation 1 [Plausibility of VAT amounts in VAT report VOO] in order to carry out an automatic adjustment to the tax base or tax, depending on the settings made in the country dialogue. |

All master data settings in this dialogue are saved for the selected company in the selected period. A mass import of the master data settings is not intended for reconciliations. When a period is created based on another period, master data settings of the reconciliations are taken into account.

Exception

Reconciliation 10 must be completely configured in the master data.

Configuration of Reconciliation 9

Reconciliation 9 can be performed in the VAT area or in the ESL area. If reconciliation 9 is to be performed in both areas, it cannot be set as mandatory.

If reconciliation 9 is configured in only one of the two areas, the reconciliations in this area can be performed only if the declaration in the other area is at least closed. Therefore, reconciliation 9 should be configured in the area that will be processed later, so that the values from the other area are already present in the standard process.

If the reconciliation is configured for both areas, there is a warning that the values may be incomplete if the other declaration is not closed.

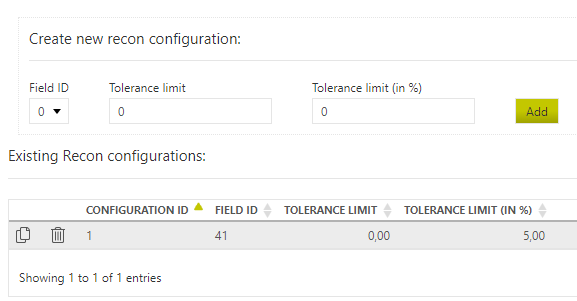

Configuration of Reconciliation 10

In order to calculate the average value of the last 12 months across the year, a field Position must be specified for which this is to be done. With tolerance limit, the amount or percentage by which the value may vary across months can be specified. Only one of the two variants can be selected. If both tolerance limits are configured, only the percentage tolerance limit is applied.

Manage reconciliation accounts

The subdialogue [Manage reconciliation accounts] contains master data of the balance sheet and profit and loss account. This is necessary for the following reconciliations [they require the data from the RFBILA report in addition to the VAT report RFUMSV00 and RFUMSV10]:

- Reconciliation 2

- Reconciliation 4

- Reconciliation 5

- Reconciliation 6

- Reconciliation 7

- Reconciliation 8

The assignment of the accounts

There are two ways how reconciliation accounts are assigned to companies in VAT@GTC:

| Individual company | SAP system | |

|---|---|---|

| Assignment | Reconciliation accounts can be assigned to each company individually. | Reconciliation accounts can be assigned for all companies in an ERP group. |

| Dialogue | In the function bar, "- - -" must be selected under [SAP system]. | The relevant ERP group must be selected in the function bar under [SAP system]. |

| Display / Usage | If available, accounts that are specifically assigned to this company are displayed and used for the reconciliations of the company. If the company is assigned to an ERP group, the accounts of the ERP group, if any, are also displayed and used for the reconciliations of the company. | The accounts that are assigned to the ERP group are displayed. |

| Import / Create | If a single company is selected, the accounts will be created only for this company during import or creation. | If an ERP group is selected, the accounts are created for the ERP group during import or creation. |

| Edit / delete existing accounts | Company-specific accounts and accounts from the assigned ERP group are displayed, but only the company-specific accounts can be edited or deleted. | All accounts in the ERP group can be edited or deleted. |

The available SAP systems are preset in the admin area and can be assigned to each company in the master data settings.

The master data of the reconciliation accounts are saved for every period, company, and company code.

Assignment: in addition to that, the “parent” reconciliation accounts can be created for all companies of a SAP engine, provided that the accounts are harmonised accordingly in the whole group. In this case the master data of the reconciliation accounts are saved for every period and every SAP system. The available SAP systems are defined in the [Administration] dialogue and are to be assigned in the master data settings of every company.

When a period is created based on another period, the reconciliation master data settings are fully considered.

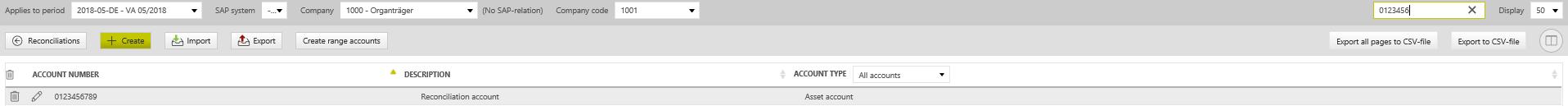

Creating an Reconciliation account

Via [Create] a new dialog opens where individual accounts can be created.

