Periods

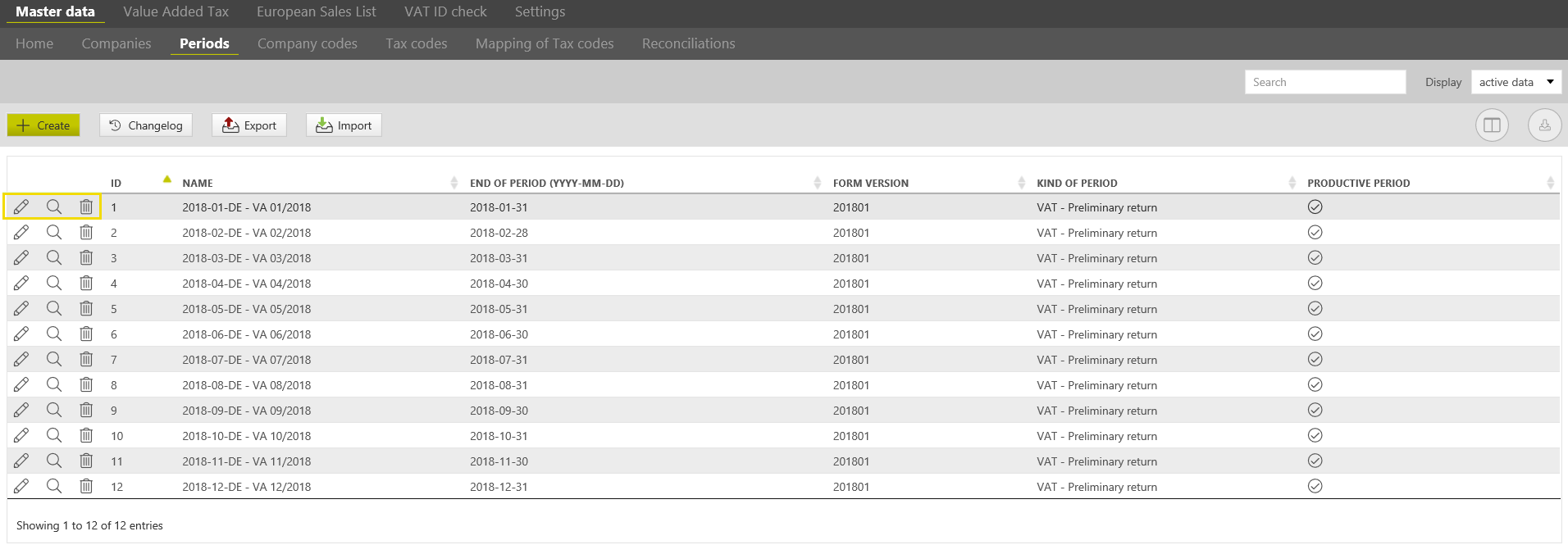

All available periods are listed on the periods overview page. Productive periods are marked by checkmarks [].

The functions of the [Period] dialogue is described below.

Create a period

Period concept

The VAT@GTC is a period-based system. In principle, a distinction is made between the (advance) declarations and the annual declarations. In Germany, there is also the special prepayment period.

- An advance declaration period in VAT@GTC always represents a single calendar month. If the reporting period of a company covers several calendar months depending on the legal regulations of the respective country, this can be stored in the company under [Master data→ Companies]. The values can be imported monthly in these companies. In the last period of the reporting period, the values from all previous periods are automatically imported and cumulated. In this period, validations can also be carried out over the quarter and the transmission process also takes place here. A manual creation of declarations that cover more than one calendar month only takes place in the last month of the declaration period.

- The annual declaration always represents the declaration of an entire calendar year. This is independent of whether advance declarations were created and sent or this is the only declaration of the year. In both cases, the preliminary declarations are imported monthly and values are transferred to the annual declaration. The only exception here are manually created declarations, which are only filled in the annual declaration.

Good to know!

In case of a quarterly VAT return, it is important to note that the ERP reports still have to be imported into the VAT@GTC once a month. Anyhow, plausibility check can be performed also for quarterly VAT returns.

Moreover, the period should be regarded as the basis for all further master data in the VAT@GTC as the master data is organised on an accrual basis per individual period. For that reason, master and transaction data have to be assigned to a specific period. It is possible to copy all master data from the previous period when creating a new period. It is therefore recommended to create periods successively, i.e. create the corresponding period just in time to create a certain VAT return.

