The [Import] dialogue is available only for the periods of the monthly VAT return and is not shown in the annual VAT return periods.

Please note: if you want to use this dialogue, do not select the [Manual processing of VAT returns] when creating the company. Select the required period and company in order to view their [Import] dialogue.

To create a monthly VAT return you will need the standard SAP report RFUMSV00. The reports RFUMSV10 and RFBILA00 are necessary for the reconciliations. They can be generated from the SAP, when you select the file path. Detailed instructions for the preparation will be given at the beginning of the Project.

| RFUMSV00 | The report contains tax base and tax amount (difference in output VAT or input VAT and/ or deductible VAT or VAT not to be paid) which are classified according to tax codes. They must be imported to the [Taxcode] dialogue in the [Master data] main area beforehand. |

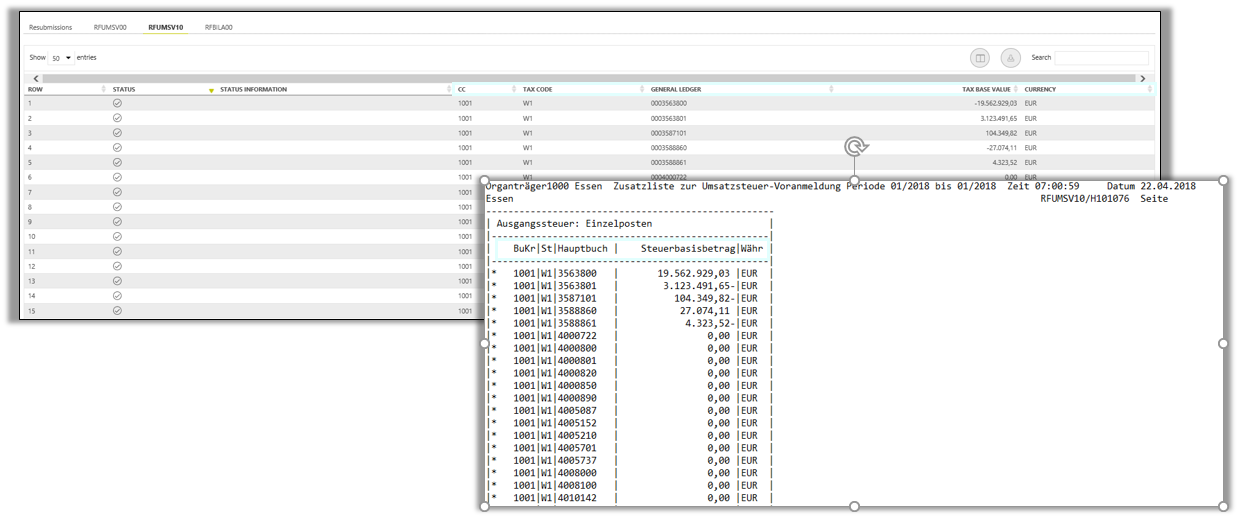

| RFUMSV10 | Tax bases of every tax code in the RFUMSV10 report are assigned to the corresponding accounts in the general ledger. |

