Table of Content

About The Converter

The AMANA CbCR Converter can be used to process XML based Country-by-Country Reports (CbCR). It offers the following functions:

- CbC Editor compliant with the global OECD specifications.

- Comfortable Web- or Windows User Interface.

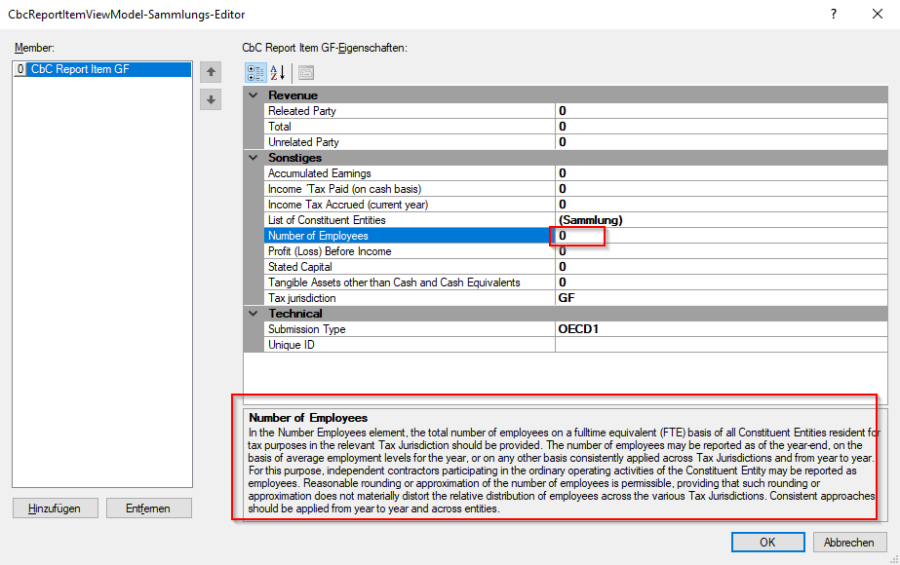

- Integrated inline help and business explanations of the mandatory data points.

- Drop-down lists for selection of valid data point values (Countries, Currency, Dates, Types).

- Online version hosted at https://cloud.amana-consulting.de

- Excel Import and Export.

- Full validation: Technical and business validation rules.

- Resubmission Wizard for correction reports (coming soon).

- Direct interface for submission to tax authorities (coming soon).

System Requirements

Hard- and Software

The converter is .NET based and requires:

- Microsoft Windows operation system

- .NET Framework 4.5.2 or later

- Microsoft Excel 2007 or later

The converter is very lightweight and does not require any special hardware. However, for future releases an internet access for direct submissions to regulators might be required.

Installation

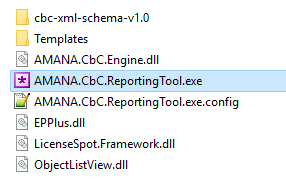

Basic installation

The download package contains the binaries. All files need to be extracted to a folder. The application can run by starting the AMANA.CbC.ReportingTool.exe executable file.

Licensing

The tool has an integration copy protection and requires a license to be usable. The license file will be provided by AMANA.

The received license file (.lic) needs to be added under the "Info" menu as highlighted in the screenshot. The grey activation button can be ignored. After you successfully added the file, the programm has to be restarted. The imported license can be found (and removed) under C:\ProgrammData\IPManager.

Usage

The usage of the application is quite intuitive. However, we will add more documentation to this section for coming releases.

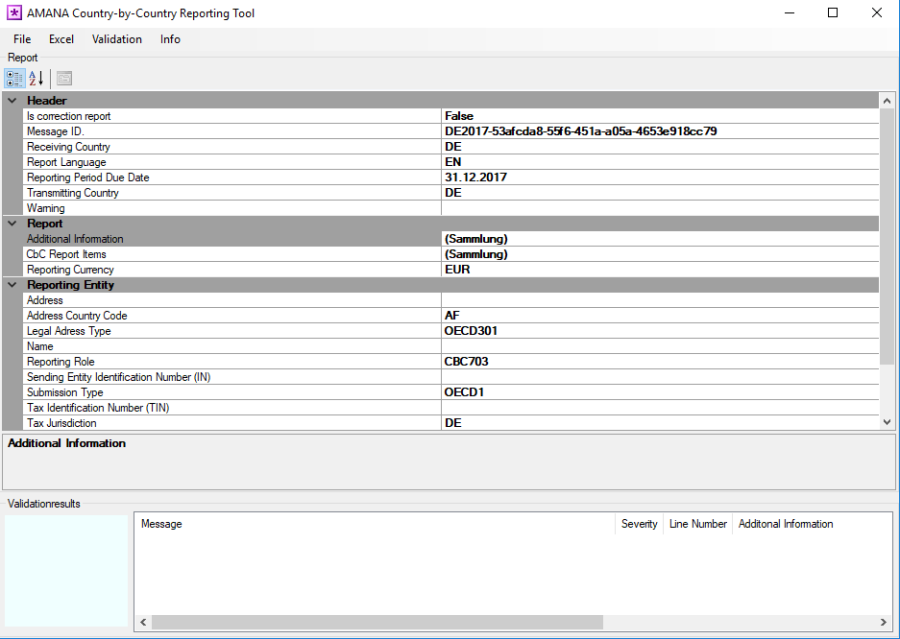

Create an CbC Report with the Editor

By clicking on „New" in the file menu, a new report will be created.