For each reconciliation account 3 fields can be filled:

| Account number | The name of the account from SAP. This field is a mandatory field. This field can be filled with up to 10 digits and is always completed with leading 0s to 10 digits. |

| Description | An optional description of the account. The description of the account from SAP should be entered here for better transparency. |

| Account type | There are 5 account types that can be selected:

|

Click on the [Save] button to save all the entries. When exiting the page without clicking on the [Save] button, all the entries will be discarded. After a reconciliation account has been created, only the description can be changed.

When [deleting ] the G/L account VAT to pay or recover the account will be deleted without any further prompts. The account will not be archived. The empty entry fields will be shown again and a new G/L account VAT to pay or recover can be created. If the account number or account type is incorrect, the account must be deleted and created again.

When [Deleting] the payment debit account, there is no archiving.

Create range accounts

In addition to the simple creation function, there is also the possibility to create a range of accounts. This function is useful when adding some new accounts that have the same account type and the account numbers are consecutive.

| Account number from | The lowest account number to be created must be specified here. An account is created for all account numbers that lie between [account number from] and [account number to]. |

| Account number to | The highest account number to be created must be specified here. An account is created for all account numbers that lie between [account number from] and [account number to]. |

| Description | Optionally, a description can be stored. This is stored uniformly for all account numbers. |

| Account type | The account type of the desired accounts must be specified here. This account type applies to all accounts to be created. |

Import of accounts

Since accounts are normally available in a very large number and can often already be pulled from the previous system as an Excel file, there is the possibility to import a CSV file with the accounts via [Import].

The information contained [Account number; Description; Account type] must be separated by semicolons. Column headings are not provided in the file.

After selecting the file path, the upload of the file is to be initiated.

If the import is not or not completely successful, an error message appears. Common causes are: is the wrong file type, a wrong structure of the file, or an account that appears multiple times in a large import file.

An account that appears multiple times in a large import file | The account will be imported only the first time, all further entries will be ignored. These accounts should be checked again in the file and in VAT@GTC. |

An incorrect structure of the file: Lines are not valid | The file type could be recognized by the VAT@GTC, but the record is not complete. The import failed in this respect. |

The filetype is wrong | The file type could not be interpreted by the VAT@GTC. A txt or CSV file is required. |

Clicking on the [Export] button opens a CSV file created in exactly the same format that can be read by the VAT@GTC during import. If no data sets have been created yet, the exported CSV file is empty.

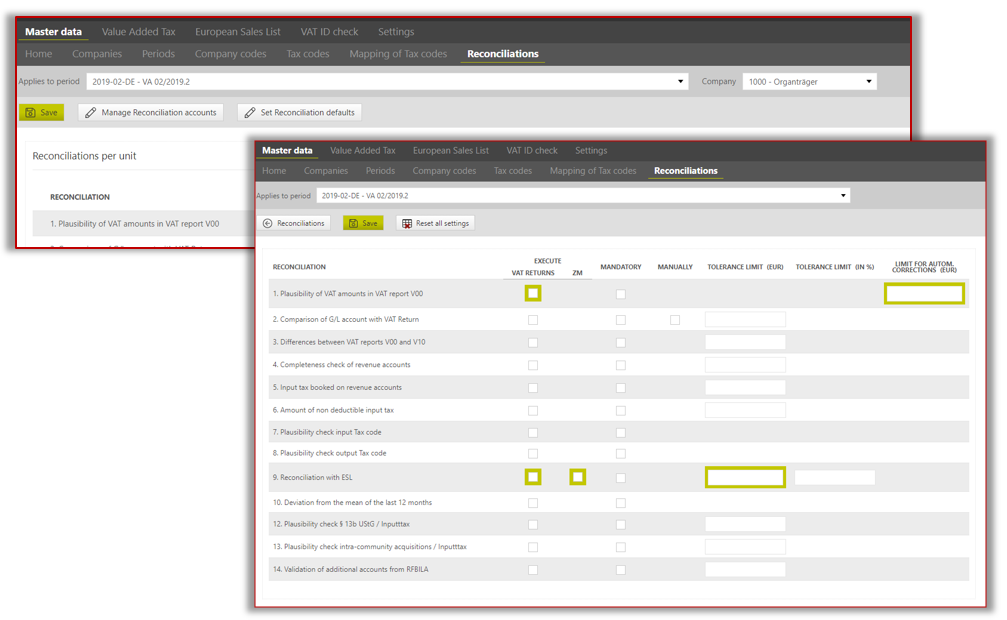

Set reconciliation defaults

Usually the reconciliations and related tolerance limits are set per company. There is also the possibility to set standards for all companies of the period. If parameters deviating from the standard have already been set in a reconciliation, the corresponding box is highlighted in green.

Good to know

Via the reconciliation defaults, set check marks can only be added, it is not possible to remove individual check marks for all companies. If the reconciliation defaults are no longer needed, they can also be reset via [Reset all settings] and then reconfigured.