VAT ID Check

Overview of Checks

All Checks

The [Overview of Checks] sub-dialogue serves as a start screen and provides information about VAT ID checks already performed in VAT@GTC. The table below lists each function and icon in the individual screen.

| Column | Symbol | Meaning |

|---|---|---|

Detailed view | The result of an inspection can be viewed in detail in the detailed view. | |

Delete | Archives the selected check. | |

Result | indicates that all checked VAT identification numbers are valid. indicates that at least one checked VAT identification number is invalid or the address or company name is incorrect. | |

Number of Errors | Provides information about the number of errors that occurred during the check. | |

Check Type | Indicates whether a simple or a qualified examination has taken place. | |

Webservice | Provides information about the interface used for this test. VIES: "VAT Information Exchange System" of the European Commission. BZSt: Interface of the Federal Central Tax Office. | |

Appendant group | Individual ID of the corresponding import. | |

Origin | Provides information on whether the checked VAT identification numbers originate from a summary declaration or from an import via the csv interface. | |

VAT ID | The VAT identification number of the applicant. | |

Amount VAT IDs | Shows the number of VAT identification numbers checked from the total number of the record. | |

Runtime | Provides information on how long the examination took. | |

Date | The date and time of the test are noted here. |

Result of a single check

This dialogue is opened either when the result is called up after a test, or afterwards from the overview of tests.

In the upper area general information about the check is displayed:

- The type of check

- The requesting VAT ID

- The addressed interface

- The date of the test

In the following table, different columns are displayed depending on the type of check and the interface addressed.

| Column | Meaning |

|---|---|

| Result | |

| Requester VAT ID | The requesting VAT ID |

| VAT ID | The checked VAT ID |

| VAT ID Valid | Validity of the VAT ID at the time of the test |

| Valid from | From when is the VAT ID valid. Usually only filled for VAT IDs that are no longer valid. |

| Valid to | Until when is the VAT ID valid. Is usually only filled when the VAT ID is no longer valid. |

| Error Code | Technical Error Code |

| Error Code Description | Description of the error of an invalid VAT ID |

| Companyname | Company name from the import file |

| Result Companyname | Returns whether the imported company name exactly matches the entry in the VAT register. |

| Street | Street from the import file |

| Result Street | Returns whether the imported street exactly matches the entry in the VAT register. |

| City | City from the import file |

| Result City | Returns whether the imported city exactly matches the entry in the VAT register. |

| Postcode | Postcode from the import file |

| Result Postcode | Returns whether the imported postcode exactly matches the entry in the VAT register. |

| VIES Adress Record | Complete record of addresses deposited with VIES (BZSt does not return this information). |

| Timestamp Request | Time at which the VAT ID was requested. |

Good to know

If a single check result is selected, the check dialogue can be called up again from the check result dialogue box by selecting [Go to VAT ID Check]. If it is a check whose VAT IDs originally came from a ESL, the corresponding ESL can also be opened via [Back to ESL].

Importing VAT IDs

There are two ways to import VAT IDs. On the one hand there is the possibility in the ESL declaration to transfer the VAT IDs into the VAT ID range, on the other hand VAT IDs can be imported via a csv file.

Import from the ZM

In the section [European Sales List] → [Declaration], pressing the [] button imports the VAT IDs contained in the declaration into the VAT ID check. The dialogue automatically switches to the [VAT ID Overview] page and the current import from the ESL is preselected.

Import from a csv file

VAT@GTC offers an import of csv files for the verification of the VAT identification number.This is done in the dialogue [VAT ID check] → [Import].

If desired, each import can be given an individual name by using the [New Group Name] field. Otherwise the default name VAT ID - Import - Date is used. Use the [Select File] button to select a file from the computer, and use the [Import] button to import it.

Praxishinweis

The expected encoding of the csv file can be specified in [Settings] → [Interface Configuration].

After selecting a file and initiating the import, the [VAT ID Overview] dialogue is automatically opened and the current import is pre-selected.

VAT ID Overview

There are several ways to enter this area initially:

- Via the menu

- From the ESL

- After a file import

Depending on how this dialogue is entered, the start view of the dialogue changes. If it is called up via the menu navigation, the overview of all imports opens. When called up after an import from the ESL or a csv file, the detailed view of the import is displayed.

Overview of all imports

The columns of the table have the following meaning:

| Column | Meaning |

|---|---|

| ID | The assigned ID of the import group |

| Group name | The name of the import group |

| Amount VAT IDs | The amount of VAT IDs in this group. |

| Import Date | The date on which the import was performed. |

Use the magnifying glass to open the detailed view of an import group.