All required input fields are document. By clicking on the the input fields, either drop-down lists or proper editors will be activated, and an integrated online-help displayed including explanations of possible values.

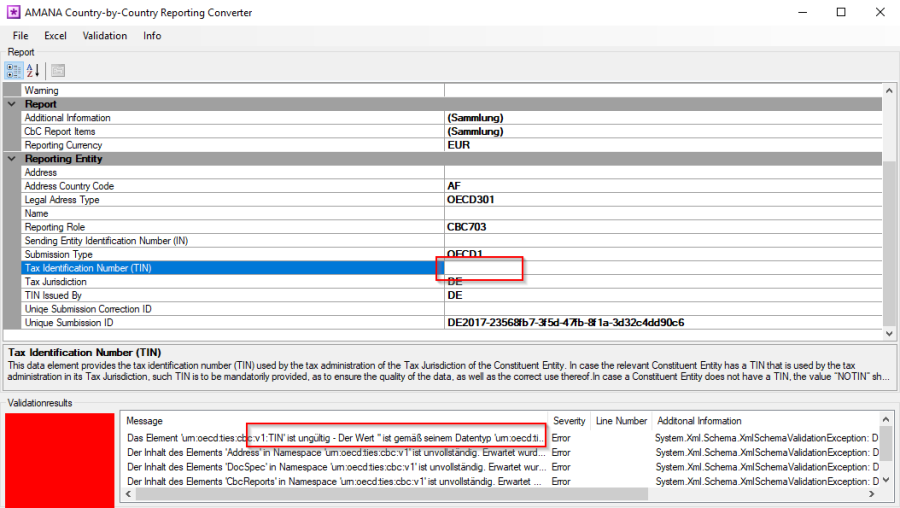

Validation

Before sending a report to the tax authorities, it is important to validate the report. Invalid reports will be rejected. The validation covers XML validation as well as business validation rules.

Mandatory input field are also validated by the validation. Fields can be identified by looking at the validation message.

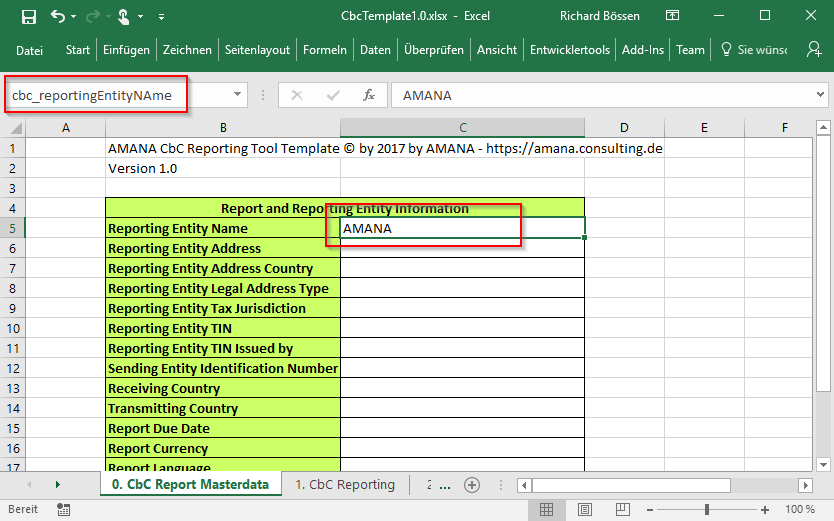

Import and Export from Excel

It is possible to import the full report from Excel. A basic import template can be opened at the Excel menu ("Save template as…"). The Excel import works with Excel named ranges, so all named ranges need to exists in a Workbook. For the multi-line and column ranges like the list of entities and summery per tax jurisdictions, the number of columns in the named range needs to match the template, otherwise the import is not possible. But the named ranges can be moved to any region in the Workbook or being integrated into existing Workbooks.

It is important to know, that all data in the report will be removed and overwritten, if an Excel import is performed. So, the recommended approach is to import data from Excel first, and then adjust the report in the tool.

