Setup VAT-Audit

Settings and Master data VAT-Audit

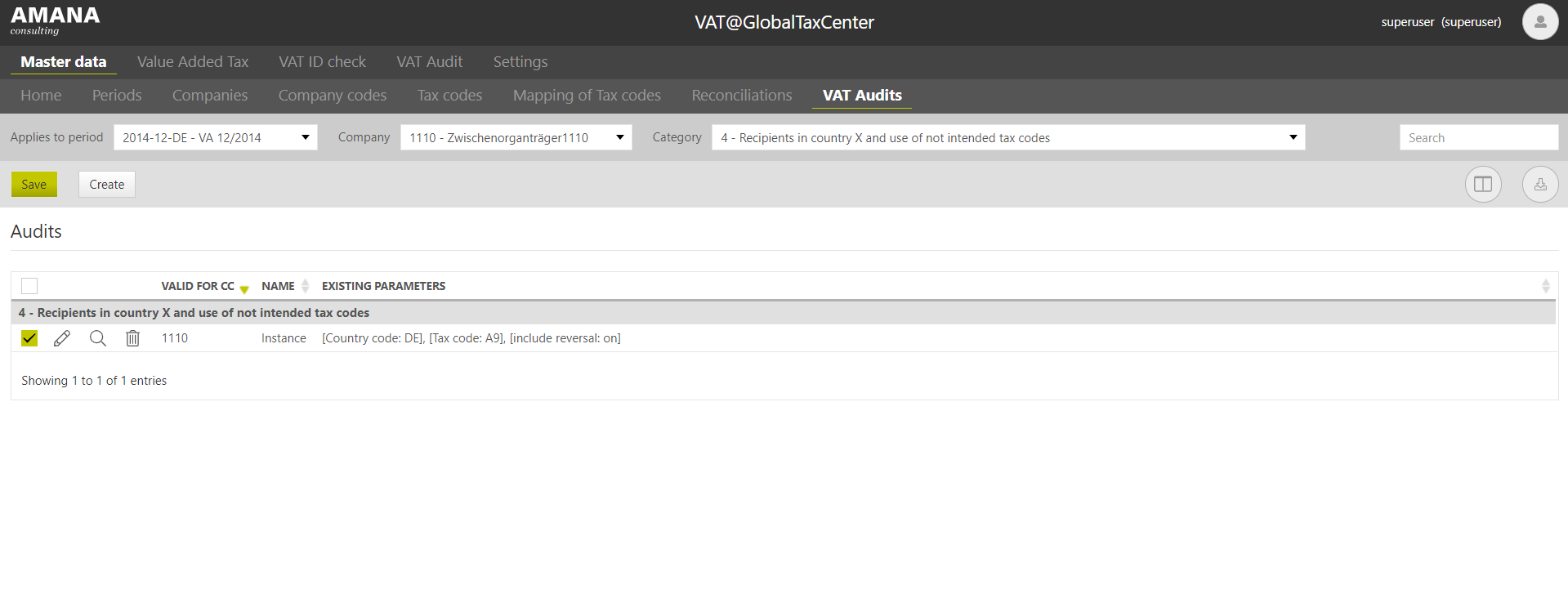

The master data for the VAT-Audit module can be found under the master data tab.

- VAT Audits

The desired audits are configured here and saved with individual names.

The audits can be filtered by:

- Periods (Explanations see user manual VAT@GTC)

- Companies (Explanations see user manual VAT@GTC)

- Category

Category

Under category all audit templates are listed, from which the audits can be individually adapted to one's own needs or according to the searched parameters.

