System requirements

This section describes the technical requirements for launching the GlobalTaxCenter (GTC) software, including all of its modules. Full instructions on how to install it are provided in the installation instructions.

System architecture

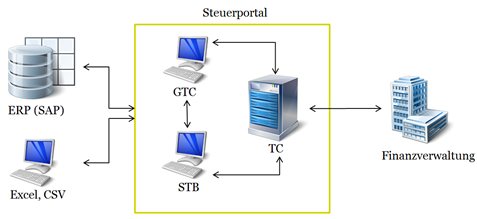

The GTC is a web-based application. It serves the group tax department as a tax portal and offers the possibility to automate process steps by connecting to other systems, thus reducing manual activities.

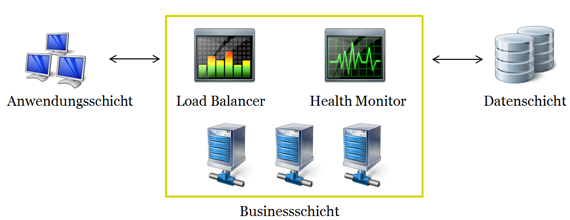

The system architecture is based on a three-tier architecture:

- Client (Web browser)

- Business logic (Web Application Server)

- Data (Database Server)

If a fail-safe operation is required, the business logic layer (business layer) can be operated in a load balancer, the availability of individual server applications [Health Check] can be monitored and if necessary a database cluster can be used. The implementation of a Single-Sign-On mechanism (SSO) is also possible on the application server. More detailed configuration information is not included in this document and can be provided separately.

Connection to the other systems is provided via the client or must be triggered by the client.

A data import, e.g. import of IFRS values from the accounting or consolidation system, can be carried out either via the client by uploading an XLSX/CSV file or via the server, i.e. through a direct connection between the server and the accounting or consolidation system.

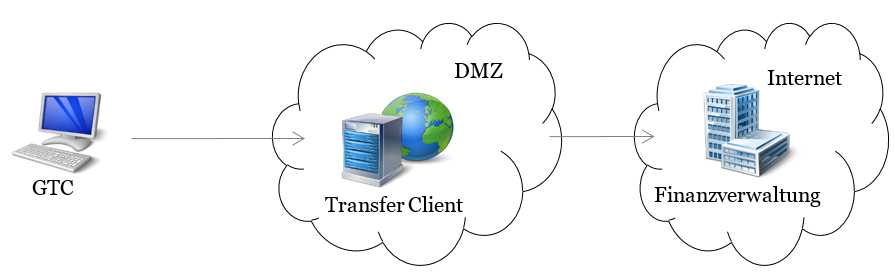

The electronic tax return is sent to the tax authority via a separate transfer client, which can be installed in a demilitarized zone of the computer centre (access to the Internet is required).

System requirements for components

AMANA does not provide support for older software versions that are no longer maintained by the manufacturer. This may concern the operating system, web browser, DBMS and WAS, among other things.

Examples for not supported software versions are Windows XP, Internet Explorer 8 and, since January 2016, Internet Explorer 10.

Database

- Microsoft SQL server 2012 (R2)/ 2014 / 2016 / 2017 and Oracle 12.2 / 19c. AMANA recommends using Microsoft SQL servers. This is particularly useful if you also use, or are planning to use, other AMANA products, e.g. SmartTaxBalance.

- Current multiple-core server processor/system (at least 2 GHz clock speed), for processor-intensive reports at least 2 cores, for larger installations (from approx. 100 companies) preferably 4 cores (also for VMs)

- At least 4 GB RAM, for larger installations (from approx. 100 companies) preferably 8 GB RAM for the database server

- The database must be UTF-8 coded

- Authorization to "CREATE", "INSERT“, "UPDATE“, "DELETE“ and "ALTER“ on the database, for Oracle: CONNECT + RESSOURCE authorization

- The required database memory depends to a large degree on company size and user behaviour. In the latter case, it is particularly relevant how often file attachments or documents (Excel, csv, ...) are stored (sometimes these files are stored in an external folder). As a rough guide, we recommend approx. 500 MB memory per 10 companies and period.

- A regular backup of the database schemas is strongly recommended.

Web application server

We recommend that the database server and web application server are installed on different hardware / servers. Virtual servers are supported (e.g. via VMWare, VirtualBox, etc.).

- JDK 8 (Advice on supported JDKs)

- JDBC driver for the database used

- Apache Tomcat 8.5 or 9.0.xx (latest available version)

Please also note the additional information on Tomcat versions.

- Current multiple-core server processor/system (at least 2 GHz clock speed), for processor-intensive reports at least 2 cores, for larger installations (from approx. 100 companies) preferably 4 cores (also for VMs)

- At least 4 GB RAM, for larger installations (from approx. 100 companies) preferably 8 GB RAM working memory (assigned to Tomcat)

- 0,5 GB hard disk capacity for the GTC application, 1 GB for the application server and the Java installation

- 5 GB for the additional folder for storing temporary files (If file attachments are not stored in the database but in an external folder, the required memory space increases by approx. 500 MB per 10 companies and period)

Web browser

- Current Google Chrome, Mozilla Firefox or Edge Chromium

- JavaScript for the GTC must be allowed in the browser

Performance

Transfer to tax authority (Tax Return module)

For submission of the electronic tax return, the Transfer Client (TC) is required.

The TC can be deployed on a separate system, or it can be installed directly on the web application server (only with Windows).

The electronic tax return is automatically transmitted from the GTC to the TC and then to the tax authority after a first-time configuration in the GTC user interface.

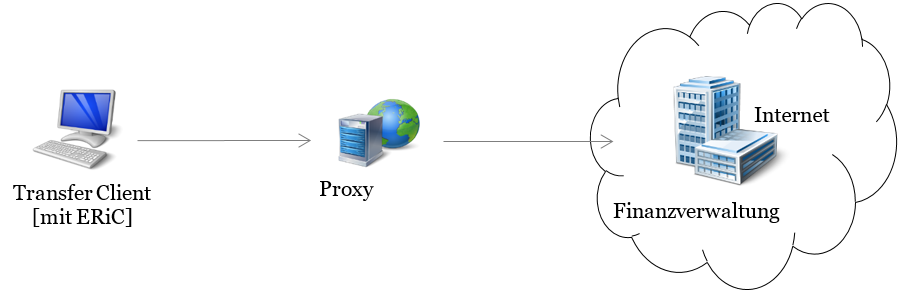

The Transfer Client web service is opened via an encrypted connection and a proxy from the company network into the DMZ. This course of action can be customized to comply with the company’s own security standards, although it may entail additional effort.

We recommend approval of www.esteuer.de [Port 80] and the ELSTER data acceptance server.

The system requirements for the Transfer Client are listed in detail here.

Note

The Elster Rich Client [ERiC] is a closed C library, provided by the tax authority. AMANA has no part in or control over its development or range of functions. The tax authority raises the minimum requirements once a year in April. For this reason, it is absolutely imperative that your GlobalTaxCenter and Transfer Client are updated before April every year if you intend to submit an electronic tax return in or after April.

The ERiC API allows the use of a proxy when accompanied by appropriate parameters [host, port, user name, password, authentication method]. However, the ERiC API does not support the use of a proxy auto-config file.