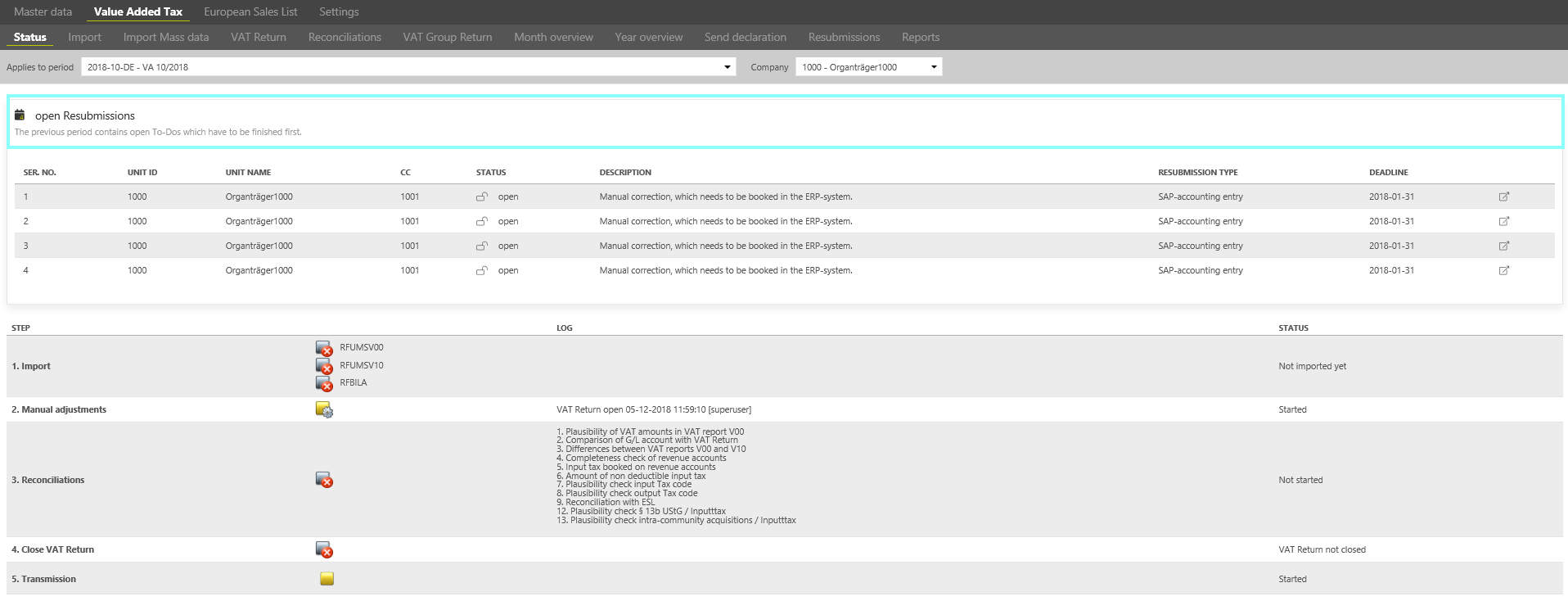

The subdialog [Status] functions as the start screen for the main dialogue [VAT] and provides information about the current status of the preliminary VAT return in VAT@GTC.

Depending on the selected period type (monthly/quarterly VAT return, annual VAT return or special prepayment), the additional dialogues next to the Status dialogue may vary. Read in the sections [preliminary VAT return], [Yearly VAT return] and [Special prepayment] to find out more about these three types of periods.

Process Status

The steps of the reporting process monitored by the VAT@GTC per company are in detail:

Import

This step is available only if import is configured for the company. Companies whose declaration is created manually do not have this step.

Symbols | Imported.

|

| Log | A compliance stamp is created for each import, in which the report name, date and time, as well as the user of the import are stored. If a report is imported multiple times, each individual import is stored so that there can be multiple entries per report. |

| Status |

|

Manual adjustments

This step is always available.

Symbols | No manual adjustments have been made yet (since the VAT return has not been created yet). The necessary adjustments have been started but have not been completed yet. Manual adjustments have been made and the VAT return has been closed. |

| Log | A compliance stamp is created for each import and each reopening after the declaration has been completed. The action, date and time, as well as the user who performed the action, are stored in the compliance stamp. If the declaration is created manually, a compliance stamp is set at the first entry of a declaration value. |

| Status |

|

Reconciliations

This step is available only if reconciliations are configured. Reconciliations can be configured only for companies that import their message values.

Symbols | Reconciliations have not been started yet. Reconciliations have been carried out but contain Errors. Reconciliation contains an error message; however, the error has been corrected. Corrections based on autolimit in reconciliation 1 are taken into account. Reconciliations without error Messages. |

| Log | A list of configured reconciliations. |

| Status |

|

Finalise

This step is always available.

Symbols | The VAT return has not been closed yet, i.e. it is open. The VAT return has been closed. |

| Log | A compliance stamp is stored for each time the declaration is closed. The action, date and time, as well as the user who performed the action, are stored in the compliance stamp. |

| Status |

|

Review

This step can be performed once before and once after the transmission and is configured under [Settings → Countries → Edit → Other System configuration → VAT / ESL Review].

Log | The Status of the review appears only after the first review has been carried out. |

Transmission

This step is performed only in Representative VAT group members and standalones.

Symbol | Declaration not yet started Declaration started Declaration not yet sent Declaration sent |

| Status |

|

Resubmission status

If there are any to-dos left open from the previous period, a notification appears [] in the [Status] dialogue. The [Deadline] column contains the deadlines for the open to-dos. They have to be finished in the [Resubmission] dialogue before proceeding with the creation of the VAT return in the current period.

Good to know!

Resubmission processing is compulsory, otherwise other dialogues of the [VAT] area are not available.

If these to-dos are left unprocessed, the dialogues [Company subdivisions] and [VAT return] are blocked.