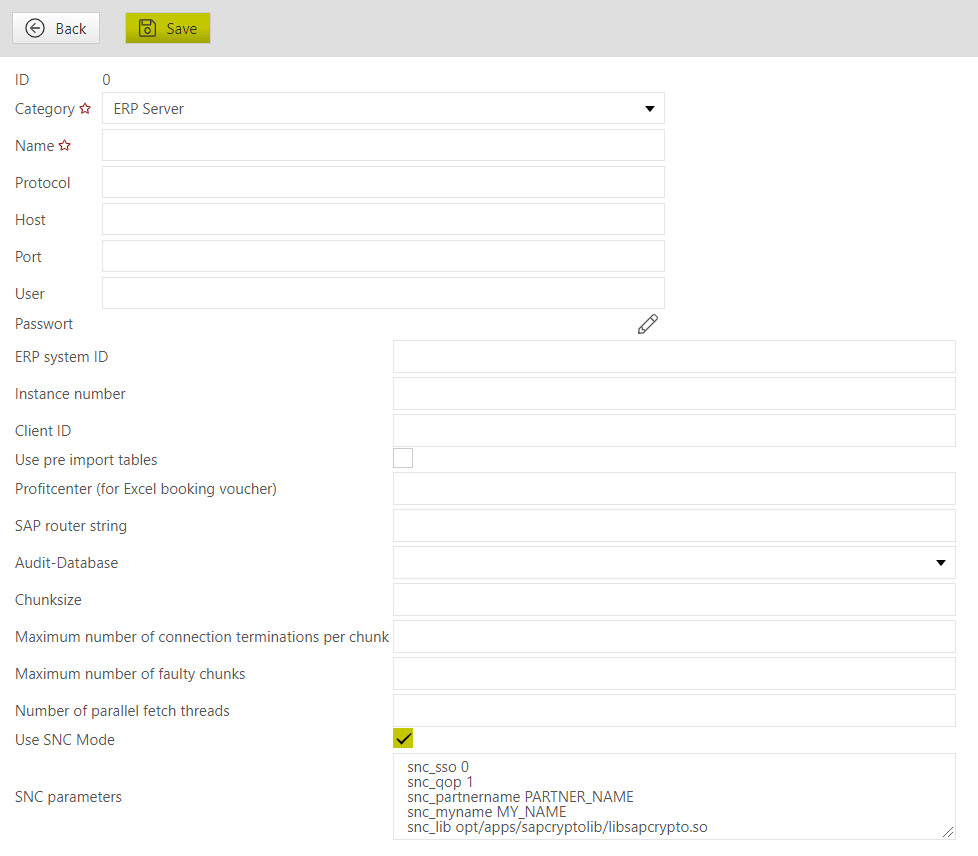

Deposit of the user credentials for SAP

The user credentials for SAP, which are required to jump directly from the VAT-Audit to the SAP GUI, are stored individually for each user under Settings → User credentials, if they are different from the user's login in VAT@GTC.

In this case, if the SAP login corresponds to the VAT@GTC login, no further data is stored in the VAT@GTC, as the system automatically logs into SAP with the VAT@GTC login. The SAP login is stored by creating a new account.

The following parameters must be selected for this purpose:

| Category | ERP Server |

| Connection parameter | Selection from drop-down menu of the created connection parameters for SAP access |

| Login of the user for the SAP login | |

| Password | User password for the SAP login |

The user credential must be deposited by the respective user himself.

SNC encryption

VAT-Audit supports SNC encryption, which can be activated in the respective connection parameter. By ticking "Use SNC", the encryption is activated and the following parameters must be added:

Parameter |

|---|

snc_sso: Use Single-Sign-On YES(1)/NO(0) → No, SSO login via VAT will not be possible |

snc_qop: Quality of Protection |

snc_partnername: The SNC name of the SAP-Server |

snc_myname: the SNC name of the client |

snc_lib: Path to the SAP encryption library |

SMTP E-Mail Server

The VAT-Audit allows the use of an SMTP server both with and without authentication. Should the use take place without authentication, no user data/password are to be entered in the user credentials. The server must be configured only once in the connection parameters.

Create an Audit

In order for the transaction data from SAP to be audited in the VAT audit, the audits must be created in advance.

Category selection

The desired category must be selected, as well as the correct period and company (or --- for all companies). Clicking the "Create" button creates the exam.

