Furthermore, it is also possible to upload an individual design template for the reports. In addition, a template can be uploaded in which several reports can be linked and the data can be further shaped and processed individually using Excel functions.

Standard reports

Depending on which company type and which period type ( preliminary return, annual return or special prepayment) is selected, the corresponding reports are shown in the overview.

Annual VAT return

This report summarises the annual VAT return of the selected company in an Excel view.

Resubmissions of the year (since 22.07)

This report shows all resubmissions of all companies that play a role in the selected year and for which the user is authorised. This includes both resubmissions from previous years that were just booked in the current year and resubmissions that were created in the selected year and are either not yet booked or will be booked in the following year. The following columns are filled in for each resubmission:

| Columns | Meaning |

|---|---|

| ID | ID of the resubmission |

| Unit-ID, Unit name, Company code, Unit type | Identification of the affected company |

| Created in period | Period in which the resubmission was created by a change made. This does not necessarily have to happen in the selected year of the report. |

| Deadline | The deadline by which the resubmission must be processed. Once a period that starts after the deadline is selected, this resubmission blocks the import if it is still open. |

| Status | The processing status of a resubmission can be either open or closed. |

| Posted in period | Period in which the resubmission was posted. This does not necessarily have to happen in the selected year of the report. For resubmissions for which "no posting necessary" was selected, "no posting necessary" is entered here. For open resubmissions, "no information available" is entered. |

| Resubmission type | Adjustments from the system always have "SAP-accounting entry" entered here. There are also deferred open reconciliations, tasks from the VAT-Audit and self-set reminders. |

| Base field, tax field | The fields that are affected by the resubmission. |

| Tax code, tax code form, tax rate, tax code description | Info about the tax code for which the resubmission was created. |

| Adjustment type | Either base or tax. If a resubmission concerns both sides, the side from which the resubmission was created is entered. |

| Basis of assessment, Tax | Value of the resubmission. If one of the entries is empty, the adjustment is only made to the opposite side. |

| Source | Resubmissions can result from manual adjustments in the declaration [MAN], or from adjustments by reconciliation, such as the automatic adjustment of the assessment base or tax from rounding differences [AUTO-AB1] , from manual reconciliation 1 [AB1], as well as other reconciliations (each AB + the number of the reconciliation). |

| SAP document-no. | When editing the resubmission, the SAP document number of the document with which the original adjustment was subsequently posted in SAP can optionally be entered here. |

| Created by, Creation date | The compliance stamp for generating the resubmission with user and time. |

| Changed by, change date | The compliance stamp for the last change to the resubmission with user and time. |

| Comment | The comment of the resubmission is already created when the manual adjustment is created and can be adjusted when editing the resubmission. |

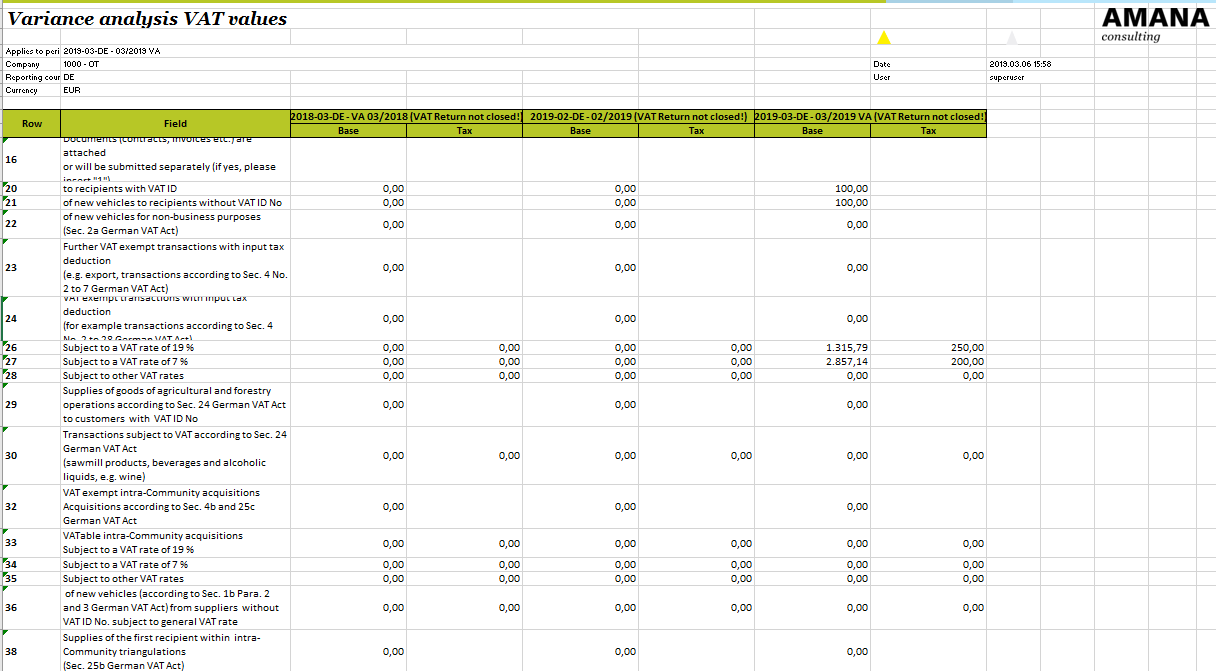

Variance analysis VAT values

This report shows the preliminary declaration values of the current period per field position. The reported values of the previous month/quarter and the corresponding months/quarters of the two previous years are used for comparison.