Detailed view of an import

A check of the VAT IDs can be triggered from the detailed view of an import. There are several possibilities:

On the one hand, a simple check can be carried out by calling it up via the [ESL] dialogue. In this simple variant, only the validity of requested VAT identification numbers at the time of execution and the validity period is checked. On the other hand, a qualified check can be carried out, in which address data is also compared. The qualified check is only possible after importing a csv document. When importing VAT IDs from the ESL, no address data is supplied for comparison.

| Comparison | Simple Check | Qualified Check |

|---|---|---|

| Valid VAT ID | x | x |

| Company Name | x | |

| City | x | |

| Postcode | x | |

| Street | x | |

| Scope of validity | x | x |

A check can also be carried out via two different interfaces: VIES (VAT Information Exchange System, the interface of the European Commission) or BZSt (interface of the Federal Central Tax Office). This can be selected in the [Webservice] field. The different interfaces have different requirements and information that is provided:

| Requirement/Information | BZSt | VIES |

|---|---|---|

| Requesting VAT ID must be German | x | |

| German VAT IDs can be queried | x | |

| Validity period can be queried | x | |

| Returns a valid address record | x | |

| Non-German VAT IDs can be queried | x | x |

Before the check can be started, the VAT IDs to be checked must be selected.

The check can be performed using the [Simple Check] or [Qualified Check] buttons.

Good to know

An invalid VAT ID is not necessarily an error. It can also happen that it was still current in the reporting month, but no longer valid at the time of the query.

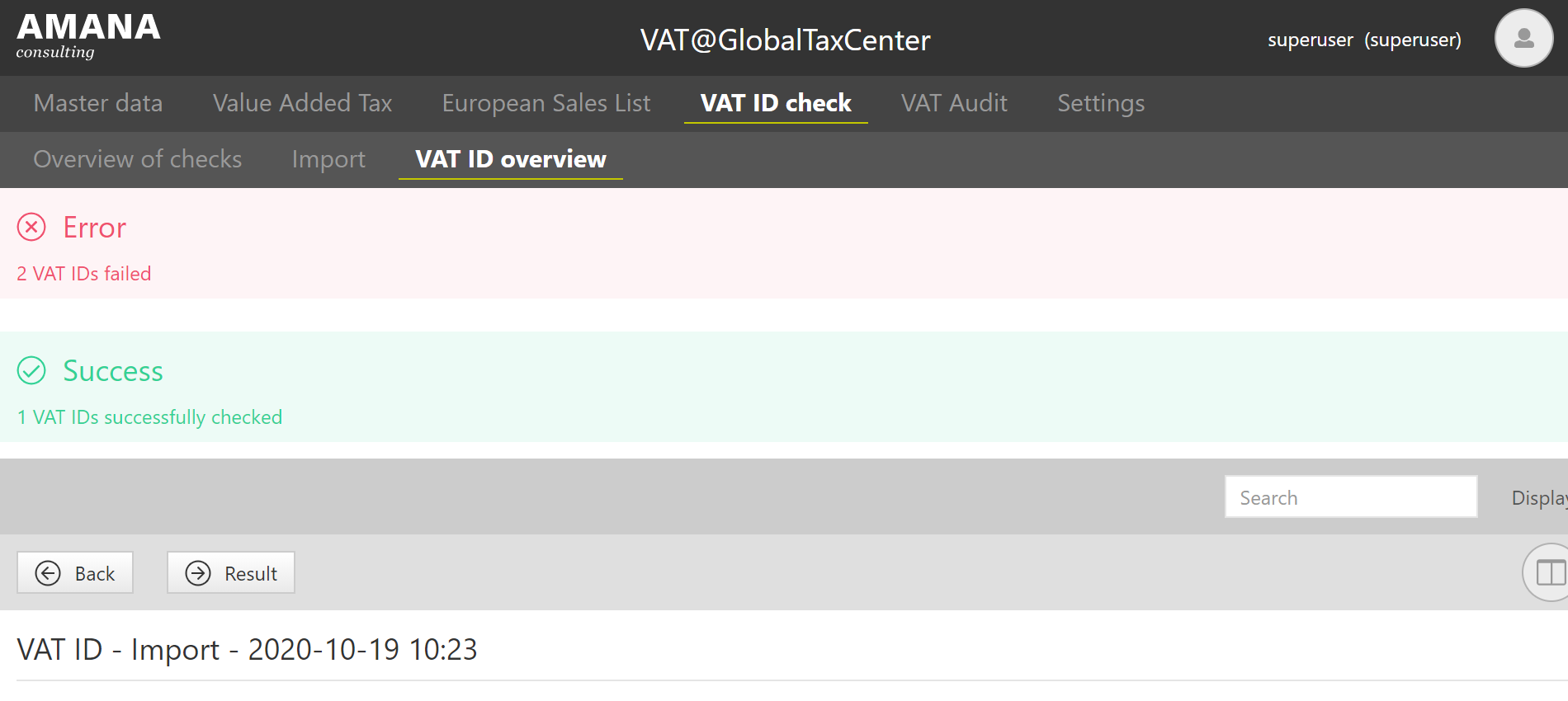

If the check is successful, the window in the lower screen is automatically displayed.

Click [Result] to list the results of the check in the detailed view of the check.

Good to know

On the one hand, the error message can mean that a VAT ID is invalid, on the other hand it can also mean that the check could not be performed.