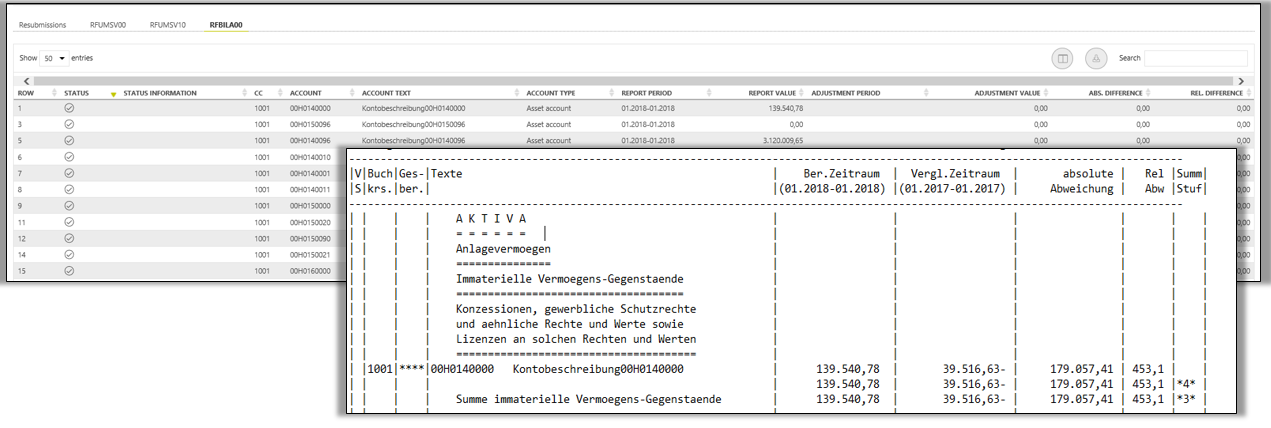

| RFBILA00 | This report contains the financial balance sheet as well as the profit and loss account SAP-Reports. |