This report is thus particularly suitable for a deviation analysis and for tracing a possible value development. The selected company and, if applicable, the values of the group of companies are displayed.

If a yearly overview is desired in addition to this comparison, see the report "Deviation between current month and average of 12 previous months".

Good to know!

Vat validation

Good to know

This report is particularly helpful for a detailed evaluation of reconciliations 3-6.

Good to know

The assessment bases, in particular of the input tax values in the line "turnover declared in preliminary (or annual) declaration (calculated values are marked in bold italics)" are calculated using the tax values and the tax rate.

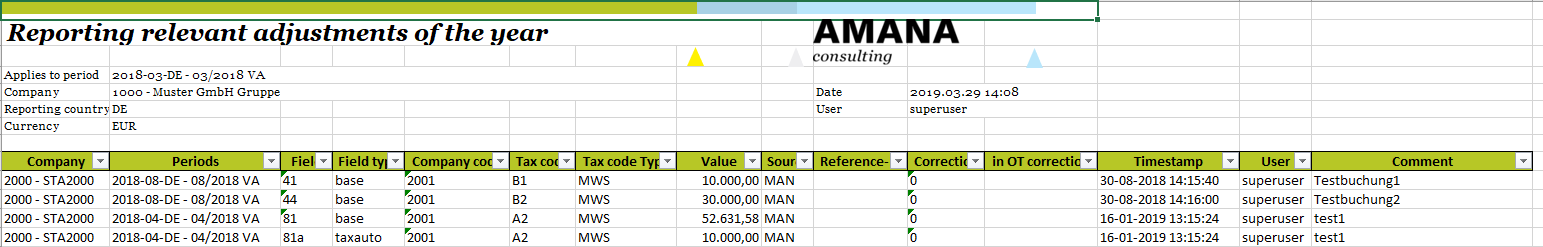

Reporting relevant adjustments of the year

All reporting-relevant adjustments such as manual changes, resubmissions and reconciliation corrections made during the year are listed in this report. There is one spreadsheet per VAT group and another spreadsheet for all standalones. The report serves as a log of which adjustments were made for a company in a period, for which tax code and with which type of reconciliation. Using the filter function, it is possible to search specifically for companies, periods, preliminary declaration fields, company codes or tax codes. In addition, it is also possible to find out who made the change and when exactly it was made. The standard filter function in the Excel application can be helpful for a better overview of this report.

VAT Returns of the past 12 months

This report is not available for Germany, but only abroad. In contrast to Germany, internationally the VAT year does not always have to correspond to the calendar year, but can also correspond to the income tax year. This report differs from the report Annual total value of advance returns only in that the calendar year is not used, but the period in which the report is called up and the 11 previous months, in order to represent the last 12 months in total. In this way, any 12-month business year can be flexibly displayed in this report without any further configuration.

For each of these months, the reported value is output for each field. In addition, there is a totals column that adds up the values of the last year for each field.

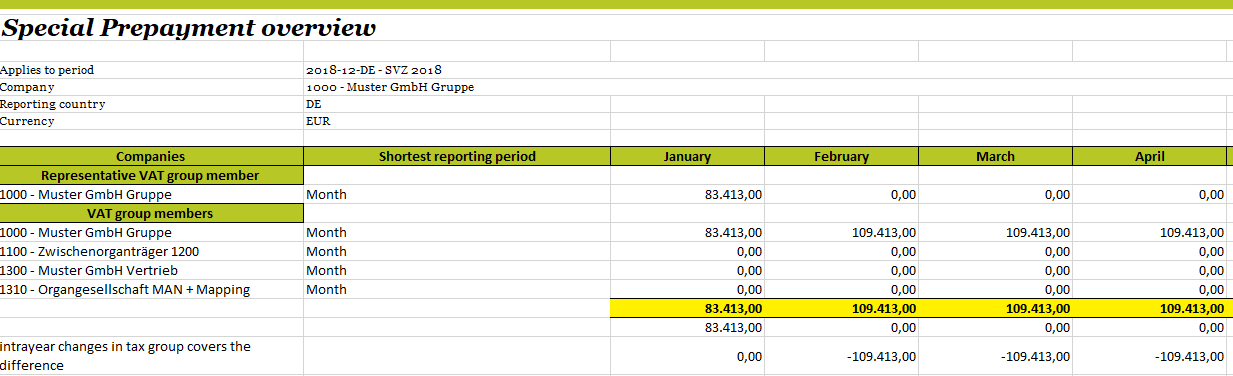

Special prepayment overview

The calculation of 1/11 for the preliminary VAT return is displayed comprehensibly for all companies (also for the VAT group).