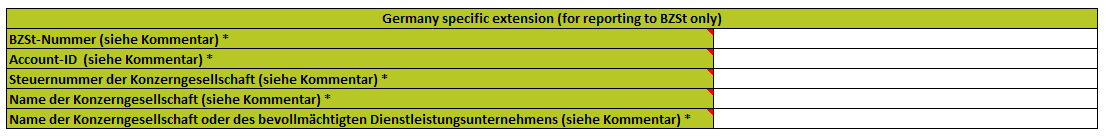

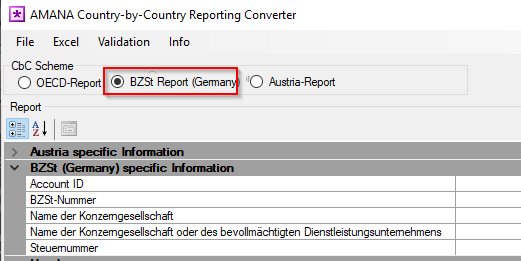

Creating Reports for the German Tax Authorities (BZSt)

When submitting the CbC Report to the German tax authorities (BZSt), a custom XML Schema have to be used with additional fields. This section is only available in the template starting with version 1.1.9, and all fields are mandatory. It is very important to carefully read the instructions about the content of the fields provided in the comment/note of the cell header.

However, for the field "Steuernummer der Konzerngesellschaft" requires a special treatment, due to an error from the BZSt (see more information on page 8 of the Kommunikationshandbuch).

- When submitting before the 1st of December 2019, the BZSt Number has to be added instead of the Steuernummer.

- When submitting on or after the 1st of December 2019, the Steuernummer has to be provided, but in a special format:

- No special characters like "/" are allowed.

- The Steuernummer has to be provided as a 12-diget, so called "Bundesschema" (see more information and sample Steuernummern on Wikipedia).

- If the Steuernummer is only 9 or 10 digest, the Finanzamtsnummer has to be added as a prefix.

- If the Finanzamtsnummer is not know, it can be found out by searching the city of the Finanzamt in the Gemfa 2.0 tool on the BZSt Webpage:

https://www.bzst.de/DE/Service/Behoerdenwegweiser/Finanzamtsuche/GemFa/finanzamtsuche_node.html

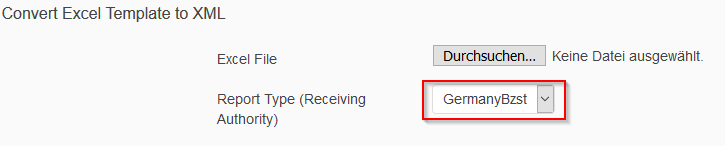

To enable the German CbC report and its specific fields in the converter, it must be selected in the and or all appropriate German specific fields have to be filled in the Excel Template.

Submitting Reports to BZSt using the ELMA SFTP Upload

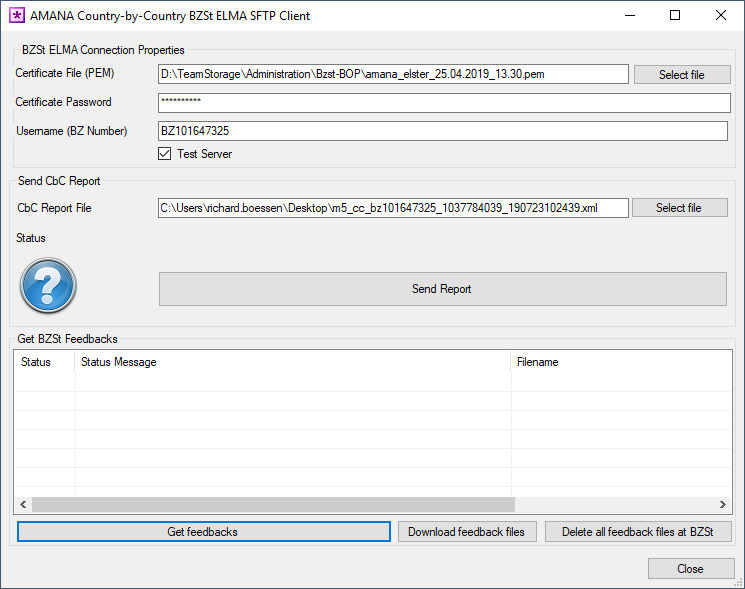

Since August 2019 it is required to send the CbC files to the German Tax Authority with the ELMA interface. The file can either be uploaded online through the BZSt Online Portal (BOP) or submitted via the the built-in SFTP client of the AMANA CbCR Converter .

To send the file via the AMANA CbCR Converter to the BZSt, a PEM certificate file is required. The PFX certificate provided for the BOP login can not be used. The PEM certificate file can be requested and downloaded from the BZSt Online Portal (BOP) at https://www.elster.de/bportal/formulare-leistungen/versandmassendaten

The CbC Converter Application does allow sending an existing XML document – it is recommended to send only validated final reports to the BZSt.

To send a file, select "BZSt Send File / Get Feedback" from the "File" menu and provide all connection details. Please note that the certificate file is NOT the PFX file provided by BZSt to login to their webpage – it's the ELMA5 certificate that can be generated inside the BOP. After submitting the file, a feedback file will be created by the BZSt. To get a list of available feedback files, click on "Get feedbacks".

It is recommend to download all files before deleting them from the server.

Preparation of Resubmissions and Correction Reports

The preparation of resubmission and correction reports is not yet supported.