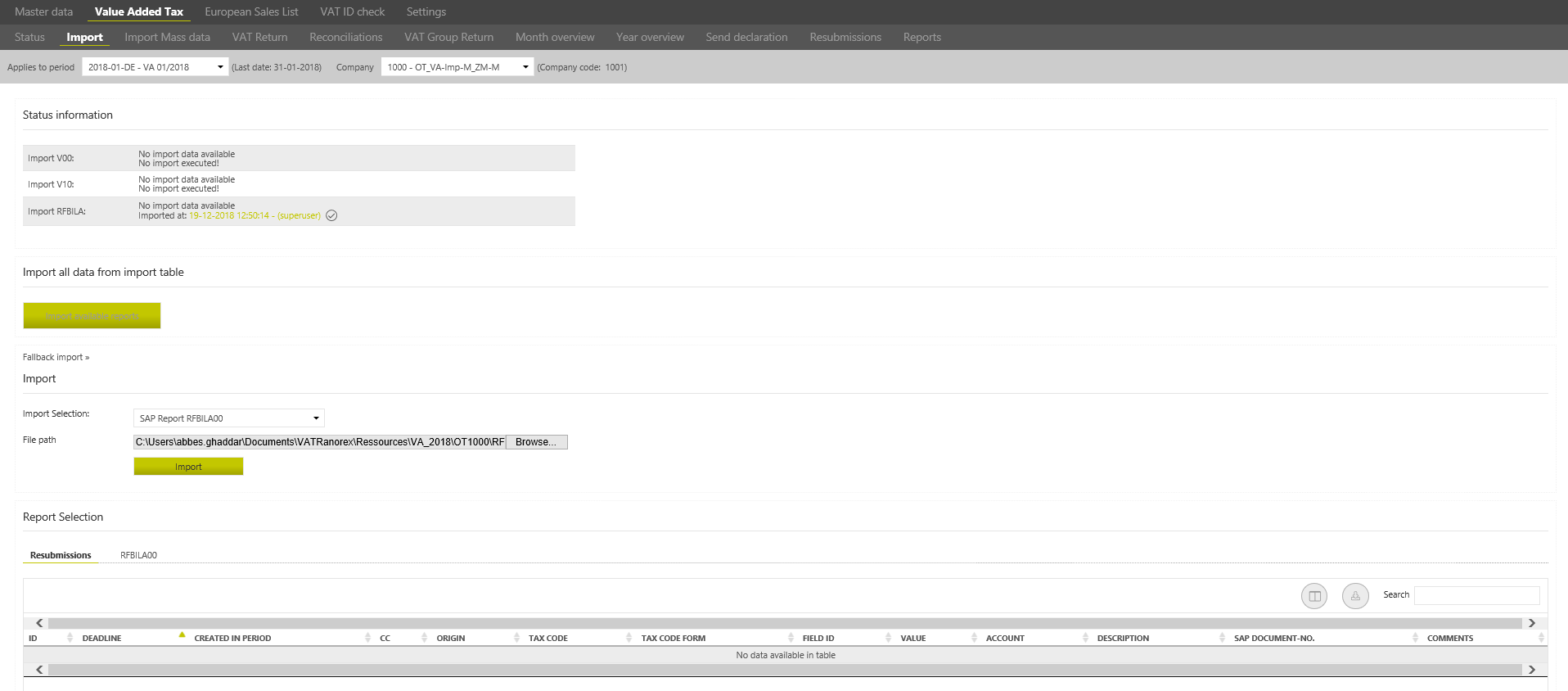

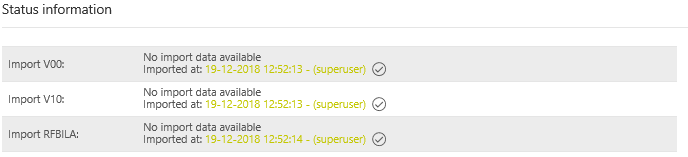

Status Information

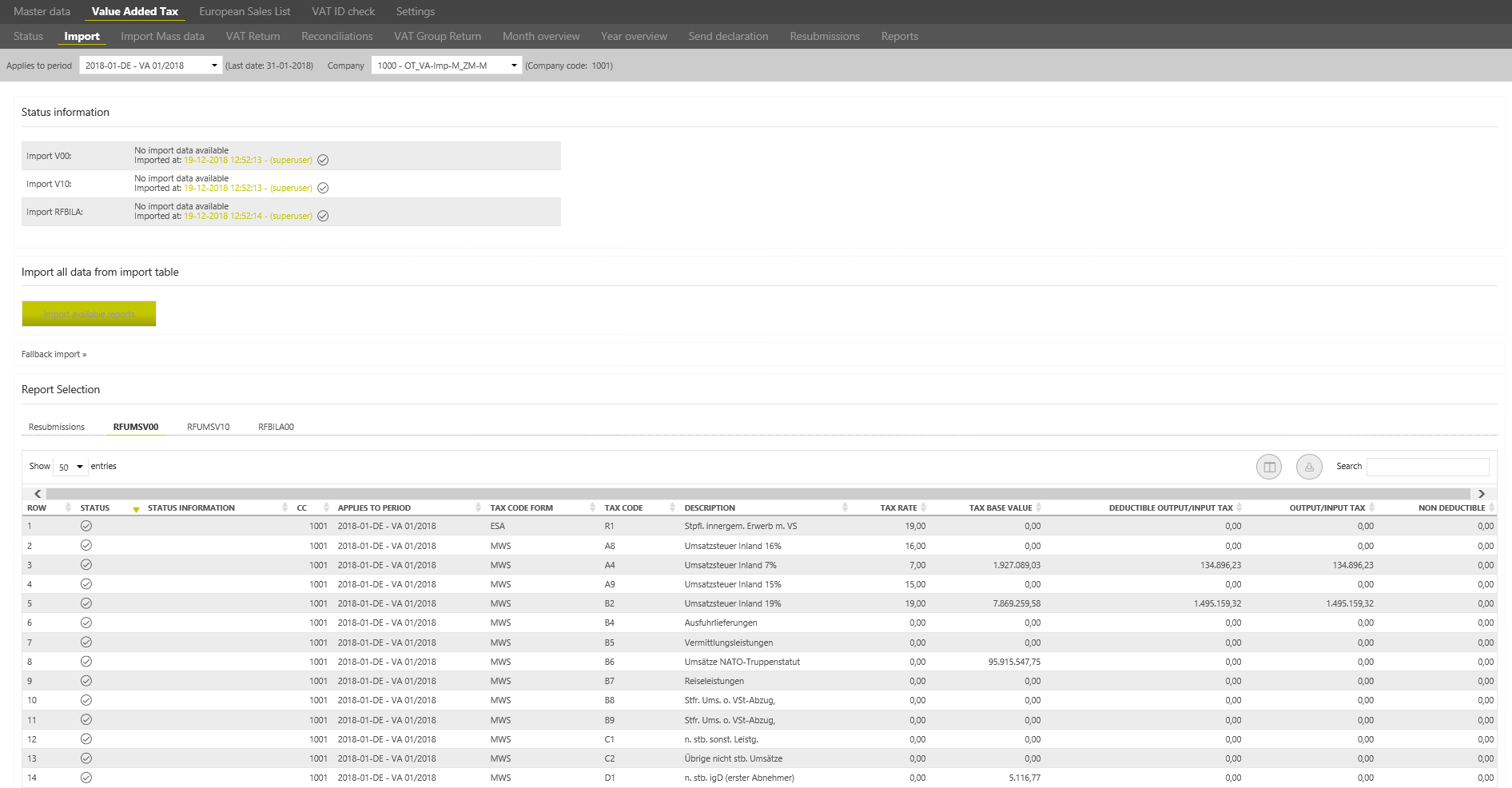

The [Status Information] is used to display the imported reports V00, V10 and RFBILA. The respective report shows whether an import has been carried out, when and by which user.

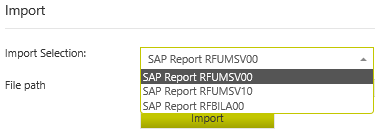

The imported reports can also be displayed in the overview table below. The report can be selected via [Import Selection], it appears in the overview table. It is possible to see the most recent Import.

Import of reports

The reports can be imported manually, via a network drive (and fallback) or via the web service. The import method used in the VAT@GTC is defined at the beginning of the Project.

Manual import

If the data are imported manually, select a report using the dropdown and the upload a locally saved document using the [Browse] button.