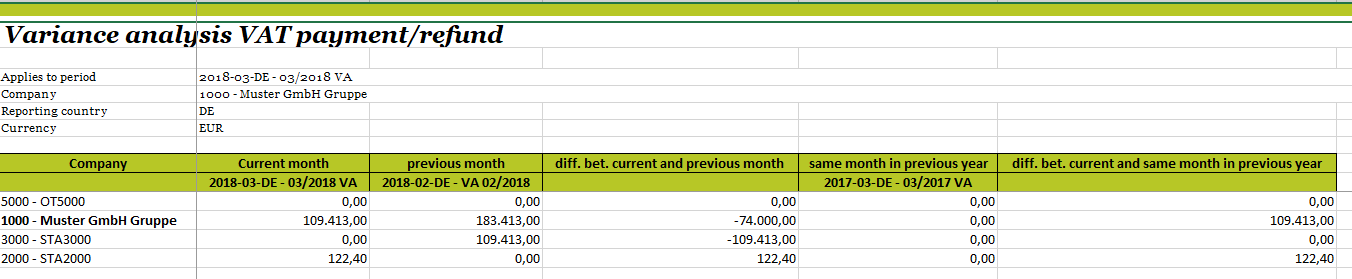

Variance analysis VAT payment/refund

All companies are listed in this report. Each VAT group has its own spreadsheet, and another spreadsheet summarises all the standalones. This report is similar to the Financial Plan Overview report, but also offers a data comparison. For this purpose, the current month is compared with the previous month and the difference is shown. Likewise, the current month is compared with the same month of the previous year and this difference is also documented.

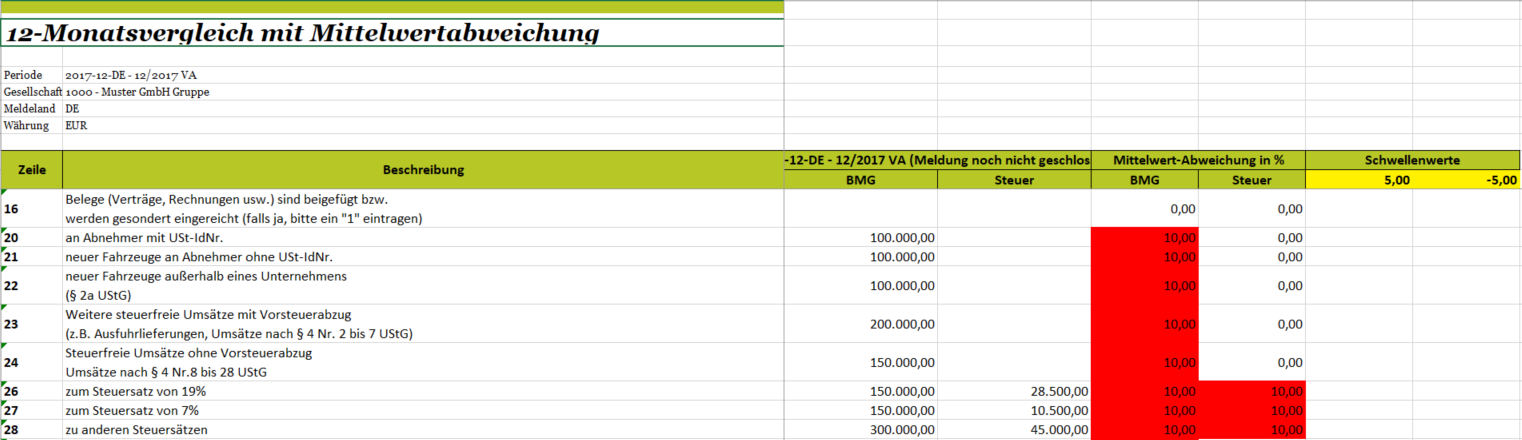

Deviation between current month and average of 12 previous months

In this report, the reporting values of the last 12 periods are shown with a mean value deviation and configurable threshold value, divided into assessment basis and tax. If the threshold value for a field is exceeded, this is highlighted in red.

The selected company and, if applicable, the values of the VAT group are displayed, broken down by reporting lines. The report is particularly suitable for companies with a different business year to determine the VAT values for the business year.

Foreign Tax codes

If foreign tax codes are entered in the VAT@GTC, the corresponding data is documented in this report. Otherwise, foreign tax codes are mapped to zero since they are not included in the German VAT return.