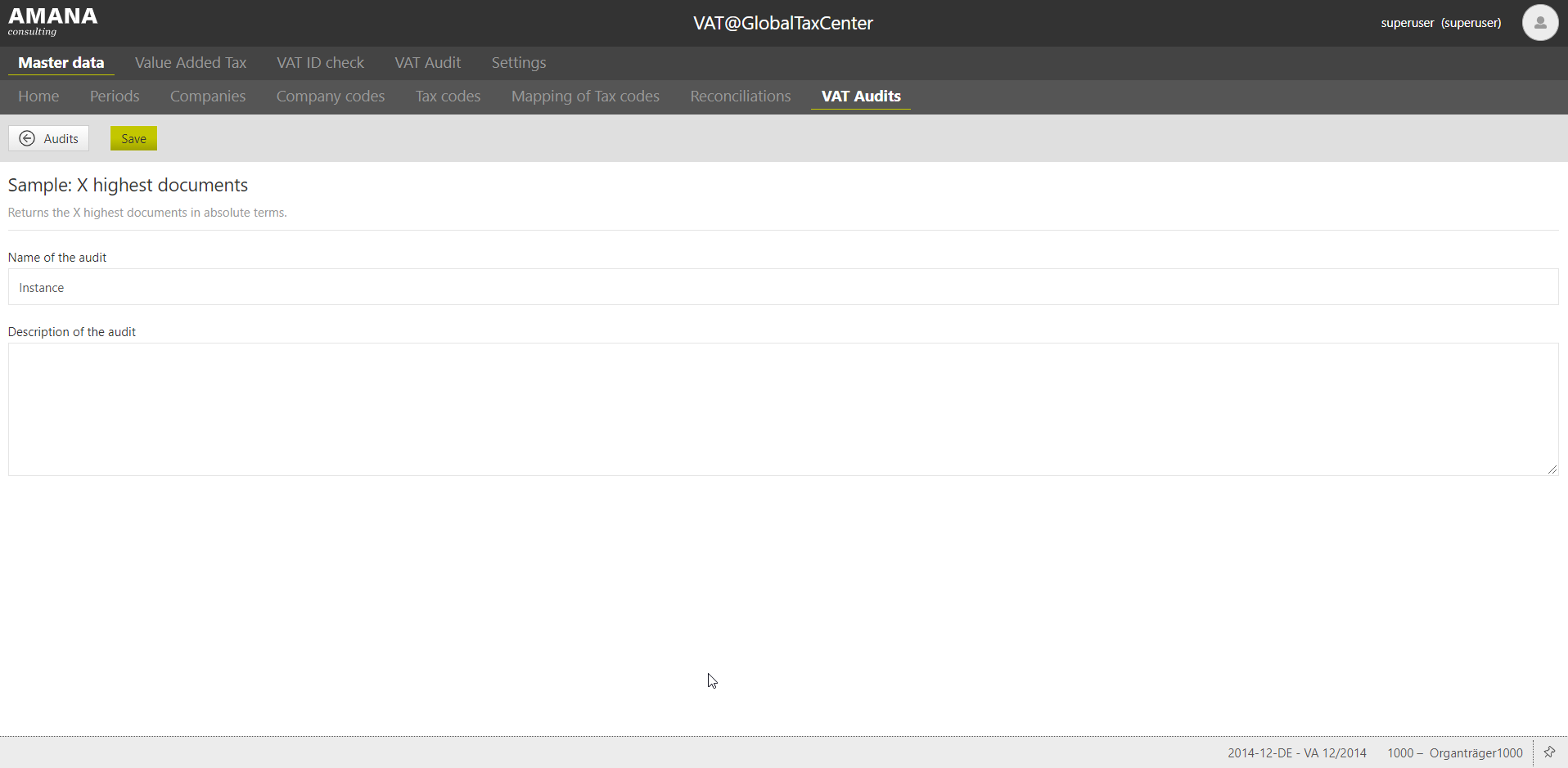

Name and description

In the next step, the created audit can be given an indvidual name and an own description (e.g. the purpose) can be added. The process is completed by clicking the "Save" button.