Netzwerk drive import

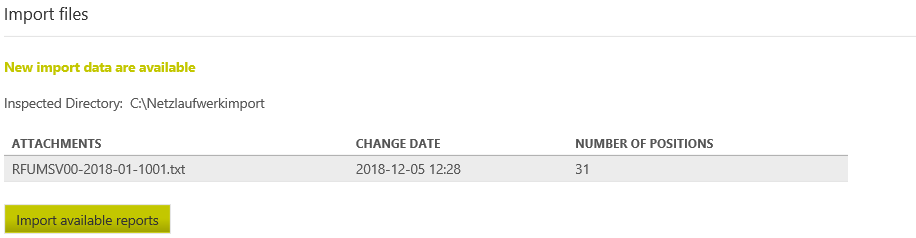

The reports are imported automatically via the network drive. Every time you click on the [Import] button, the VAT@GTC checks whether the reports are available in the corresponding folder. Please note that the file name of the report must be composed of a naming conventions defined in the current project and separated by underscores.

Type of reports | BuKr | Month | Year | Format |

|---|---|---|---|---|

RFUMSV00 | e.g. 2000 | MM | JJJJ | .txt |

| RFUMSV10 | ||||

| RFBILA00 |

If the VAT@GTC recognises the available reports, they appear in the overview. Use the [New import data are available] to import the available reports into the VAT@GTC.

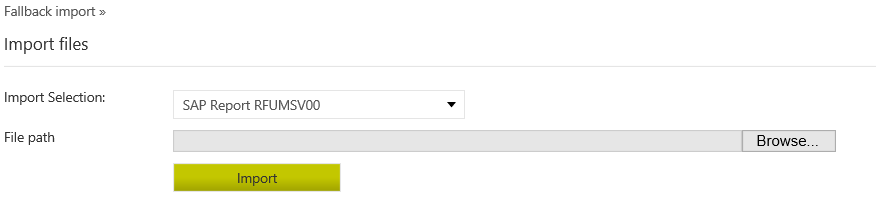

Fallback Import

If the network drive is temporarily not available, the [Fallback Import] option can be used. Select the report type, find it on your computer and Import.