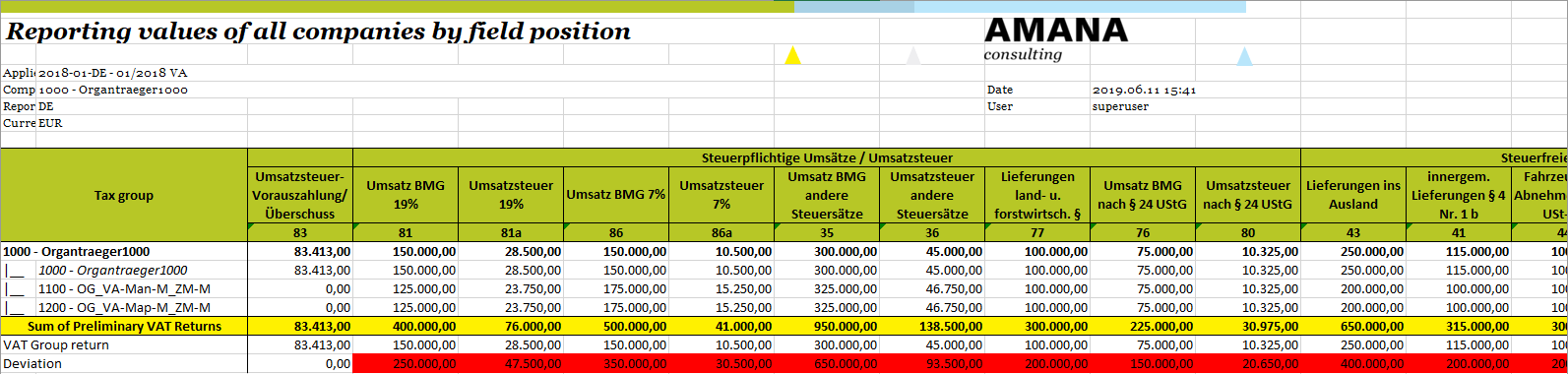

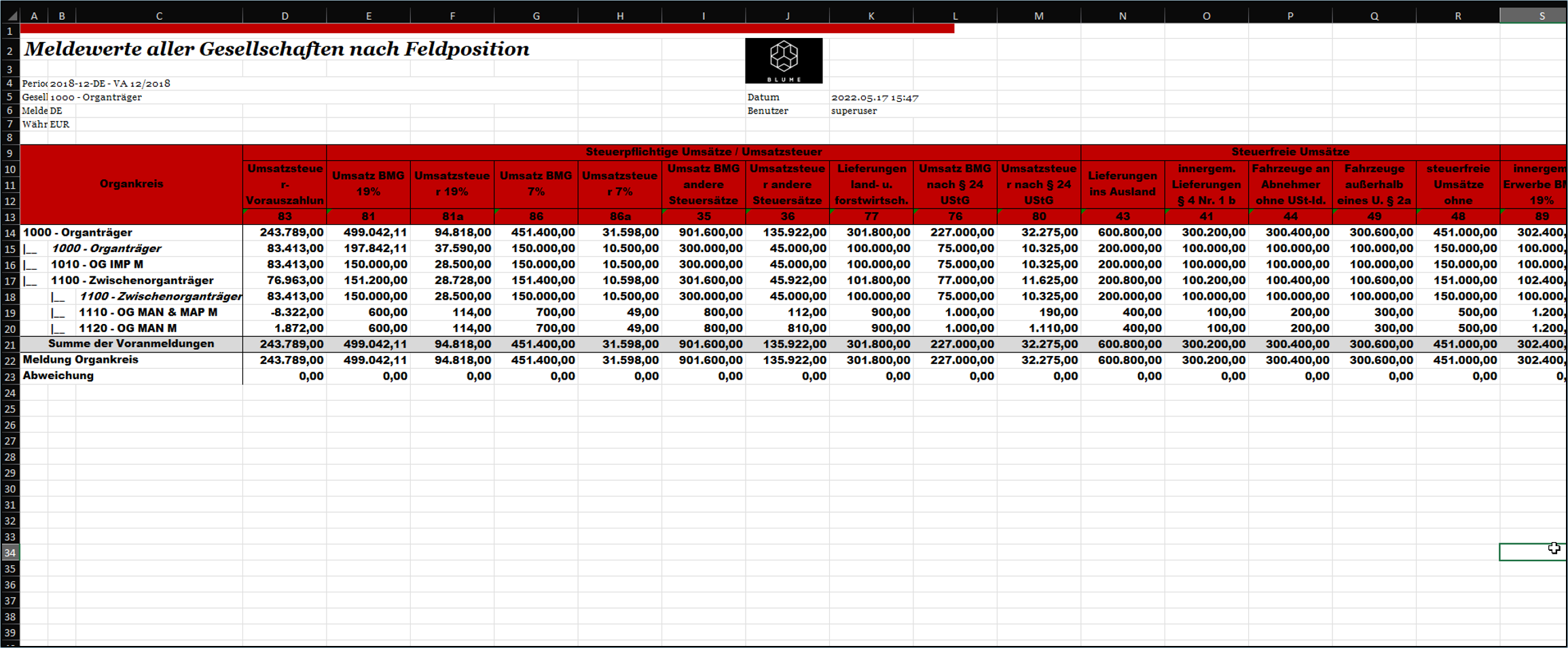

Reporting values of all companies by tax codes

There is one spreadsheet for the selected VAT group and another spreadsheet for all standalones. Here, all preliminary declaration values are listed per field position for each company. For the VAT groups, the values are added to the corresponding tax codes of the representative VAT group member and its child companies and compared with the VAT group declaration.

Since the report is very extensive and contains a large amount of data, the Excel sheet covers many columns and is therefore difficult to print out. If an analysis of the individual values based on the tax codes is desired, this can be done with the help of the report "Reporting values of all companies by tax codes".