Create a period

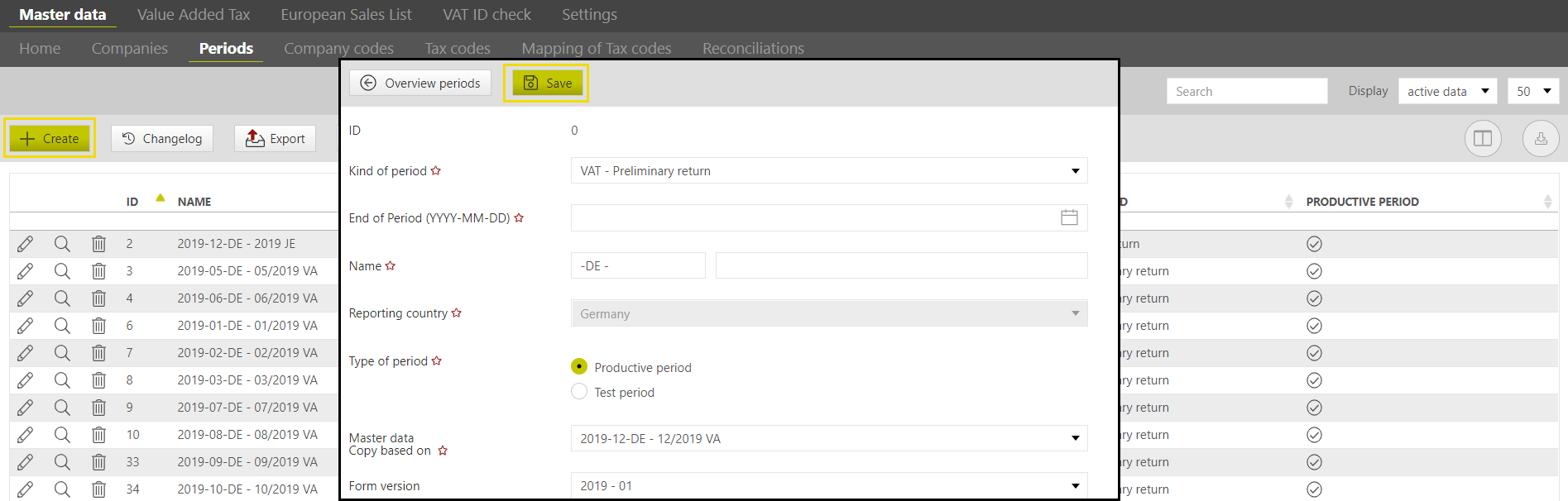

When creating a new period with [Create], a new input mask appears. Fill out the required fields and then click on [Save]:

| ID | No entry required. The ID is assigned by the VAT@GTC as a consecutive number. It is used only to identify the period in the database. |

Ultimo | The end of period represents the last day of a period, so that e.g. the end of period for the monthly VAT return January 2017 is 31.01.2017. The required date can be entered using the calendar function or manually, using the specified format. |

Name | The period must have a name that can be entered as a free text. It is recommended to apply a uniform rule per period type, e.g. monthly VAT return periods can be identified with a “YYYY-MM”. In contrast, annual VAT return and special prepayment periods have to be identified in another way, e.g. “VAT-AR YYYY” (for yearly VAT returns) and “SPP YYYY” (for special prepayment). The period name appears in the dropdown menu of most dialogues, as well as during some copy functions. |

Reporting country | The reporting country is preselected and cannot be changed in this dialogue, it results from the selected reporting country in the [Home] dialogue. |

Kind of period | The [Kind of VAT period] specifies what kind of VAT returns is to be created. At the same time, it defines the time unit for this period. The kind of VAT period also affects the availability of certain subdialogues during the VAT return creation process. The [VAT – Monthly return] is a classic VAT return period with the duration of one month resp. one quarter. The ESL can also be created when selecting this kind of VAT period. During the mapping of tax codes of the preliminary VAT return only the fields of the preliminary VAT return form can be selected. |

Type of period | Productive periods are the periods used for the creation of VAT returns. Per calendar month only one productive period can be created for each kind of VAT period. The type of period usually remains unchanged [productive period]. The test period has the same functions as the productive period, however, the actual filing of VAT returns is not possible. The test period is usually created during the VAT@GTC implementation in the company and is suitable for first attempts of using the application, since these data have no effect on the actual business operations. In addition to that, this type of period can also be used for the simulation of specific scenarios. In contrast to productive periods, several test periods can be created within a certain period of time. If a test period is selected, only test periods are shown in overviews such as the annual overview. Data transfers to test periods also only take place from test periods. Conversely, the same also applies to the productive periods. |