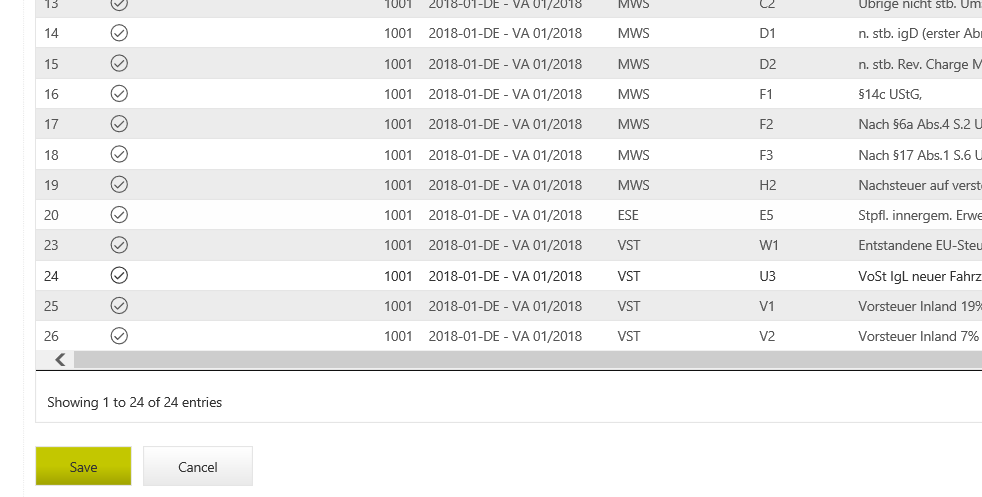

If the import is successful, the number of data sets and a part of the report are displayed in the overview table.

Click on the [Save to VAT return] button under the overview table to save the report import and add the data to the VAT return. The saved report appears in the upper part of the overview with a checkbox [], date and time of import and a username.

The import can also be unsuccessful. If any errors occur, an error message is displayed in the upper area of the [Import] dialogue. The following messages are displayed:

This error message means that the company code in the report does not match the company code in the [Company code] dialogue of the [Master data] main area.

This error message is shown if the date in the report does not match the selected period.

No report has been selected.

Report contains a value that cannot be read by the VAT@GTC, thus the import cannot be performed.

If an error message relates not to the whole report, but only to certain positions of the report, this will be marked correspondingly in the position overview:

The [Error] message means that something has gone wrong. The error must be corrected before continuing the work.

There may be errors related to this report position, e.g. if the accounts, contained in the RFBILA, are missing from the [Master data] main area. The error does not have to be corrected in order to continue the work.

No plausibility errors in the report Position.

Import process

The following section is not relevant for the companies with manual VAT return creation. If an import is carried out, the VAT@GTC processes the files during import and adapts them to the rules in the master data. The following sections explain what exactly happens when importing the respective Reports.