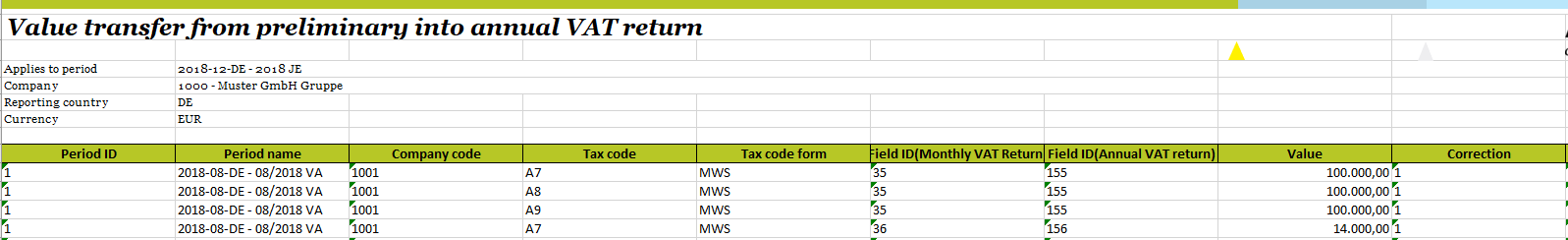

Value transfer from preliminary into annual VAT return

This report has two spreadsheets:

- An overview of the values that were transferred to the annual return by the data transfer from the preliminary returns.

- An overview of the values that were NOT transferred to the annual return through the data transfer from the preliminary returns.

The reasons for values not being transferred can be very different. In the case of manual returns without a tax code, not every field can be filled using the standard main field mapping. Either some values must be transferred manually or the main field mapping must be extended for company purposes. During the transfer, the values are transferred per tax code, not per field. Therefore, for multiple mappings, one side is always declared as not transferred. There is a note explaining the situation that the transfer of this value is not necessary.

Good to know!

In order for the values to be displayed, the preliminary VAT return must be closed in the individual periods.

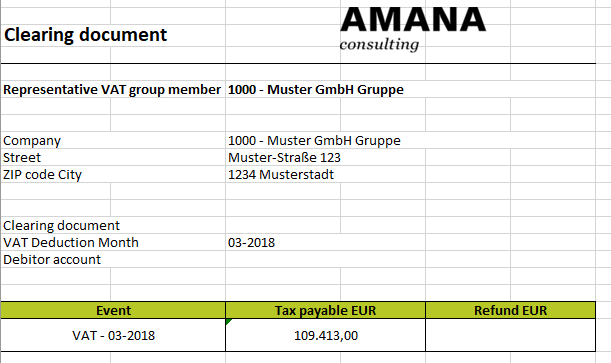

Clearing document

After the VAT return of the selected company is sent to the tax office, the amount payable is displayed in this report. The company data and, depending on whether it is a payment charge or a refund, the debtor or creditor account number stored in the master data are included.

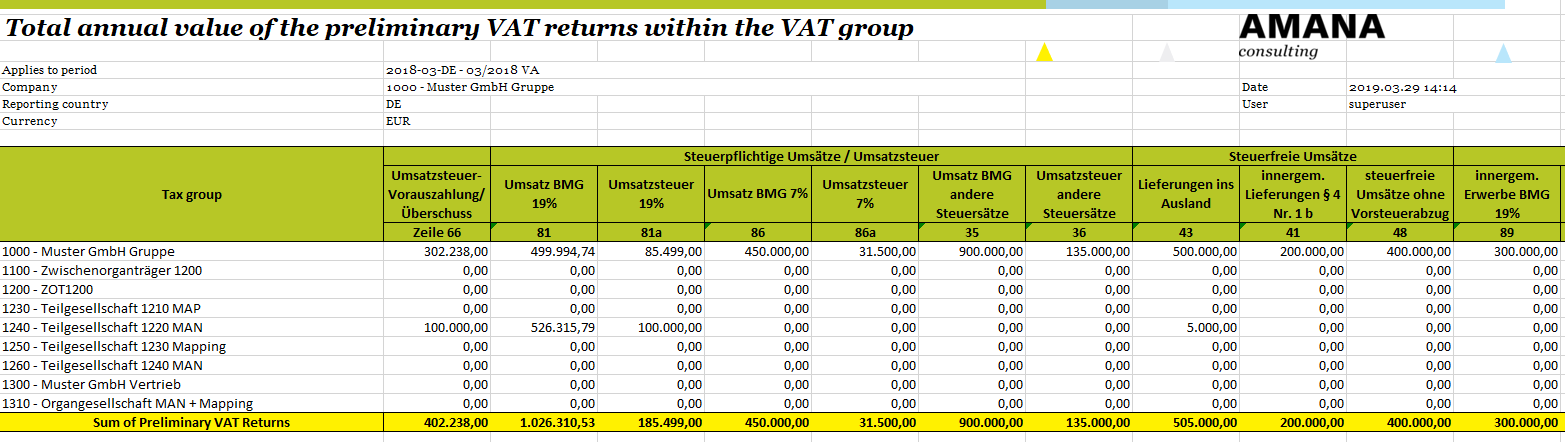

Total annual value of the preliminary VAT returns within the VAT group

This report contains an individual list of the values from the preliminary VAT return for all companies in the VAT group. To ensure better clarity, only selected field items are listed. The values are totaled values that result from the January period to the current period. In the second column, the preliminary VAT return payment or surplus is also displayed at the present position. The report can be used, for example, to track values during the fiscal year or to gain an impression of the annual values of the controlling company in advance with regard to the upcoming annual return or the annual financial statements.

