Differences

A user-configurable evaluation of deferred taxes is possible in the Differences dialogue (report). The report is based on the B/S Comparison dialogue (main dialogue Company) and can be viewed as an Excel file. In addition to deferred taxes the corresponding gross differences are displayed here.

Parameters to be set

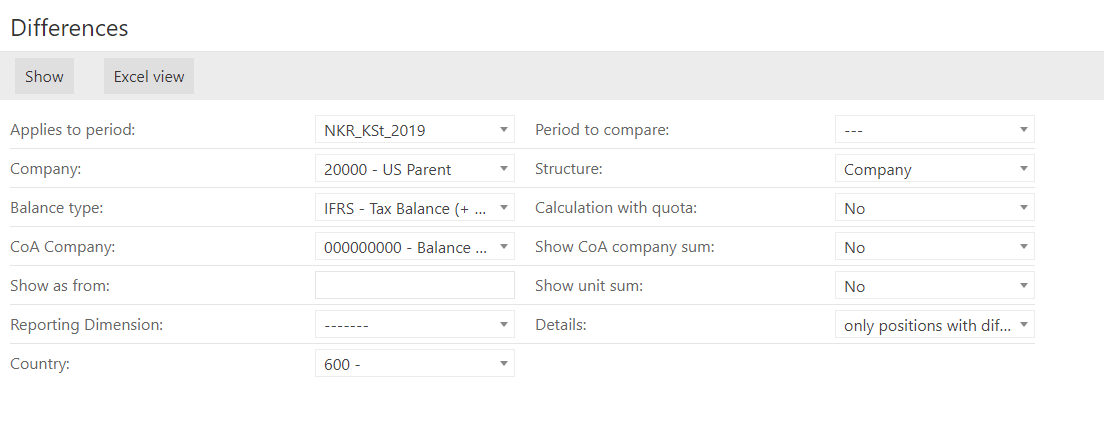

The report is based on the selected parameters. Individual settings can be made in the dialogue header; they are described further. Having configured the parameters, click on the Show button.

Parameter | Description |

Applies to period | The period must be specified; defines the period under consideration |

Company | The company must be specified. Depending on the selected 'Structure' parameter, e.g. a tax group or a subgroup is evaluated here. |

Balance type | Balance type defines the level of the considered balance sheet differences. It can be determined whether, for e.g. IFRS – Tax balance or Local GAAP – Tax Balance should be included in the analysis. |

CoA Company | By selecting an account position the number of considered differences can be limited (optionally) by another parameter. |

| Show as from | In this entry field you can (optionally) set a limit for the displayed differences. In this case, account positions that have their balance sheet differences under the defined limit are not shown in the report. |

| Country | you can (optionally) select a country here. The content of the dropdown list is determined by 'Countries' dialogue of the period selected above. |

| Reporting Dimension | You can (optionally) select a reporting dimension here. The content of the dropdown list is determined by the 'Reporting Dimension' dialogue of the period selected above. |

Period to compare | The dropdown list 'Period to compare' contains all periods created in the GTC. This entry is optional. |

Structure | There are five display options. This parameter is relevant only for those companies for which the user is authorised.

|