Report RFUMSV00

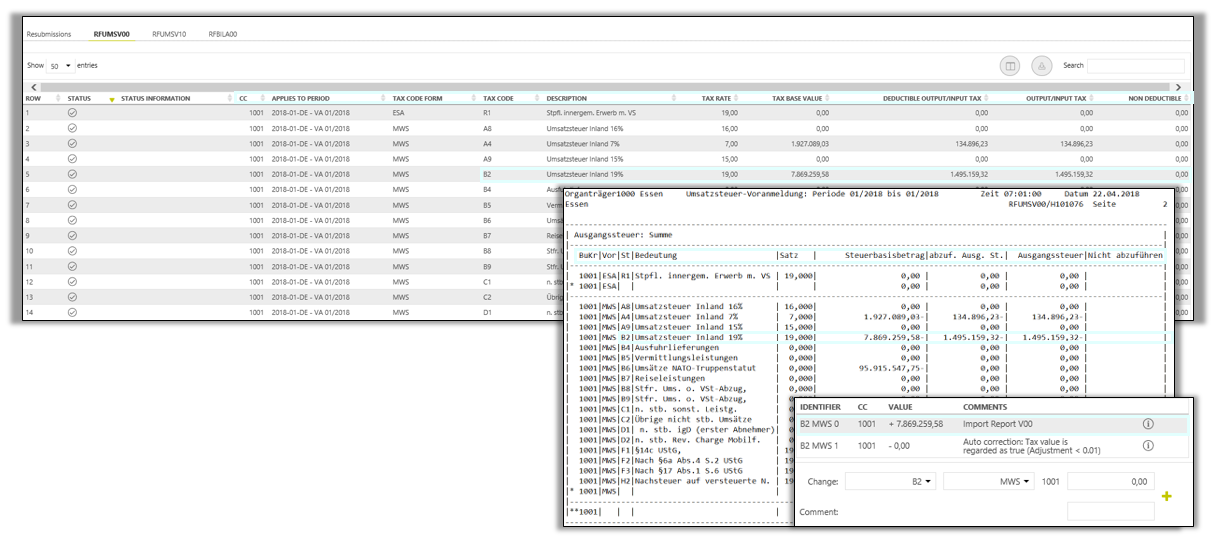

The original report and the overview table in the VAT@GTC can be seen in the following figure [Import process RFUMSV00]. The columns from [Company code] to the column [Non-deductible] are displayed in the overview table as in the report.

When importing the RFUMSV00 the following items are first checked for correctness:

- Date

- Company code

- Tax code(tax code and VAT rate)

- Deductible tax codes

If all the items match, a green check mark [] is displayed in the overview table for each line.

If the import has been carried out successfully, the signs are adjusted as follows:

Normalcase | sign in report | Adjustment of the sign in the VAT@GTC | |

|---|---|---|---|

| Tax base & tax | The same sign | The same sign | |

| MWS/ESA | - | + | |

| VST/ESE | + | + |

Special case I | sign in report | Adjustment of the sign in the VAT@GTC | |

|---|---|---|---|

Tax base & tax | The same sign | The same sign | |

| MWS/ESA | + | - | |

| VST/ESE | - | - |

If the signs of the tax base and tax are different, a coordination with AMANA must be carried out and parameters must be adapted in the master data area (special case).

Automatic correction

The figure [Import process RFUMSV00] shows that an automatic correction has been made. The automatic correction setting can be made in the master data, where it can be decided whether the tax base or tax is considered relevant. An automatic correction is made if the tax base and tax do not correspond exactly.

It can also be specified in the [master data - reconciliations] to which value the tax base or tax is to be adjusted, in order to copy the adjusted value to the VAT return form and ensure that the tax base and tax are identical.

Copy the values to the VAT return

To copy the values from the import correctly, a tax code mapping must be performed. Specify which tax codes are deductbile in the (Master Data: Tax Code) dialogue.

If the Checkbox has not been activated, only the (Output VAT) and (Input VAT) columns are taken into account in addition to the (Tax base). When this field is activated, the columns (Tax base), deductible Output tax) and (detuctible Input tax) are recorded.

Report RFUMSV10

The original report and the overview table in the VAT@GTC can be seen in the following figure [Import process RFUMSV10]. The columns from [Company report.

When importing the RFUMSV10 the following items are first checked for correctness and availability

- Date

- Company code

- Tax codes

If all the items match, a green check mark [] is displayed in the overview table for each line.

If the import has been carried out successfully, the signs are adjusted as follows:

Normalcase | Vorzeichen im Report | Adjustment of the sign in the VAT@GTC | |

|---|---|---|---|

Tax base & tax | The same sign | The same sign | |

| MWS / ESA | - | + | |

| VST / ESE | + | + |

Please note: There are no types of tax codes in the RFUMSV10. VAT@GTC takes them from the master data area.

Report RFBILA

The original report and the overview table in the VAT@GTC with the same columns can be seen in the following figure [Import process RFBILA00].

When importing the RFBILA00 the following items are first checked for correctness and availability:

- Date

- Company code

- account

If all the items match, a green check mark [] is displayed in the overview table for each line.

The signs for active/ expense accounts from the current movement balance are copied into VAT@GTC, since in SAP it is usually debited to the account. And since the liabilities/ revenue accounts from the current movement balance are usually credited in SAP, the system reverses the signs.

If an account is not saved in the master data, this is indicated by a [Warning]. Nevertheless, import is possible. The accounts that are marked with a [Warning] are not imported. If such warning is displayed, it is recommended to check whether this account has been newly added to SAP and if so, add it to the master data.

If the message is given that an account has already been imported, this account will be listed twice in the RFBILA.