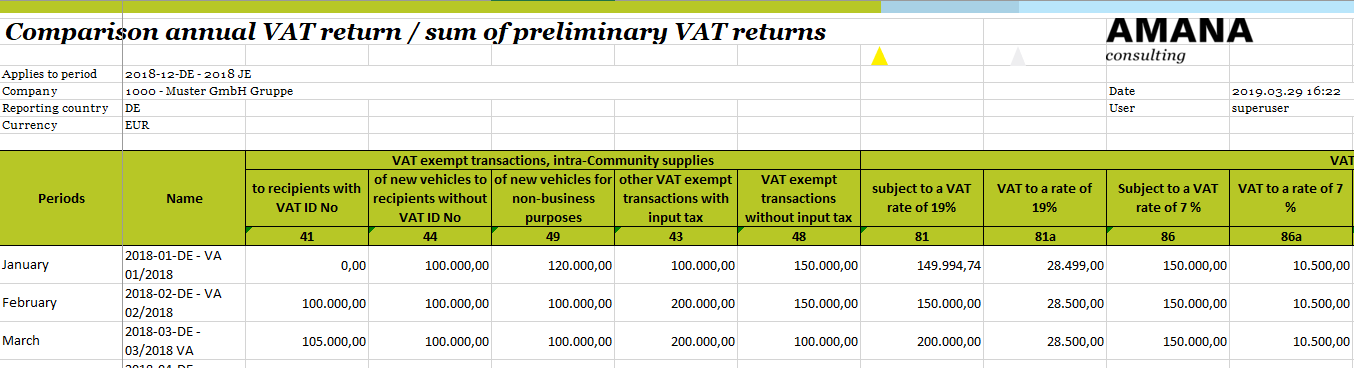

Comparison annual VAT return/sum of preliminary VAT returns

The total preliminary VAT return values from the calendar year are compared with the annual declaration. These are listed sorted by field position, totaled, and compared with the corresponding fields in the annual declaration.

The system displays the selected company and, if necessary, the values of the VAT group.

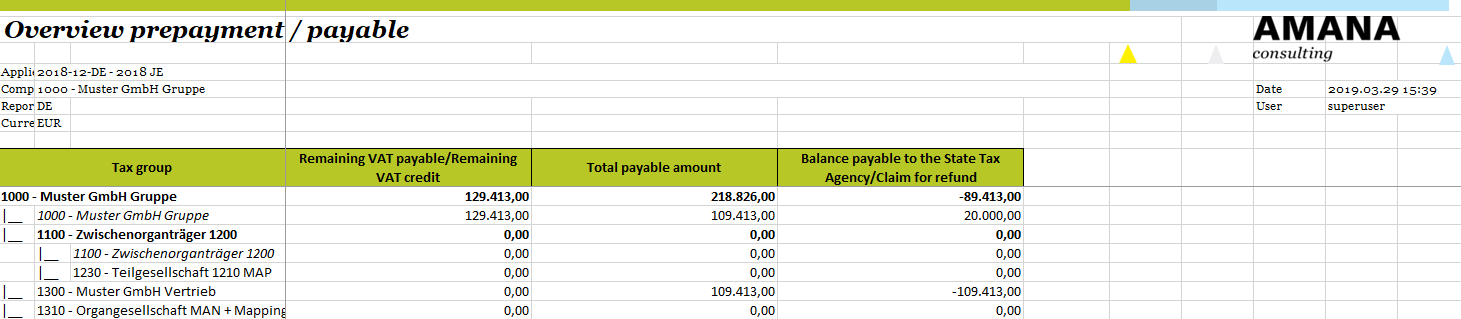

Overview prepayment / payable

In this report, the selected VAT group and all standalones are displayed. For each company, the total payable amount determined from the preliminary returns is compared with the remaining VAT payable or the remaining VAT credit (816) in order to obtain an overview of all amounts still to be paid to the tax office or all refund claims (820) at the end of the year.

Preliminary / Annual VAT return in detail

This report provides a detailed overview of the return for the selected period at individual company level. A breakdown by tax code and data origin as well as the total per field is shown.

In the Import column, the values imported per tax code are listed individually, so that it can be traced exactly which individual values make up the value of the fields. The sum of the individual values is shown in the Total column. In addition, manual changes are listed in the base adjustments column. The Origin column also shows where the manual change resulted from.

Year summary of the VAT returns

The total preliminary declaration values per field of the selected company and, if applicable, the VAT group values are shown in this report in an annual overview. All values for the entire year are listed in detail by reporting month and field position.

This report can be used as an aid in the preparation of the annual declaration. However, in this case it is important to note that the annual total cannot be transferred 1 to 1, but only 1 to n, since it is possible that several tax codes have been used for different field positions, while only the total of the field position is displayed under the year specification. An error analysis as well as the evaluation of all bookings of the year can be facilitated by means of numerous filter functions.

In addition to the information described above, the reports contain an additional worksheet that provides further details on the declarations. In this detailed view, it is possible to see which postings were made to the individual company codes and with which tax code. Manual changes are also shown here.

Good to know

If a company has changed its company status within one year, it should also be noted that in this case several worksheets are created which only contain the data for the period in which the company existed in the respective form.

Month overview

Overview of the monthly status of all companies for which the user is authorised, separated according to VAT groups and standalones. This report reproduces the Month Overview dialogue as an Excel report.