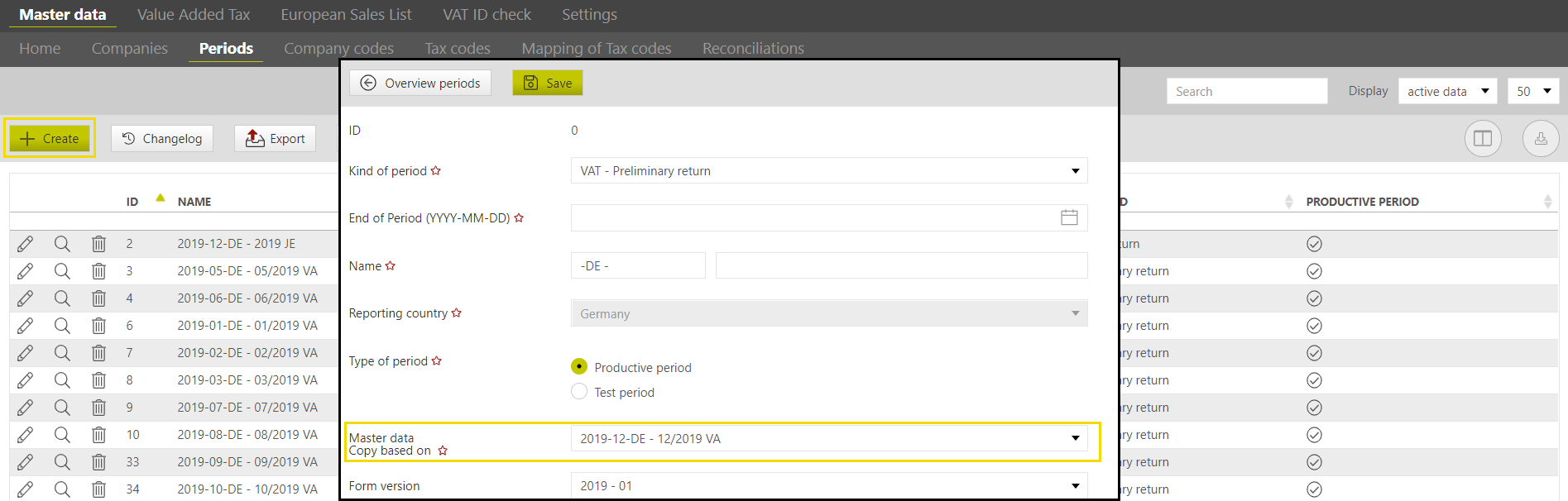

Master data copy based on | Using this dropdown menu, it is possible to copy all the master data from any previous period to the current period. This is only undertaken by creating the period and cannot be changed later. For preliminary declaration periods and special prepayment periods, only preliminary declaration periods can be used as a basis. For annual return periods, the master data can be copied from previous annual returns. However, this is limited to the tax codes. The companies and other master data are determined on the basis of the preliminary declaration periods, provided the corresponding check mark is set. If no tax codes were copied from a previous annual return, they must be maintained manually afterwards or the tax codes must be imported together with the tax code mapping. |

| Form version | This setting defines which form version will be used for the current period. If the tax law has changed or e.g. a calculation error was corrected, a new form will be created in the VAT@GTC by means of the product update. It is highly recommended to select the latest offered version (applies to any period type and kind). This is the default setting in the VAT@GTC. |

| Note for periods abroad | If the most recent version of the form has not yet been saved, it ist still possible to create a period. When saving the period enter "---". The form version can be changed later. |

The entry in the fields must then be confirmed by [Save].

Thr process of creating a new period

Creation of a new period is very similar to the creation of the first period, with the only difference that all subsequent periods can be based on the previous periods [Master date copy based on]. Please make sure that the periods are created successively. Master data is copied to the new period by clicking on [Save].

It may take up to several minutes to copy the data.

If the period has been created successfully, a green checkmark and the period name appear over the toolbar and the periods overview including the newly created period appears.

Good to know!

A clear process should be defined in advance as to which user is allowed to create which period at which time. By the clear definition of the temporal procedures and the responsibilities on the one hand a clean VAT Compliance process is secured. On the other hand, it can only be guaranteed by a timely period creation that a current representation of the fiscal group remains guaranteed. If a period is created prematurely and a controlled company leaves the controlling area between the creation of the period and the reporting month or if a new controlled company is added, the controlling area is not represented correctly in the reporting month because the period was created too early.

Even if individual tax codes are changed in the meantime, it is advisable to create the periods in a timely manner. This applies in particular if the master data from the previous period is to be transferred to the period to be created using [Copy master data on basis of]. If periods have already been created prematurely in the meantime, these periods still contain the obsolete tax codes and the changed tax codes must be maintained or changed manually.

Edit, show and delete periods

The availability of the following functions depends on user’s role and authorisations. Click on the [Edit] button of the selected period to open the detail view of this specific period. The data of the already saved periods can be changed here. Once selected, the kind of VAT period cannot be changed anymore. Click [Save] to save the entered data and go back to the period overview page.

Click on the [Show] button of the selected period to open the period`s detail view. It is possible to view the data but not to change it. To delete a period, click on the [Delete] button. The deleted period does not disappear, it is moved to the archived data and can be viewed using the display function. Previously deleted periods can be restored using the [Restore] button. The restored periods are shown under the active again.

Good to know!

When restored the type of period is automatically set to the test period. This is done, since there may exist a productive period with the same end of period and kind of VAT period. Only one reporting period with the same name can exist. However, it is still possible to switch to a productive period.

Export and import of a period

VAT@GTC offers the possibility to export and import the data sets of a selected period. This function can be used, for example, for a company restructuring in order to select certain periods, companies, master data and transaction data and assign them to another company. Moreover, it can also be used for test purposes by copying the data from one period and creating a test period. The period export can also be used for error analysis for AMANA. The prerequisite for period export or import is the availability of identical systems with the same application versions.