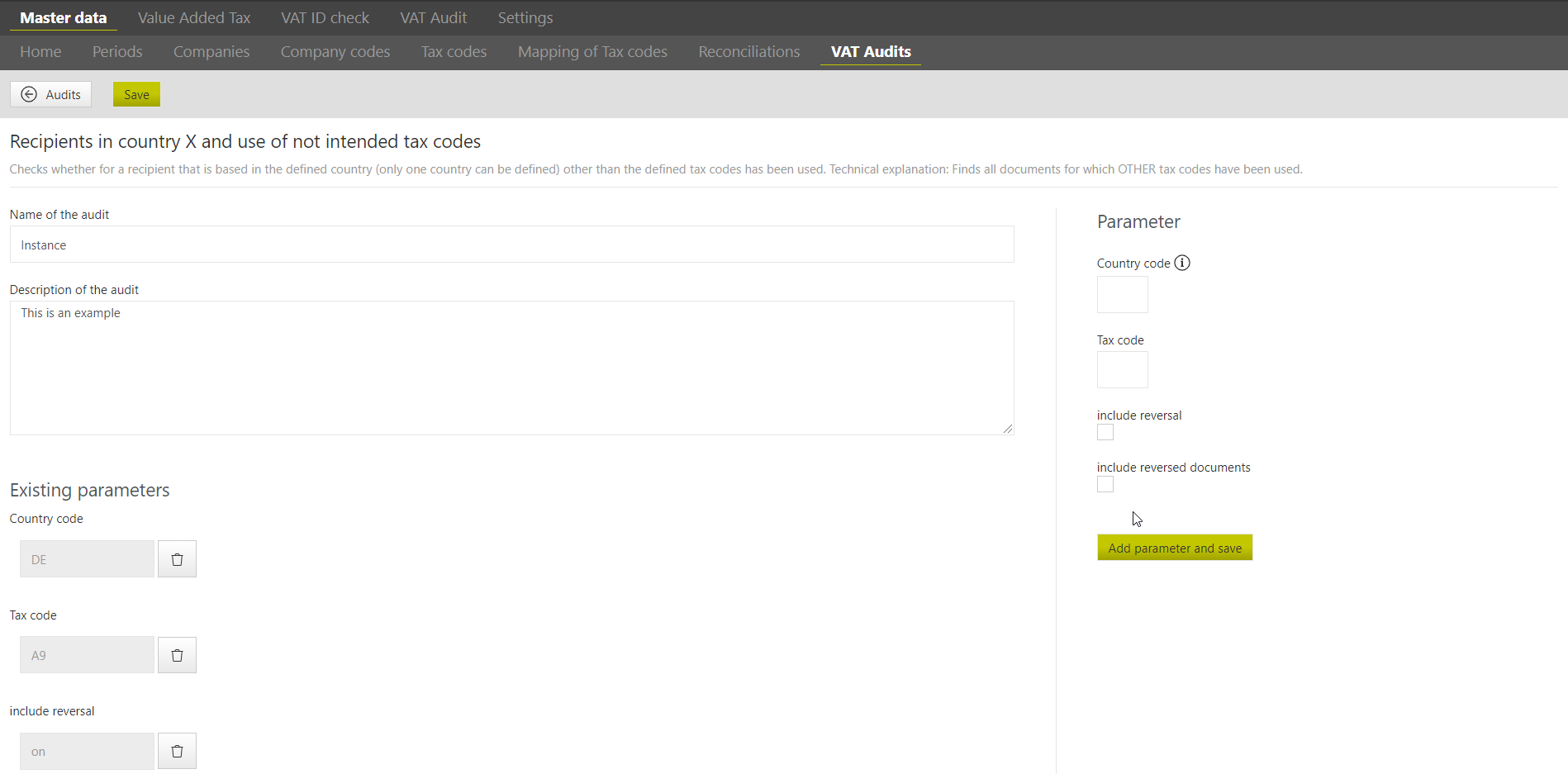

Audit details

Finally, the audit is filled with life. Here, for example, parameters for countries, tax codes and reversal are specified. Note that depending on the test, parameters may be limited to a maximum of one. Once the audit has been configured, the creation of the audit is completed by clicking the "Save" button and the "←Audits" button takes you back to the overview. The audit can now be used.

Edit an existing audit

By clicking the "pencil button" of the respective audit, you can edit it again (see details of the audit).

View of the audit (description)

By clicking the "magnifying glass" you can call up the detailed description of the audit again, but only for viewing and not for editing.

Deleting an audit

By clicking the "bin" you can delete the respective audit.

Roles and users

Roles with corresponding authorisation objects must be assigned to each employee who is to work with VAT-Audit. See also VAT@GTC Roles.

The following authorisation objects can be assigned for this purpose:

| Role "Lil:" | Description |

|---|---|

| Line Item Level | Access/authorisation to the VAT-Audit area and the SAP Interface area. Without further functions (read/edit). |

| Results | Access/authorisation to the Tasks and Tasks Overview area (read/edit). |

Results Assigend To | Authorisation to assign tasks to employees (edit; Requires the role "Results" edit) or to only be able to see them (read; Requires the "Results" read role). |

| Results Reopen | Permission to reopen closed tasks (edit only). |

| Audits | Access/authorisation to the audits area (read/edit). |

| SAP Interface | "Read" authorises the user to view the imported data. "Edit" additionally authorises the import of transaction data. |

| SAP Interface MasterData | "Read" authorises the user to view the imported data. "Edit" additionally authorises the import of master data. |

| Mass Data Import | Authorisation for importing via mass data import (only edit). |

| Responsible Account | Authorisation "Read" allows the accountant in charge to view the tasks and document details. |