Good to know

The total in the VAT group return of the is displayed when the declaration is closed. The totals of the individual companies are also displayed when the preliminary VAT return is open.

The following columns are created:

| Company | Type of VAT group member | Company code | Import V00 | Import V10 | Import RFBILA | Reconciliations | VAT Return | Reporting period | Due dates VAT Return | VAT Return | Review before transfer | Review after VAT Return has been sent/payed | Tax payable / Refund | |||||||||

| Last status change | User | Review | Last status change | User | Review | Last status change | User | |||||||||||||||

| Active | Successful | Incorrect | ||||||||||||||||||||

Plausibility of the tax amounts in the VAT report

Overview of the result of reconciliation 1 for all companies for which the user is authorised. Each reconciled row is mapped, with the information that is also offered in the application for reconciliation 1. Each line is also supplemented with additional information, such as the corresponding field in the declaration. Using a filter, all incorrect reconciliation items from all companies can thus be viewed at a glance.

If reconciliation 1 is not set or has not been carried out, the report remains empty.

The following columns are created:

| Unit number | Unit name | Rec. result | Status | CC | Tax code | Tax code description | Tax code form | VAT rate from V00 | Assessment base from VAT Return | VAT from VAT Return | Calculated Tax base | Calculated tax | initial difference base | initial difference tax | Base field | Tax field | Reconciliation executed at | Executed by |

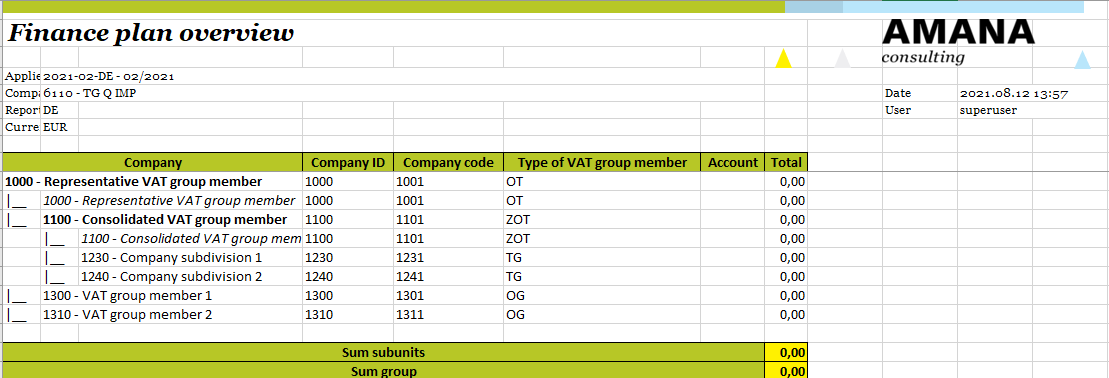

Finanzplanübersicht

This report contains a total overview of the tax payable and refund amounts for the period called up and how these are distributed among the individual companies. All companies stored in VAT@GTC are taken into account and added up. A spreadsheet is created for each VAT group, one for all standalones and another spreadsheet with all companies.

The totals of the tax payable or refund amounts allocated to the individual companies can be assigned to the values of field position 83 in the preliminary declaration.

All reporting values of the year

This report provides every single entry from all declarations from all companies over all periods of the year. All import values, manual adjustments, resubmissions and reconciliation corrections are taken into account. Especially if the year is far advanced, the report is filled with a lot of data and therefore needs a bit more time to be created. The following columns are filled in for each declaration value:

| Company | Unit type | Representative VAT group member | Period name | Declaration field | Declaration field | Field type | Company code | Tax code | Tax code Type | Tax rate | Tax code description | Value | Source | Reference-ID | Correction | in OT correction | Timestamp | User | Comment |

With the Excel filters, you can filter the report in many different ways, in order to possibly trace individual specific declaration values.

Data base for bookkeeping voucher

The report Data base for bookkeeping voucher provides a technical basis for the creation of system-specific bookkeeping vouchers via the custom report function. A posting document is used to post the VAT payment debits or credits within an organisational unit and to the tax office in the ERP system. For each company that reports in the selected period, up to 6 different posting lines are generated, which are filled with a lot of partly redundant information. This makes it possible to fulfil the many different requirements that an bookkeeping voucher can have in one technical basis. When creating the custom report template, the result of which is ultimately to be posted to the ERP system, the actual sheets are filled to the data basis using Excel formulas.

Import Excel-Template

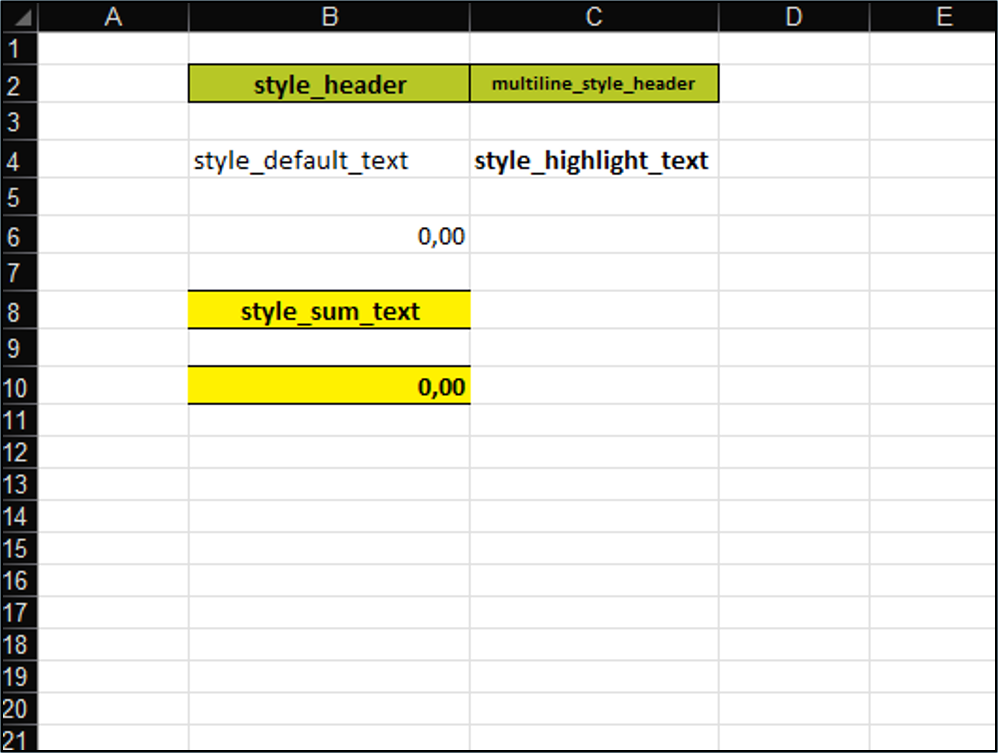

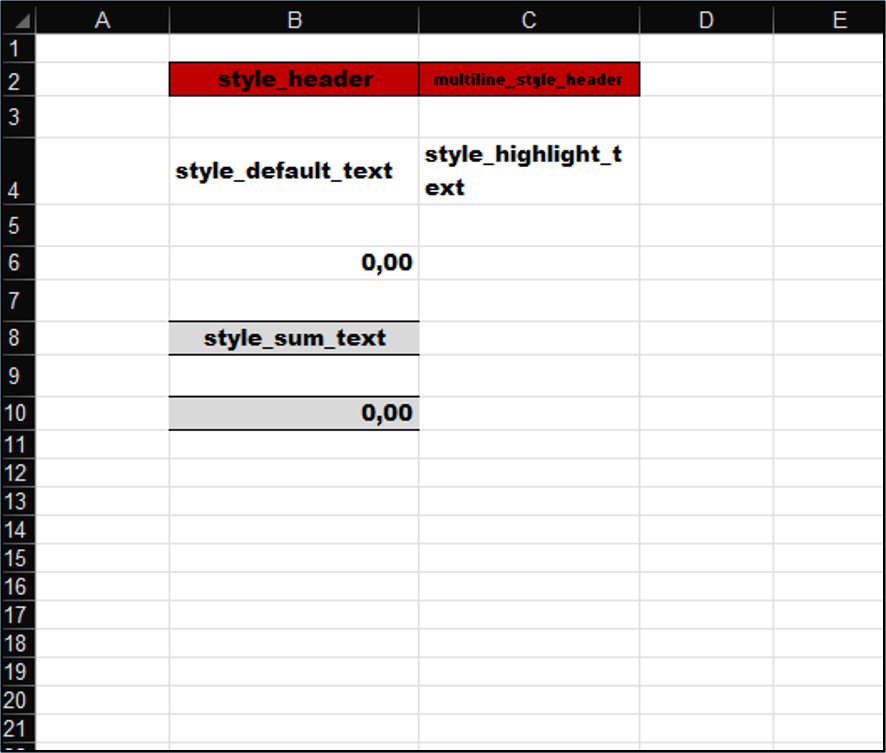

Using this function, it is possible to customise the layout of the reports created from VAT@GTC. With the help of a template, for example, the classic AMANA colours can be exchanged with the colours of the company, the font size and type of various cell types can be adapted, as well as own graphics and symbols can be incorporated into the header and AMANA elements can be removed. If a customisation of the report layout is desired, vat-support@amana.de will gladly provide the template and assist with the implementation.

| Standard template | ||

| Adjustet example | ||

| Result (example) | ||

Import custom Excel reports

With the custom reporting function of VAT@GTC, it is possible to upload your own report templates and thus create customer-specific reports. The existing standard reports serve as the basis for these reports. One or more standard reports can be stored in a custom report. When the custom report is called up, all table sheets from all stored reports are called up and made available for download in the same file. As usual, the content of these reports depends on the period and the company from which the custom report is retrieved.

In addition, further spreadsheets can be permanently stored in the template. In one of these additional spreadsheets, for example, it is possible to process the values from the configured standard reports via Excel formulas in a cover sheet. Another example are fixed comparison tables that can be stored for comparisons. The large number of standard reports makes it possible to create and use completely customised reports.

When uploading, each custom report can be given a name, a description and a data origin, which are then displayed in the table of retrievable reports.

Good to know

A custom report can be downloaded by any user in any period and any company. Whether the result is useful depends on whether the standard reports used can be downloaded in the context used.

We will be happy to assist you in creating a custom report template. Contact us at vat-support@amana.de